by Calculated Risk on 1/03/2014 11:51:00 AM

Friday, January 03, 2014

Question #1 for 2014: How much will the economy grow in 2014?

Note: Near the beginning of each year, I find it useful to jot down a few thoughts on how I expect the economy to perform. This isn't to test my forecasting skills - sometimes I learn more when I miss a forecast (As an example, I've spent a significant amount of time looking at the participation rate and demographics since I've been overly pessimistic on the unemployment rate the last few years).

Earlier I posted some questions for this year: Ten Economic Questions for 2014.

Here is a review of the Ten Economic Questions for 2013.

1) Economic growth: Heading into 2014, it seems most analysts expect faster economic growth. So do I. Will 2014 be the best year of the recovery so far? Could 2014 be the best year since the '90s? Or will 2014 disappoint?

First, here is a table of the annual change in real GDP since 1999. Since 2000, the fastest real GDP growth was 3.8% in 2004, and the fastest growth for the recovery was 2.8% in 2012.

It is likely that 2014 will be the best year of the recovery, and possibly (with some luck) the best year since Clinton was president.

| Annual Real GDP Growth | ||

|---|---|---|

| Year | GDP | |

| 1999 | 4.8% | |

| 2000 | 4.1% | |

| 2001 | 1.0% | |

| 2002 | 1.8% | |

| 2003 | 2.8% | |

| 2004 | 3.8% | |

| 2005 | 3.4% | |

| 2006 | 2.7% | |

| 2007 | 1.8% | |

| 2008 | -0.3% | |

| 2009 | -2.8% | |

| 2010 | 2.5% | |

| 2011 | 1.8% | |

| 2012 | 2.8% | |

| 20131 | 2.0% | |

| 1 2013 estimate. | ||

There are several positives for the economy at the beginning of 2014: the housing recovery is ongoing (usually the best leading indicator for the economy), state and local government austerity is over (in the aggregate), household balance sheets are in much better shape - and it appears that in the aggregate, household deleveraging is over, most of the obvious downside risks have diminished, and even commercial real estate (CRE) investment and public construction will both probably make small positive contributions in 2014.

There is still some austerity at the Federal level (and cutting off emergency unemployment benefits is bad economic policy). Also, there are always downside risks from Europe and China, rising interest rates and more, but with all these positive trends I'd expect a pickup in US growth in 2014.

In 2012 (the best year of recovery for GDP growth so far), Personal consumption expenditures (PCE) only increased at a 2.5% real rate, compared to 3.8% in 2004 (best year since 2000). I expect PCE to pick up again into the 3% to 4% range, and this will give a boost to GDP. This increase in consumer spending should provide an incentive for business investment. Add in the ongoing housing recovery, some increase in state and local government spending, and 2014 should be the best year of the recovery with GDP growth at or above 3% (4% is not impossible).

Here are the ten questions for 2014 and a few predictions:

• Question #1 for 2014: How much will the economy grow in 2014?

• Question #2 for 2014: How many payroll jobs will be added in 2014?

• Question #3 for 2014: What will the unemployment rate be in December 2014?

• Question #4 for 2014: Will too much inflation be a concern in 2014?

• Question #5 for 2014: Monetary Policy: Will the Fed end QE3 in 2014?

• Question #6 for 2014: How much will Residential Investment increase?

• Question #7 for 2014: What will happen with house prices in 2014?

• Question #8 for 2014: Housing Credit: Will we see easier mortgage lending in 2014?

• Question #9 for 2014: How much will housing inventory increase in 2014?

• Question #10 for 2014: Downside Risks

Merrill Ups Q4 GDP Forecast to 3.0%

by Calculated Risk on 1/03/2014 09:59:00 AM

2013 finished strong ...

From Merrill Lynch:

As we enter 2014, most of the data releases continue to surprise to the upside. We are now tracking 3.0% for 4Q GDP growth, following a solid 4.1% pace in 3Q. This is a marked improvement from the first half average growth rate of 1.8%. We should not be too surprised, however. The economy was hit with significant fiscal tightening at the beginning of 2013: taxes were hiked in January and the sequester spending cuts went into effect early in the year. The economy was able to handle the drag and has proved resilient. This leaves us feeling optimistic about the prospects for stronger growth to persist in 2014.

