by Calculated Risk on 12/08/2013 09:55:00 AM

Sunday, December 08, 2013

Update: Four Charts to Track Timing for QE3 Tapering

Here is an update of the four charts I'm using to track when the Fed will start tapering QE3 purchases.

In general the year-end data might be "broadly consistent" with the June (and September) FOMC projections.

However I suspect the FOMC is very concerned about the low level of inflation, and also the decline in the employment participation rate.

The December FOMC meeting is on the 17th and 18th. Note: Another key is that a budget agreement is reached by December 13th.

Click on graph for larger image.

Click on graph for larger image.

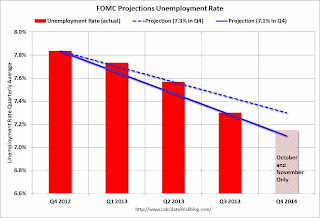

The first graph is for the unemployment rate.

The current forecast is for the unemployment rate to decline to 7.1% to 7.3% in Q4 2013.

We only have data through November, but it is pretty clear that the unemployment rate is tracking the FOMC forecast (lower is better).

However, in July, Bernanke said that the unemployment rate "probably understates the weakness of the labor market." He suggested he is watching other employment indicators too, and I suspect the FOMC will also discuss the decline in the participation rate.

The second graph is for GDP.

The second graph is for GDP.

The current forecast is for GDP to increase between 2.0% and 2.3% (the FOMC revised down their forecast from 2.3% and 2.6% in June). This is the increase in GDP from Q4 2012 to Q4 2013.

Currently GDP is tracking the FOMC forecasts, and real GDP only has to increase 0.8% annualized in Q4 to reach the lower forecast. Even with a negative contribution from inventories in Q4, it appears GDP will meet the lower forecast.

The third graph is for PCE prices.

The current forecast is for prices to increase 1.1% to 1.2% from Q4 2012 to Q4 2013. This was revised up from 0.8% to 1.2% in June.

The current forecast is for prices to increase 1.1% to 1.2% from Q4 2012 to Q4 2013. This was revised up from 0.8% to 1.2% in June.

We only have data through October, but so far PCE prices are below this projection - and this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects inflation to pickup, and a key is if the recent decline in inflation is "transitory".

The fourth graph is for core PCE prices

The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

Through October core PCE prices are below this projection - and, once again, this projection is significantly below the FOMC target of 2%.

Saturday, December 07, 2013

Schedule for Week of December 8th

by Calculated Risk on 12/07/2013 01:11:00 PM

This will be a light week for economic data.

The key report this week will be retail sales for November.

12:00 PM: Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

7:30 AM ET: NFIB Small Business Optimism Index for November.

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS.

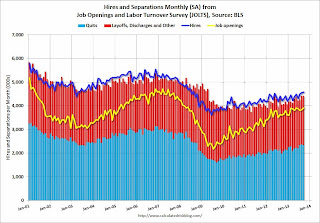

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in September to 3.913 million from 3.844 million in August. The number of job openings (yellow) is up 8.6% year-over-year compared to September 2012 and openings are at the highest level since early 2008.

Quits were mostly unchanged in September and are up about 18% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for October. The consensus is for a 0.4% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 325 thousand from 298 thousand last week.

8:30 AM ET: Retail sales for November will be released.

8:30 AM ET: Retail sales for November will be released.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 29.1% from the bottom, and now 13.2% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to be 0.6% in November, and to increase 0.3% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for October. The consensus is for a 0.3% increase in inventories.

8:30 AM: Producer Price Index for November. The consensus is for a 0.1% decrease in producer prices (and 0.1% increase in core PPI).

Unofficial Problem Bank list declines to 643 Institutions

by Calculated Risk on 12/07/2013 08:36:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for December 6, 2013.

Changes and comments from surferdude808:

There were only two removals this week to the Unofficial Problem Bank List, which now stand at 643 institutions with assets of $219.8 billion. A year ago, the list held 849 institutions with assets of $316.2 billion.Note on the unofficial list:

The Federal Reserve terminated the Written Agreement against Peoples Bank, Lawrence, KS ($412 million). Metropolitan National Bank, Little Rock, AR ($973 million) merged with Simmons First National Bank, Pine Bluff, AR to exit the list.

There is nothing new to report on the status of the banking subsidiaries controlled by Capitol Bancorp, Ltd. Next week should be fairly quiet as we do not anticipate the OCC releasing its latest action activity until December 20th.

Because the FDIC does not publish the official list, a proxy or unofficial list can be developed by reviewing press releases and published formal enforcement actions issued by the three federal banking regulators, reviewing SEC filings, or through media reports and company announcements describing that the bank is under a formal enforcement action. For the most part, the official problem bank list is comprised of banks with a safety & soundness CAMELS composite rating of 4 or 5 (the banking regulators use the FFIEC rating system known as CAMELS, which stands for the components that receive a rating including Capital adequacy, Asset quality, Management quality, Earnings strength, Liquidity strength, and Sensitivity to market risk. A composite rating is assigned from the components, but it does not result from a simple average of the components. The composite and component rating scale is from 1 to 5, with 1 being the strongest). Customarily, a banking regulator will only issue a safety & soundness formal enforcement when a bank has a composite CAMELS rating of 4 or 5, which reflects an unsafe & unsound financial condition that if not corrected could result in failure. There is high positive correlation between banks with a safety & soundness composite rating of 4 or worse and those listed on the official list. For example, many safety & soundness enforcement actions state in their preamble that an unsafe & sound condition exists, which is the reason for action issuance.

