by Calculated Risk on 12/12/2013 11:56:00 AM

Thursday, December 12, 2013

CoStar: Commercial Real Estate prices increase in October, Distress Sales Lowest Level in Five Years

Here is a price index for commercial real estate that I follow.

From CoStar: Commercial Real Estate Prices Resume Upward Trend in October

The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—advanced by 1.1% and 1.4%, respectively, in October 2013. ... On an annual basis, the equal weighted CCRSI Composite Index has risen 7.4% while the value-weighted Composite CCRSI Index has advanced by 9.5%.

...

The percentage of commercial property selling at distressed prices dropped to 10.7% in October 2013 from nearly 20% one year earlier, the lowest level since December 2008. ... Distress levels vary widely by market, however. In housing bust markets including, Atlanta, Las Vegas and Orlando, distress deals still accounted for more than 20% of all sales activity in the third quarter of 2013, suggesting there is still significant room for price appreciation in those markets. Conversely, in healthier markets such as San Francisco, Boston, Los Angeles, Seattle and New York, the share of distressed sales fell into the single digits in the third quarter of 2013.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Value-Weighted and Equal-Weighted indexes. CoStar reported that the Value-Weighted index is up 50.3% from the bottom (showing the earlier and stronger demand for higher end properties) and up 9.5% year-over-year. However the Equal-Weighted index is only up 17.0% from the bottom, and up 7.4% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Retail Sales increased 0.7% in November

by Calculated Risk on 12/12/2013 08:49:00 AM

On a monthly basis, retail sales increased 0.7% from October to November (seasonally adjusted), and sales were up 4.7% from November 2012. Sales in October were revised up from a 0.4% increase to 0.6%. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for November, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $432.3 billion, an increase of 0.7 percent from the previous month, and 4.7 percent above November 2012. ... The September to October 2013 percent change was revised from +0.4 percent to +0.6 percent.

Click on graph for larger image.

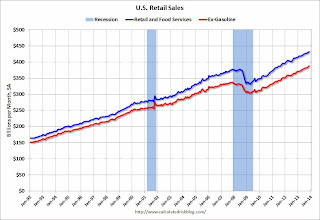

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-autos increased 0.4%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.5% on a YoY basis (4.7% for all retail sales).

Retail sales ex-gasoline increased by 5.5% on a YoY basis (4.7% for all retail sales).This was a solid report, and especially strong considering the upward revision to October sales.

Weekly Initial Unemployment Claims increase to 368,000

by Calculated Risk on 12/12/2013 08:36:00 AM

The DOL reports:

In the week ending December 7, the advance figure for seasonally adjusted initial claims was 368,000, an increase of 68,000 from the previous week's revised figure of 300,000. The 4-week moving average was 328,750, an increase of 6,000 from the previous week's revised average of 322,750.The previous week was up from 298,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 328,750.

Weekly claims are frequently volatile around the holidays (Thanksgiving), and the level of the four week average of weekly claims suggests an improving labor market.

Wednesday, December 11, 2013

Thursday: Retail Sales, Unemployment Claims

by Calculated Risk on 12/11/2013 08:42:00 PM

Something to be aware of from Victoria McGrane And Jon Hilsenrath at the WSJ: Fed Moves Toward New Tool for Setting Rates

An experimental bond-trading program being run at the Federal Reserve Bank of New York could fundamentally change the way the central bank sets interest rates.Thursday:

Fed officials see the program, known as a "reverse repo" facility, as a potentially critical tool when they want to raise short-term rates in the future to fend off broader threats to the economy.

...

"The Federal Reserve has never tightened monetary policy, or even tried to maintain short-term interest rates significantly above zero, with such abundant amounts of liquidity in the financial system," according to a draft of a new research paper by Brian Sack, the former head of the New York Fed's markets group, and Joseph Gagnon, an economist at the Peterson Institute for International Economics and a former Fed economist.

...

When it does want to raise rates, the Fed under the repo program would use securities it accumulated through its bond-buying programs as collateral for loans from money-market mutual funds, banks, securities dealers, government-sponsored enterprises and others.

The rates it sets on these loans, in theory, could become a new benchmark for global credit markets.

• 8:30 AM ET, 8he initial weekly unemployment claims report will be released. The consensus is for claims to increase to 325 thousand from 298 thousand last week.

• Also at 8:30 AM, Retail sales for November will be released. The consensus is for retail sales to be 0.6% in November, and to increase 0.3% ex-autos.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for October. The consensus is for a 0.3% increase in inventories.

Lawler on Fed Note: “Business Investor Activity in the Single-Family-Housing Market”

by Calculated Risk on 12/11/2013 04:37:00 PM

Economist Tom Lawler writes:

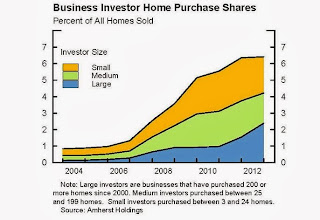

A “FEDS Note” (by Fed economists Malloy and Zarutskie), available on the Federal Reserve’s website, Business Investor Activity in the Single-Family-Housing Market, is a brief note on purchases of SF homes by “business investors” over the past few years. The data are based on an analysis of CoreLogic real estate transactions by analysts at Amherst Holdings. While the note does not give details on how a “business investor” was determined, the note says that this determination was made by looking at the names of the buyers of record. A link to the chart says that “(b)usiness investors are defined as business entities identified as purchasing homes for primarily for the purpose of earning a financial return.”

Here is a chart from the report on the Business Investor share of national home purchases.

As noted above, this chart only reflects the BUSINESS INVESTOR” share of home purchases, and does not include INDIVIDUAL investors. Back in 2004 and 2005 the investor share of mortgage-financed home purchases was extremely high, with such purchases mainly being by individuals (many of whom purchased multiple properties.)

At first glance this share increase, while noticeable, may not seem “large.” However, these shares suggest that business investor purchase of SF homes from 2010 to 2013 (using full-year estimates for 2013) totaled over 950,000, more than double the total number of business investor purchases over the previous SIX years (2004-2009). If the bulk of these business investor purchases were bought with the intent to rent the properties out for “several” years, then the sharp decline in the number of residential properties from 2010 to early 2013 seems a bit more “explainable.”

The note has a table showing the business-investor share of SF home purchases for selected metro areas.

CR Note: The metro areas with the largest share of investor buying in 2012 were Atlanta at 16.43%, Phoenix at 13.99% and Las Vegas at 10.97%.