The gain in the second half of 2013 has been driven by the consumer. For 4Q, real consumer spending is tracking a solid 4.0% pace. ... We believe a pickup in consumer spending should leave businesses feeling more confident and willing to invest.

Thursday, January 02, 2014

Friday: Bernanke, December Vehicle Sales

by Calculated Risk on 1/02/2014 09:02:00 PM

From NDD at the Bonddad Blog: Calculated Risk and I have made a bet on housing's direction in 2014

Both of us thought that housing was in a bubble in 2005. Both of us thought in 2011 that housing prices would bottom in early 2012.It is possible that we both will win (and two charities will receive donations). I'll update everyone in 2014.

But we have totally different opinions about the direction of housing in 2014.

...

So here are the terms of our bet: If starts or sales are up at least 20% YoY in any month in 2014, I will make a $100 donation to the charity of Bill's choice, which he has designated as the Memorial Fund in honor of his late co-blogger, Tanta. If housing permits or starts are down 100,000 YoY at least once in 2014, he make a $100 donation to the charity of my choice, which is the Alzheimer's Association.

Note that since our forecasts are not mirror images of one another, it is possible that both or us will win this bet. Or neither!

Friday:

• All day: Light vehicle sales for November. The consensus is for light vehicle sales to decrease to 16.0 million SAAR in December (Seasonally Adjusted Annual Rate) from 16.3 million SAAR in November. I'll post a graph - probably around 3 PM ET.

• 2:30 PM, Fed Chairman Ben S. Bernanke speaks, The Changing Federal Reserve: Past, Present, Future, At the American Economic Association Meeting, Philadelphia, Pennsylvania

Question #2 for 2014: How many payroll jobs will be added in 2014?

by Calculated Risk on 1/02/2014 01:45:00 PM

Note: Near the beginning of each year, I find it useful to jot down a few thoughts on how I expect the economy to perform. This isn't to test my forecasting skills - sometimes I learn more when I miss a forecast (As an example, I've spent a significant amount of time looking at the participation rate and demographics since I've been overly pessimistic on the unemployment rate the last few years).

Earlier I posted some questions for this year: Ten Economic Questions for 2014.

Here is a review of the Ten Economic Questions for 2013.

2) Employment: How many payroll jobs will be added in 2014? Will we finally see some pickup over the approximately 2.1 to 2.3 million job creation rate of 2011, 2012, and 2013?

First, here is a table of the annual change in total nonfarm and private sector payrolls jobs since 1999. The last three years have been near the best since 1999 (2005 was the best year for total nonfarm, and 2011 the best for private jobs).

It is possible that 2014 will be the best year since 1999 for both total nonfarm and private sector employment.

| Change in Payroll Jobs per Year (000s) | ||

|---|---|---|

| Total, Nonfarm | Private | |

| 1999 | 3,170 | 2,709 |

| 2000 | 1,944 | 1,680 |

| 2001 | -1,757 | -2,308 |

| 2002 | -532 | -765 |

| 2003 | 62 | 104 |

| 2004 | 2,019 | 1,872 |

| 2005 | 2,484 | 2,298 |

| 2006 | 2,071 | 1,862 |

| 2007 | 1,115 | 827 |

| 2008 | -3,617 | -3,797 |

| 2009 | -5,052 | -4,976 |

| 2010 | 1,022 | 1,235 |

| 2011 | 2,103 | 2,420 |

| 2012 | 2,193 | 2,269 |

| 20131 | 2,293 | 2,315 |

| 1 2013 is 12 month change ended in November. | ||

For the last couple of years, I've been hammering on two key positive themes: 1) the pickup in residential investment (RI), and 2) the end of state and local government layoffs. Both of these will be positive for employment again in 2014 (there seems to be a lag between increases in RI and employment, and I expect a larger increase in residential construction employment in 2014).

The following table shows the annual change in State and Local government since 2008. The four years of declining employment ended in 2008. Note: The Federal government layoffs are ongoing, and total government employment declined again in 2013.

