by Calculated Risk on 12/10/2013 02:35:00 PM

Tuesday, December 10, 2013

Public and Private Sector Payroll Jobs: Reagan, Bush, Clinton, Bush, Obama

By request, here is an update on an earlier post through the November employment report.

In April, I posted two graphs comparing changes in public and private sector payrolls during the Bush and Obama presidencies. Several readers asked if I could add Presidents Reagan and Clinton (I've also added the single term of President George H.W. Bush). Below are updates through the September report.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, so a different comparison might be to look at the percentage change. Of course the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the first year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.

The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was very sluggish, and private employment was down 946,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 665,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,490,000 private sector jobs added.

Private sector employment increased by 20,864,000 under President Clinton (light blue) and 14,688,000 under President Reagan (yellow).

There were only 1,933,000 more private sector jobs at the end of Mr. Obama's first term. At this early point in Mr. Obama's second term, there are now 3,860,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

The public sector grew during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,748,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 726,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

A big question is when the public sector layoffs will end. It appears the cutbacks are mostly over at the state and local levels, but there are ongoing cutbacks at the Federal level - but overall public employment will probably start increasing soon.

Las Vegas Real Estate in November: Year-over-year Non-contingent Inventory up 77.4%

by Calculated Risk on 12/10/2013 12:11:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports home prices, sales, supply dip heading into holidays

GLVAR said the total number of existing local homes, condominiums and townhomes sold in November was 2,694. That’s down from 3,192 in October and down from 3,293 total sales in November 2012. Compared to October, single-family home sales during November decreased by 16.2 percent, while sales of condos and townhomes decreased by 12.7 percent. Compared to one year ago, single-family home sales were down 17.9 percent, while condo and townhome sales were down 19.3 percent. ...There are several key trends that we've been following:

...

In November, 21 percent of all existing home sales were short sales, unchanged from October. Another 7 percent of all November sales were bank-owned properties, up from 6 percent in October. The remaining 72 percent of all sales were the traditional type, down from 73 percent in October.

...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service decreased in November, with 14,240 single-family homes listed for sale at the end of the month. That’s down 5.1 percent from 15,011 single-family homes listed for sale at the end of October and down 8.9 percent from one year ago. ...

By the end of November, GLVAR reported 6,830 single-family homes listed without any sort of offer. That’s down 3.4 percent from 7,072 such homes listed in October, but still up 77.4 percent from one year ago. For condos and townhomes, the 2,192 properties listed without offers in November represented a 2.4 percent decrease from 2,247 such properties listed in October, but an 80.0 percent increase from one year ago.

emphasis added

1) Sales were down again in November, and down about 17.9% year-over-year.

2) Conventional sales are up solidly. In November 2012, only 48.1% of all sales were conventional. This year, in November 2013, 72.0% were conventional. That is an increase in conventional sales of about 23% year-over-year.

3) Most distressed sales are short sales instead of foreclosures (3 to 1). Both foreclosures and short sales are down sharply year-over-year.

4) and most interesting right now is that non-contingent inventory (year-over-year) is now increasing rapidly. Non-contingent inventory is up 77.4% year-over-year!

Inventory has clearly bottomed in Las Vegas (A major theme for housing in 2013). And fewer distressed sales and more inventory means price increases will slow.

BLS: Job Openings "little changed" in October

by Calculated Risk on 12/10/2013 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 3.9 million job openings on the last business day of October, little changed from September, the U.S. Bureau of Labor Statistics reported today. The hires rate (3.3 percent) and separations rate (3.1 percent) were also little changed in October. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. Layoffs and discharges are involuntary separations initiated by the employer. ... The number of quits (not seasonally adjusted) increased over the 12 months ending in October for total nonfarm and total private and was little changed for government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for October, the most recent employment report was for November.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in October to 3.925 million from 3.883 million in September. The number of job openings (yellow) is up 7.7% year-over-year compared to October 2012 and openings are at the highest level since early 2008.

Quits increase in October and are up about 14.7% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits"). This is the highest level for quits since 2008.

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market. It is a good sign that job openings and quits (voluntary separations) are both at the highest level since 2008.

NFIB: Small Business Optimism Index increases in November

by Calculated Risk on 12/10/2013 08:50:00 AM

From the National Federation of Independent Business (NFIB): Small Businesses Optimism Up Slightly

Owner sentiment increased by 0.9 points to 92.5 ... Over half of the improvement was accounted for by the labor market components which is certainly good news, lifting them closer to normal levels.

Fifty-one percent of the owners hired or tried to hire in the last three months and 44 percent reported few or no qualified applicants for open positions. This is the highest level of hiring activity since October 2007.

Click on graph for larger image.

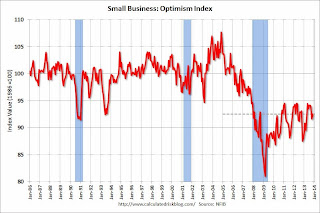

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index increased to 92.5 in November from 91.6 in October.

Another positive: During the recession, the single most important problem was "poor sales". The percentage of owners naming "poor sales" has fallen significantly, and small business owners are once again complaining about taxes and government - this is what they complain about in good times!

Monday, December 09, 2013

Tuesday: Small Business Survey, Job Openings

by Calculated Risk on 12/09/2013 08:56:00 PM

The FHFA will charge higher fees in certain states (slow judicial foreclosure states). From Nick Timiraos at the WSJ: Fannie, Freddie to Raise Loan Fees

Mortgage-finance giants Fannie Mae and Freddie Mac will boost certain fees that they charge lenders ... The firms’ federal regulator, the Federal Housing Finance Agency, said Monday it would direct the companies to increase by 0.1 percentage points the so-called “guarantee” fees that the companies charge to lenders. Those fees have nearly doubled since 2009.It is clearly appropriate to charge higher fees in states with higher costs. Maybe there will be a move towards a national foreclosure law ...

But the latest increase will be muted in most states because the FHFA also said that it would direct the companies to eliminate separate fees that had been implemented in the aftermath of the financial crisis. ...

The upshot is that borrowing costs could rise slightly in the four states—New York, Florida, New Jersey and Connecticut—where the latest fee increases won’t be offset by the removal of the crisis-era fees.

Tuesday:

• 7:30 AM ET, NFIB Small Business Optimism Index for November.

• 10:00 AM, Job Openings and Labor Turnover Survey for October from the BLS. Jobs openings increased in September to 3.913 million from 3.844 million in August. This is a survey closely followed by the Fed.

• Also at 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for October. The consensus is for a 0.4% increase in inventories.