by Calculated Risk on 12/16/2013 12:07:00 PM

Monday, December 16, 2013

Weekly Update: Housing Tracker Existing Home Inventory up 1.9% year-over-year on Dec 16th

Here is another weekly update on housing inventory ... for the ninth consecutive week, housing inventory is up year-over-year. This suggests inventory bottomed early in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for October; November data will be released later this week). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012 and 2013.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2013 is now 1.9% above the same week in 2012 (red is 2013, blue is 2012).

Inventory is still very low - and barely up year-over-year - but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? I'll post some thoughts on inventory at the end of the year.

Fed: Industrial Production increased 1.1% in November, Above Pre-recession Peak

by Calculated Risk on 12/16/2013 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 1.1 percent in November after having edged up 0.1 percent in October; output was previously reported to have declined 0.1 percent in October. The gain in November was the largest since November 2012, when production rose 1.3 percent. Manufacturing output increased 0.6 percent in November for its fourth consecutive monthly gain. Production at mines advanced 1.7 percent to more than reverse a decline of 1.5 percent in October. The index for utilities was up 3.9 percent in November, as colder-than-average temperatures boosted demand for heating. At 101.3 percent of its 2007 average, total industrial production was 3.2 percent above its year-earlier level. In November, industrial production surpassed for the first time its pre-recession peak of December 2007 and was 21 percent above its trough of June 2009. Capacity utilization for the industrial sector increased 0.8 percentage point in November to 79.0 percent, a rate 1.2 percentage points below its long-run (1972-2012) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.0 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.0% is still 1.2 percentage points below its average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

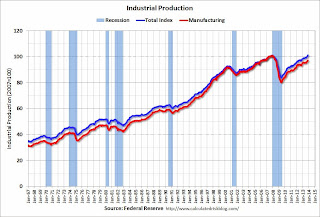

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 1.1% in November to 101.3. This is 21% above the recession low, and slightly above the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were above expectations. The consensus was for a 0.6% increase in Industrial Production in November, and for Capacity Utilization to be at 78.4%.

NY Fed: Empire State Manufacturing Activity "flat" in December

by Calculated Risk on 12/16/2013 08:30:00 AM

From the NY Fed: Empire State Manufacturing Survey

The December 2013 Empire State Manufacturing Survey indicates that manufacturing conditions were flat for New York manufacturers. The general business conditions index rose three points but, at 1.0, indicated that activity changed little over the month. The new orders index inched up, but remained negative at -3.5 ...This is the first of the regional surveys for December. The general business conditions index was below the consensus forecast of a reading of 4.5, and shows little expansion.

Labor market conditions remained weak, with the index for number of employees holding at 0.0 for a second month in a row and the average workweek index dropping six points to -10.8. Indexes for the six-month outlook generally conveyed a fair degree of optimism about future conditions ... emphasis added

Sunday, December 15, 2013

Sunday Night Futures: Time for Taper?

by Calculated Risk on 12/15/2013 08:22:00 PM

Monday:

• At 8:30 AM ET, the NY Fed Empire Manufacturing Survey for December. The consensus is for a reading of 4.5, up from -2.2 in November (above zero is expansion).

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for November. The consensus is for a 0.6% increase in Industrial Production, and for Capacity Utilization to increase to 78.4%.

This will be a busy week for economic data, and the focus will be on Fed Chairman Ben Bernanke's last FOMC meeting and press conference on Wednesday.

From Pedro Nicolaci da Costa and Jon Hilsenrath at the WSJ: Tough Question for Fed: Time to Act?

Fed Chairman Ben Bernanke in June set out a three-part test—based on employment, growth and inflation—for reducing the $85 billion in monthly bond buys. He said the Fed's policy committee wants to see progress in the job market, supported by improving economic activity and an inflation rate rising toward its 2% target.Weekend:

"If the incoming data are broadly consistent with this forecast, the committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year," Mr. Bernanke said at a news conference.

Recent data show progress on the first two criteria, but not on the third. The inflation rate has been persistently below the Fed's objective and reflects weak consumption and wage growth, which bode poorly for the economic recovery. Fed officials will likely differ on whether the gains overall are good enough to clear Mr. Bernanke's hurdles.

• Schedule for Week of December 15th

• FOMC Projections Preview: To Taper, or Not to Taper

The Nikkei is down about 0.5%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 2 and DOW futures are up 20 (fair value).

Oil prices have mostly been moving sideways with WTI futures at $96.71 per barrel and Brent at $109.48 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.22 per gallon. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

FOMC Projections Preview: To Taper, or Not to Taper

by Calculated Risk on 12/15/2013 11:11:00 AM

The FOMC meets on Tuesday and Wednesday of this week. It seems some modest "tapering" of monthly asset purchases is possible, although the consensus is the Fed will wait until January or March of next year.

Here is some analysis, first from Merrill Lynch:

Once again, market anticipation is rising ahead of a Fed meeting. In our view, this meeting will be defined by what the Fed doesn’t do: we see a low chance of the start to tapering or meaningful changes to forward guidance. Rather, we look to Chairman Bernanke’s final press conference for a broad discussion of Fed policy options into next year. He is likely to signal both that tapering could start early next year — conditional on the data — and that the Fed will be patient and gradual as it winds down its purchase program. We also expect him to indicate that the Fed will strengthen its forward guidance if needed, but keep his options open. The overall tone should be modestly dovish, especially relative to market expectations of potential start to tapering. We expect him to reiterate that the Fed intends to keep policy accommodative well into the future in order to support a broader and more sustained recovery.And from economist David Mericle at Goldman Sachs:

Fed officials face a more difficult decision at their meeting next week, as the employment and growth data have picked up since the October meeting. But our central forecast for the first tapering move remains March, with January possible as well. We see a decision to taper next week as unlikely for three reasons.My view is the data is broadly consistent with the FOMC's projections in June and September. Inflation is too low, but the FOMC was projecting low inflation - and they are expecting inflation to pick up in 2014. Most analysts expect the FOMC to wait until 2014, but a small taper this week should not be a surprise.