To put these declines in perspective, during the G.W. Bush years (2001 through 2008), state and local governments added about 215 thousand jobs each year.

| State and Local Government, Annual Change in Payroll (000s) | |||

|---|---|---|---|

| Year | State Government | Local Government | Total |

| 2008 | 52 | 109 | 161 |

| 2009 | -40 | -88 | -128 |

| 2010 | -15 | -243 | -258 |

| 2011 | -94 | -192 | -286 |

| 2012 | -2 | -32 | -34 |

| 20131 | 12 | 58 | 70 |

| 1 2013 is 12 month change ended in November. | |||

The second table shows the change in construction payrolls starting in 2006.

| Construction Jobs (000s) | |

|---|---|

| 2006 | 152 |

| 2007 | -195 |

| 2008 | -789 |

| 2009 | -1,051 |

| 2010 | -182 |

| 2011 | 144 |

| 2012 | 99 |

| 20131 | 178 |

It is important to note that construction includes residential, commercial and public. In 2013, residential spending was up solidly, but public construction commercial spending mostly moved sideways. I expect all three categories to make positive contributions in 2014.

Both state and local government and construction hiring should improve further in 2014. Federal layoffs will be a negative, but most sectors should be solid. So my forecast is somewhat above the previous three years, and I expect gains of about 200,000 to 225,000 payroll jobs per month in 2014.

It is possible that 2014 will be the best year since 1999 (264 thousand total per month, 225 thousand private sector). Maybe we will even party like it is 1999 (for employment growth).

Here are the ten questions for 2014 and a few predictions:

• Question #1 for 2014: How much will the economy grow in 2014?

• Question #2 for 2014: How many payroll jobs will be added in 2014?

• Question #3 for 2014: What will the unemployment rate be in December 2014?

• Question #4 for 2014: Will too much inflation be a concern in 2014?

• Question #5 for 2014: Monetary Policy: Will the Fed end QE3 in 2014?

• Question #6 for 2014: How much will Residential Investment increase?

• Question #7 for 2014: What will happen with house prices in 2014?

• Question #8 for 2014: Housing Credit: Will we see easier mortgage lending in 2014?

• Question #9 for 2014: How much will housing inventory increase in 2014?

• Question #10 for 2014: Downside Risks

Construction Spending increased in November, Highest since March 2009

by Calculated Risk on 1/02/2014 10:52:00 AM

The Census Bureau reported that overall construction spending increased in November:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during November 2013 was estimated at a seasonally adjusted annual rate of $934.4 billion, 1.0 percent above the revised October estimate of $925.1 billion. The November figure is 5.9 percent (±2.0%) above the November 2012 estimate of $882.7 billion.

...

Spending on private construction was at a seasonally adjusted annual rate of $659.4 billion, 2.2 percent above the revised October estimate of $644.9 billion. Residential construction was at a seasonally adjusted annual rate of $345.5 billion in November, 1.9 percent above the revised October estimate of $339.2 billion. Nonresidential construction was at a seasonally adjusted annual rate of $313.9 billion in November, 2.7 percent above the revised October estimate of $305.7 billion. ...

November, the estimated seasonally adjusted annual rate of public construction spending was $275.0 billion, 1.8 percent below the revised October estimate of $280.2 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 49% below the peak in early 2006, and up 51% from the post-bubble low.

Non-residential spending is 24% below the peak in January 2008, and up about 39% from the recent low.

Public construction spending is now 16% below the peak in March 2009 and up about 4% from the recent low.

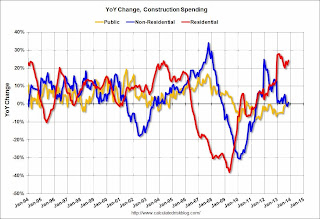

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 24%. Non-residential spending is up 1% year-over-year. Public spending is down slightly year-over-year.

To repeat a few key themes:

1) Private residential construction is usually the largest category for construction spending, and is now the largest category once again. Usually private residential construction leads the economy, so this is a good sign going forward.

2) Private non-residential construction spending usually lags the economy. There was some increase this time for a couple of years - mostly related to energy and power - but the key sectors of office, retail and hotels are still at very low levels. Based on the architecture billings index, I expect private non-residential to increase in 2014

3) Public construction spending was down in November and is now only 4% above the low in April. However it appears that the drag from public construction spending is over. Public spending has declined to 2006 levels (not adjusted for inflation) and was a drag on the economy for 4 years. In real terms, public construction spending has declined to 2001 levels.

Looking forward, all categories of construction spending should continue to increase. Residential spending is still very low, non-residential should start to pickup, and public spending appears to have bottomed.