by Calculated Risk on 12/23/2013 05:58:00 PM

Monday, December 23, 2013

Ten Economic Questions for 2014

Here is a review of the Ten Economic Questions for 2013.

I'll follow up some thoughts on each of these questions. I'm sure there are other important questions, but these are the ones I'm thinking about now.

1) Economic growth: Heading into 2014, it seems most analysts expect faster economic growth. So do I. Will 2014 be the best year of the recovery so far? Could 2014 be the best year since the '90s? Or will 2014 disappoint?

2) Employment: How many payroll jobs will be added in 2014? Will we finally see some pickup over the approximately 2.1 to 2.3 million job creation rate of 2011, 2012, and 2013?

3) Unemployment Rate: The unemployment rate is still elevated at 7.0% in November. For the last three years I've been too pessimistic on the unemployment rate because I was expecting some minor bounce back in the participation rate. Instead the participation rate continued to decline. Maybe 2014 will be the year the participation rate increases a little, or at least stabilizes.

What will the unemployment rate be in December 2014?

4) Inflation: The Fed has made it clear they will tolerate a little more inflation, but currently the inflation rate is running well below the Fed's 2% target. Will the inflation rate rise in 2014? Will too much inflation be a concern in 2014?

5) Monetary Policy: It appears the Fed's current plan is to reduce their monthly asset purchases by about $10 billion at each FOMC meeting in 2014. That would put the monthly purchases at close to zero in December 2014. Will the Fed complete QE3 in 2014? Or will the Fed continue to buy assets in 2015?

6) Residential Investment: Residential investment (RI) picked was up solidly in 2012 and 2013. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. Even with the recent increases, RI is still at a historical low level. How much will RI increase in 2014?

7) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up about 12% or so in 2013. What will happen with house prices in 2014?

8) Housing Credit: Will we see easier mortgage lending in 2014? Will we see positive mortgage equity withdrawal (MEW) after six years of negative MEW?

9) Housing Inventory: It appears housing inventory bottomed in early 2013. Will inventory increase in 2014, and, if so, by how much?

10) Downside Risks: What are the downside risks in 2014?

I'm sure there are other key questions, but these are the ones I'm thinking about now.

Weekly Update: Housing Tracker Existing Home Inventory up 2.3% year-over-year on Dec 23rd

by Calculated Risk on 12/23/2013 02:49:00 PM

Here is another weekly update on housing inventory ... for the tenth consecutive week, housing inventory is up year-over-year. This suggests inventory bottomed early in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for November). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012 and 2013.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2013 is now 2.3% above the same week in 2012 (red is 2013, blue is 2012).

Inventory is still very low - and barely up year-over-year - but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? I'll post some thoughts on inventory at the end of the year.

Chicago Fed: "Economic growth picked up in November"

by Calculated Risk on 12/23/2013 12:23:00 PM

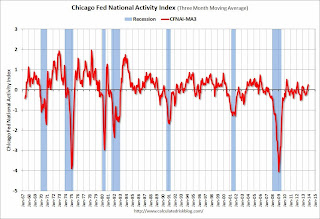

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth picked up in November

Led by gains in employment- and production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to +0.60 in November from –0.07 in October.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased to +0.25 in November from +0.12 in October, marking its second consecutive reading above zero and highest reading since February 2012. November’s CFNAI-MA3 suggests that growth in national economic activity was above its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was above the historical trend in November (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Final December Consumer Sentiment at 82.5

by Calculated Risk on 12/23/2013 09:55:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for December was at 82.5, up from the November reading of 75.1, and unchanged from the preliminary December reading of 82.5.

This was below the consensus forecast of 83.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011. The decline in October and early November was probably also due to the government shutdown and another threat to "not pay the bills".

As usual sentiment rebounds fairly quickly following event driven declines, and I expect to see sentiment at post-recession highs very soon.

Personal Income increased 0.2% in November, Spending increased 0.5%

by Calculated Risk on 12/23/2013 08:53:00 AM

The BEA released the Personal Income and Outlays report for November:

Personal income increased $30.1 billion, or 0.2 percent ... in November according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $63.0 billion, or 0.5 percent.On inflation, the PCE price index decreased at a 0.3% annual rate in October, and core PCE prices increased at a 1.2% annual rate. This is very low and far below the Fed's 2% target.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.5 percent in November, compared with an increase of 0.4 percent in October. ... The price index for PCE increased less than 0.1 percent in November, in contrast to a decrease of less than 0.1 percent in October. The PCE price index, excluding food and energy, increased 0.1 percent in November, the same increase as in October.

The following graph shows real Personal Consumption Expenditures (PCE) through November 2013 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Using the two-month method to estimate Q4 PCE growth (first two months of the quarter), PCE was increasing at a 4.1% annual rate in Q4 2013 (using mid-month method, PCE was increasing at 4.6% rate). This suggests solid PCE growth in Q4.