Since 1991, the banking regulators have statutorily been required to publish formal enforcement actions. For many reasons, the banking regulators have a general discomfort publishing any information on open banks especially formal enforcement actions, so not much energy is expended on their part ensuring the completeness of information in the public domain or making its retrieval simple. Given the difficulty for easy retrieval of all banks operating under a safety & soundness formal enforcement action, the unofficial list fills this void as a matter of public interest.

All of the banks on the unofficial list have received a safety & soundness formal enforcement action by a federal banking regulator or there is other information in the public domain such as an SEC filing, media release, or company statement that describe the bank being issued such an action. No confidential or non-public information supports any bank listed and a hypertext link to the public information is provided in the spreadsheet listing. The publishers make every effort to ensure the accuracy of the unofficial list and welcome all feedback and any credible information to support removal of any bank listed erroneously.

Friday, December 06, 2013

AAR: Rail Traffic increased in November

by Calculated Risk on 12/06/2013 08:53:00 PM

From the Association of American Railroads (AAR): AAR Reports Increased Intermodal, Carload Traffic for November

The Association of American Railroads (AAR) today reported increased U.S. rail traffic for November 2013 over November 2012. Intermodal traffic in November totaled 1,007,549 containers and trailers, up 7.8 percent (73,004 units) compared with November 2012. The weekly average of 251,887 intermodal containers and trailers per week in November 2013 was the highest weekly average for any November in history. Carloads originated in November 2013 totaled 1,145,353, up 1.3 percent (14,931 carloads) compared with the same month last year.

...

Excluding coal, U.S. carloads were up 5.3 percent, or 34,988 carloads, in November 2013 compared with November 2012. Excluding coal and grain, U.S. carloads were up 3.3 percent, or 19,303 carloads, in November.

“U.S. rail traffic in November 2013 saw a big decline in coal carloads that was more than offset by gains in carloads of grain and petroleum products,” said AAR Senior Vice President John T. Gray. “Carload traffic continues to be consistent with an economy that’s growing at a moderate pace. Meanwhile, rail intermodal volume was extremely strong in November, demonstrating the tremendous value that intermodal has become for rail customers.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Green is 2013.

U.S. rail carloads were up 1.3% (14,931 carloads) in November 2013 over November 2012, totaling 1,145,353 carloads for the month. That’s the fourth consecutive year-over-year monthly increase, the first time that’s happened in two years. The weekly average in November 2013 was 286,338 carloads ...

Among the 20 commodity categories tracked by the AAR each month, grain had by far the biggest carload gain in November, with grain carloads up 15,685 (20.6%) over the same month last year. ... Carloads of petroleum and petroleum products averaged 14,532 per week in November 2013, up 20.0% over November 2012.

Graphs and excerpts reprinted with permission.

Graphs and excerpts reprinted with permission.The second graph is for intermodal traffic (using intermodal or shipping containers):

Intermodal traffic is on track for a record year in 2013.

U.S. railroads originated an average of 251,887 intermodal containers and trailers per week in November 2013, easily the highest weekly average for any November in history and up 7.8% (73,004 intermodal units) over November 2012. That’s the biggest year-over-year percentage change in nine months.Rail traffic and the economy usually grow together, so this is a good sign for the overall economy.

To date, the peak full year for U.S. rail intermodal volume is 2006, when originations totaled 12.3 million containers and trailers. In order for 2013 not to set an annual record, intermodal volume in December 2013 would have to average no more than approximately 102,000 units per week. So far in 2013, the weekly average has been more than 247,000 units, so it’s a safe bet that next month in this space we’ll be reporting that 2013 was a record year for intermodal.

CBO: Federal Deficit declined Sharply in October and November compared to last year

by Calculated Risk on 12/06/2013 05:26:00 PM

From the Congressional Budget Office (CBO): Monthly Budget Review for November 2013

The federal government ran a budget deficit of $231 billion for the first two months of fiscal year 2014, $61 billion less than the shortfall recorded in October and November of last year, CBO estimates.The most recent CBO projection put the fiscal 2014 deficit at 3.3% of GDP, down from 4.1% in fiscal 2013. These monthly deficits suggest even more improvement in fiscal 2014 than originally forecast.

...

Receipts for the first two months of fiscal year 2014 totaled $380 billion, CBO estimates—$34 billion more than receipts during the same period last year.

...

Outlays for the first two months of fiscal year 2014 were $27 billion less than they were during the same period last year, CBO estimates. That decrease would have been slightly larger if not for shifts in the timing of certain payments from December to November (because December 1 fell on a weekend in both years). Without those timing shifts, CBO estimates, spending would have declined by $29 billion (or 5 percent).