by Calculated Risk on 12/24/2013 02:48:00 PM

Tuesday, December 24, 2013

Philly Fed: State Coincident Indexes increased in 46 states in November

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for November 2013. In the past month, the indexes increased in 46 states, decreased in two states (Alaska and Ohio), and remained stable in two (New Hampshire and Washington), for a one-month diffusion index of 88. Over the past three months, the indexes increased in 46 states, decreased in three, and remained stable in one for a three-month diffusion index of 86.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In November, 48 states had increasing activity(including minor increases). This measure has been and up down over the last few years ...

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green at times during the recovery.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green at times during the recovery.There are a few states with three month declining activity, but most of the map is green - and I expect the map to be all green soon.

Comments on New Home Sales

by Calculated Risk on 12/24/2013 11:53:00 AM

Earlier: New Home Sales at 464,000 Annual Rate in November

Looking at the first eleven months of 2013, there has been a significant increase in new home sales this year. The Census Bureau reported that there were 401 new homes sold during the first eleven months of 2013, up 17.6% from the 341 thousand sold during the same period in 2012. That follows an annual increase of 20% in 2012.

This puts new home sales on pace for about 433 thousand in 2013. But even though there has been a large increase in the sales rate, sales are close to the lows for previous recessions. Right now it looks like 2013 will be the sixth worst year for new home sales since 1963.

The sales rate was only lower than 2013 in the worst housing bust years of 2009 through 2012, and the worst year of early '80s recession (1982).

| Worst Years for New Home Sales since 1963 | ||

|---|---|---|

| Rank | Year | New Home Sales (000s) |

| 1 | 2011 | 306 |

| 2 | 2010 | 323 |

| 3 | 2012 | 368 |

| 4 | 2009 | 375 |

| 5 | 1982 | 412 |

| 6 | 2013*** | 433 |

| 7 | 1981 | 436 |

| 8 | 1969 | 448 |

| 9 | 1966 | 461 |

| 10 | 1970 | 485 |

| 11 | 2008 | 485 |

| *** Estimate for 2013 | ||

This suggests significant upside over the next several years. Based on estimates of household formation and demographics, I expect sales to increase to 750 to 800 thousand over the next several years - substantially higher than the current 464 thousand sales rate. So I expect the recovery to continue.

And here is another update to the "distressing gap" graph that I first started posting over four years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Click on graph for larger image.

Click on graph for larger image.The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through November 2013. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I expect existing home sales to decline some (distressed sales will slowly decline and be partially offset by more conventional sales). And I expect this gap to continue to close - mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales at 464,000 Annual Rate in November

by Calculated Risk on 12/24/2013 10:00:00 AM

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 464 thousand.

October sales were revised up from 444 thousand to 474 thousand, and September sales were revised up from 354 thousand to 403 thousand. August sales were revised up from 379 thousand to 388 thousand.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

"Sales of new single-family houses in November 2013 were at a seasonally adjusted annual rate of 464,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 2.1 percent below the revised October rate of 474,000, but is 16.6 percent above the November 2012 estimate of 398,000."

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This was reported as a decrease in the sales rate, but that was because sales in October were revised up. Sales in October and November were at the highest rate since 2008.

Even with this increase, new home sales are still near the bottom for previous recessions.

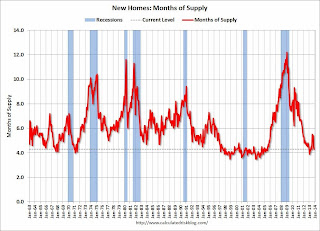

The second graph shows New Home Months of Supply.

The months of supply decreased in November to 4.3 months from 4.5 months in October.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of November was 167,000. This represents a supply of 4.3 months at the current sales rate."On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale is near the record low. The combined total of completed and under construction is still very low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In November 2013 (red column), 33 thousand new homes were sold (NSA). Last year 29 thousand homes were sold in November. The high for November was 86 thousand in 2005, and the low for November was 20 thousand in 2010.

This was above expectations of 450,000 sales in November, and there were significant upward revisions to prior months.

I'll have more later today - but this was a solid report and the housing recovery will continue.

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Refinance Activity Lowest since Nov 2008

by Calculated Risk on 12/24/2013 09:01:00 AM

From the MBA: Mortgage Applications Fall During Holiday-Shortened Week

Mortgage applications decreased 6.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 20, 2013. ...

The Refinance Index decreased 8 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier....

...

"Purchase volume was weak too, continuing to run more than ten percent below last year's pace." [said Mike Fratantoni, MBA’s Vice President of Research and Economics].

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.63 percent, the highest level since September 2013, from 4.61 percent, with points unchanged at 0.24 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down sharply - and down 72% from the levels in early May - and at the lowest level since November 2008

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 11% from a year ago.

Monday, December 23, 2013

Tuesday: New Home Sales, Durable Goods, Richmond Fed Mfg Survey and More

by Calculated Risk on 12/23/2013 08:36:00 PM

China remains a risk, from the WSJ: China Cash Crunch Shows Central Bank's Difficulties

A cash crunch among China's banks intensified, highlighting the difficulties faced by the central bank in managing an increasingly stressed financial system.Tuesday: All US markets will close early

...

The current squeeze is driven by several factors, analysts said. One is a little-noticed drop in China's year-end government spending. ... Banks are becoming more cautious and are hoarding more cash for future needs in case the cash squeeze worsens. Some of them are also boosting provisions for potential loan defaults.

...

"To prevent systemic risks, and reduce the impact on liquidity, the supervision of the interbank market will continue to be strengthened," analysts at Bank of China Ltd. said in a report Monday, adding that interbank lending was "accentuating hidden dangers" in the financial system. The rise in rates came despite the Chinese central bank's announcement late Friday that it had injected more than 300 billion yuan into the financial system over a three-day period following the increase in interbank rates last week.

• At 7:00 AM ET, Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for November from the Census Bureau. The consensus is for a 1.5% increase in durable goods orders.

• At 9:00 AM, the FHFA House Price Index for October 2013. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% increase.

• At 10:00 AM, New Home Sales for November from the Census Bureau. The consensus is for an increase in sales to 450 thousand Seasonally Adjusted Annual Rate (SAAR) in November from 444 thousand in October.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for December. The consensus is a reading of 10, down from 13 in November (above zero is expansion).