First, the case for tapering on the basis of the data since October is mixed at best. The strongest argument in favor is the improvement in the trend rate of payroll growth to the 200k level. However, we expect that Fed officials will also put considerable weight on inflation, which has fallen further in recent months. At current spot and projected inflation rates, a tightening move would be quite unusual by historical standards.

Second, we continue to expect that tapering will be offset by a strengthening of the forward guidance, but we doubt the FOMC is ready to take this step. While some eventual strengthening or clarifying of the forward guidance is now a consensus expectation, the October minutes and recent Fed commentary suggest little agreement on what form this should take.

Third, while consensus expectations now place greater probability on a December taper, it remains a minority view. We suspect that this makes a move less likely, as Fed officials will be reluctant to deliver a hawkish surprise that could tighten financial conditions and raise doubts about their commitment to the inflation target.

If the Fed does reduce their asset purchases, the "taper" will probably be small - perhaps to $75 or $80 billion per month from the current $85 billion per month. If purchases are reduced, it seems likely that the Fed will continue to purchase agency mortgage-backed securities at the current rate ($40 billion per month), but reduce their purchases of longer-term Treasury securities from $45 billion per month.

In the press conference on Wednesday, I expect Fed Chairman Ben Bernanke will probably make it clear that the Fed will not raise rates for a "considerable" time after the end of QE, and it seems likely he will express more concern about the low level of inflation.

On the projections, it looks like GDP will be mostly unchanged, and the projections for the unemployment rate might be reduced, and PCE inflation will be reduced. Note: I've included earlier projections to show the trend (TBA: To be announced).

Early forecasts for Q4 are that real GDP will increase at around a 1.7% annual rate, and that would put 2013 real GDP growth at 2.2% or so - right in the FOMC's September range. A key will be any changes to the 2014 GDP projections.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2013 | 2014 | 2015 | 2016 |

| Dec 2013 Meeting Projections | TBA | TBA | TBA | TBA |

| Sept 2013 Meeting Projections | 2.0 to 2.3 | 2.9 to 3.1 | 3.0 to 3.5 | 2.5 to 3.3 |

| June 2013 Meeting Projections | 2.3 to 2.6 | 3.0 to 3.5 | 2.9 to 3.6 | |

| Mar 2013 Meeting Projections | 2.3 to 2.8 | 2.9 to 3.4 | 2.9 to 3.7 | |

The unemployment rate was at 7.0% in November (and 7.3% in October) and the projections for the Q4 average might be revised down a little.

I also expect the FOMC to project lower unemployment rates in 2014 and 2015.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2013 | 2014 | 2015 | 2016 |

| Dec 2013 Meeting Projections | TBA | TBA | TBA | TBA |

| Sept 2013 Meeting Projections | 7.1 to 7.3 | 6.4 to 6.8 | 5.9 to 6.2 | 5.4 to 5.9 |

| June 2013 Meeting Projections | 7.2 to 7.3 | 6.5 to 6.8 | 5.8 to 6.2 | |

| Mar 2013 Meeting Projections | 7.3 to 7.5 | 6.7 to 7.0 | 6.0 to 6.5 | |

Projections for inflation will probably be lower. PCE inflation through October was only up 0.7%, although PCE inflation should be up a little more year-over-year in November and December (because prices declined in November and December last year). I expect the FOMC to revised down 2013 inflation to 1.0% or so.

A key will be the FOMC's projections for inflation in 2014 and 2015. If the FOMC thinks low inflation is transitory, they will be more willing to taper at this meeting. If not - if they think low inflation will persist - then they will want to wait to reduce asset purchases

The current concern is that inflation is too low and well below the Fed's target.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2013 | 2014 | 2015 | 2016 |

| Dec 2013 Meeting Projections | TBA | TBA | TBA | TBA |

| Sept 2013 Meeting Projections | 1.1 to 1.2 | 1.3 to 1.8 | 1.6 to 2.0 | 1.7 to 2.0 |

| June 2013 Meeting Projections | 0.8 to 1.2 | 1.4 to 2.0 | 1.6 to 2.0 | |

| Mar 2013 Meeting Projections | 1.3 to 1.7 | 1.5 to 2.0 | 1.7 to 2.0 | |

Core inflation was up 1.1% year-over-year in October, and will probably be a little higher in November and December. The FOMC might revise core inflation down slightly for 2013, but the key will be 2014.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2013 | 2014 | 2015 | 2016 |

| Dec 2013 Meeting Projections | TBA | TBA | TBA | TBA |

| Sept 2013 Meeting Projections | 1.2 to 1.3 | 1.5 to 1.7 | 1.7 to 2.0 | 1.9 to 2.0 |

| June 2013 Meeting Projections | 1.2 to 1.3 | 1.5 to 1.8 | 1.7 to 2.0 | |

| Mar 2013 Meeting Projections | 1.5 to 1.6 | 1.7 to 2.0 | 1.8 to 2.0 | |

Conclusion: In September I wrote "It does seem odd that the FOMC would start reducing asset purchases while downgrading GDP, and also expressing concern about the downside risks from fiscal policy". In some ways the reverse is true now. GDP and unemployment will meet or exceed the FOMC's September projections, and core inflation will be close. And fiscal policies appear resolved for 2014.

Clearly the data is broadly consistent with the September FOMC projections, so a small taper should not be a surprise (even if most analysts think the FOMC will wait until early 2014).