by Calculated Risk on 1/04/2014 10:20:00 AM

Saturday, January 04, 2014

Schedule for Week of January 5th

The key report this week is the December employment report to be released on Friday.

Other key reports include the December ISM non-manufacturing report on Monday and the November trade report on Tuesday.

Also, Reis is scheduled to release their Q4 surveys of rents and vacancy rates for apartments, offices and malls.

Early: Reis Q4 2013 Office Survey of rents and vacancy rates.

10:00 AM: ISM non-Manufacturing Index for December. The consensus is for a reading of 54.8, up from 53.9 in November. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for November. The consensus is for a 1.6% increase in orders.

Early: Reis Q4 2013 Apartment Survey of rents and vacancy rates.

8:30 AM: Trade Balance report for November from the Census Bureau.

8:30 AM: Trade Balance report for November from the Census Bureau. Both imports and exports increased in October.

The consensus is for the U.S. trade deficit to decrease to $39.9 billion in November from $40.6 billion in October.

Early: Reis Q4 2013 Mall Survey of rents and vacancy rates.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index for the previous two weeks.

8:15 AM: The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 205,000 payroll jobs added in December, down from 215,000 in November.

2:00 PM: The Fed will release the FOMC Minutes for the Meeting of December 17-18, 2013.

3:00 PM: Consumer Credit for November from the Federal Reserve. The consensus is for credit to increase $14.2 billion in November.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decline to 331 thousand from 339 thousand.

10:00 AM: Trulia Price Rent Monitors for December. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

8:30 AM: Employment Report for December. The consensus is for an increase of 200,000 non-farm payroll jobs in December, down from the 203,000 non-farm payroll jobs added in November.

The consensus is for the unemployment rate to be unchanged at 7.0% in December.

The following graph shows the percentage of payroll jobs lost during post WWII recessions through November.

The economy has added 8.1 million private sector jobs since employment bottomed in February 2010 (7.45 million total jobs added including all the public sector layoffs).

The economy has added 8.1 million private sector jobs since employment bottomed in February 2010 (7.45 million total jobs added including all the public sector layoffs).There are still almost 760 thousand fewer private sector jobs now than when the recession started in 2007.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for November. The consensus is for a 0.5% increase in inventories.

Friday, January 03, 2014

Unofficial Problem Bank list declines to 618 Institutions

by Calculated Risk on 1/03/2014 07:29:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for January 3, 2013.

Changes and comments from surferdude808:

Quiet week to start off the New Year as expected. This week there were two removals and one addition to the Unofficial Problem Bank List. After the changes, the list stands at 618 institutions with assets of $205.6 billion. A year ago, the list held 834 institutions with assets of $311.6 billion.

Removals include the FDIC terminating an action against Oconee State Bank, Watkinsville, GA ($265 million) and Advance Bank, Baltimore, MD ($54 million) finding a merger partner. Hat tip to reader HR for alerting us to the Consent Order issued against The Bank of Oswego, Lake Oswego, OR ($118 million), which cannot be located on the FDIC website.

Next week should be as quiet as we do not anticipate the OCC releasing an update on its enforcement actions until January 17th.

U.S. Light Vehicle Sales decrease to 15.5 million annual rate in December, Annual Sales up 7.5%

by Calculated Risk on 1/03/2014 03:27:00 PM

Based on an estimate from WardsAuto, light vehicle sales were at a 15.53 million SAAR in December. That is up 2.3% from December 2012, and down 4.8% from the sales rate last month.

This was below the consensus forecast of 16.0 million SAAR (seasonally adjusted annual rate).

For the year, most forecasts were for auto sales growth to slow in 2013 to around 4% growth or 15.0 million units. Actually sales growth were up about 7.5% to 15.5 million.

| Light Vehicle Sales | ||

|---|---|---|

| Sales (millions) | Annual Change | |

| 2000 | 17.4 | 2.7% |

| 2001 | 17.1 | -1.3% |

| 2002 | 16.8 | -1.8% |

| 2003 | 16.6 | -1.1% |

| 2004 | 16.9 | 1.4% |

| 2005 | 16.9 | 0.5% |

| 2006 | 16.5 | -2.6% |

| 2007 | 16.1 | -2.5% |

| 2008 | 13.2 | -18.0% |

| 2009 | 10.4 | -21.2% |

| 2010 | 11.6 | 11.1% |

| 2011 | 12.7 | 10.2% |

| 2012 | 14.4 | 13.4% |

| 20131 | 15.5 | 7.5% |

| 1Initial estimate. | ||

Click on graph for larger image.

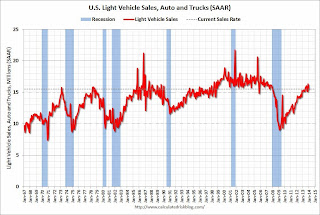

Click on graph for larger image.This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for December (red, light vehicle sales of 15.53 million SAAR from WardsAuto).

December sales were a little disappointing, but overall 2013 was solid.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.Unlike residential investment, auto sales bounced back fairly quickly following the recession and were a key driver of the recovery.

Looking forward, the growth rate will slow for auto sales, and most forecasts are for around a 4% sales gain in 2014 to around 16.1 million light vehicles.

Bernanke: The Federal Reserve: Looking Back, Looking Forward

by Calculated Risk on 1/03/2014 02:40:00 PM

From Fed Chairman Ben Bernanke: The Federal Reserve: Looking Back, Looking Forward. On the economy:

I have discussed the factors that have held back the recovery, not only to better understand the recent past but also to think about the economy's prospects. The encouraging news is that the headwinds I have mentioned may now be abating. Near-term fiscal policy at the federal level remains restrictive, but the degree of restraint on economic growth seems likely to lessen somewhat in 2014 and even more so in 2015; meanwhile, the budgetary situations of state and local governments have improved, reducing the need for further sharp cuts. The aftereffects of the housing bust also appear to have waned. For example, notwithstanding the effects of somewhat higher mortgage rates, house prices have rebounded, with one consequence being that the number of homeowners with "underwater" mortgages has dropped significantly, as have foreclosures and mortgage delinquencies. Household balance sheets have strengthened considerably, with wealth and income rising and the household debt-service burden at its lowest level in decades. Partly as a result of households' improved finances, lending standards to households are showing signs of easing, though potential mortgage borrowers still face impediments. Businesses, especially larger ones, are also in good financial shape. The combination of financial healing, greater balance in the housing market, less fiscal restraint, and, of course, continued monetary policy accommodation bodes well for U.S. economic growth in coming quarters. But, of course, if the experience of the past few years teaches us anything, it is that we should be cautious in our forecasts.CR Note: This fits my current view - and I hope Bernanke is correct!

emphasis added

Fed's Lacker: Projecting 2% GDP Growth in 2014

by Calculated Risk on 1/03/2014 01:58:00 PM

From Richmond Fed President Jeffery Lacker: Economic Outlook, January 2014

Many forecasters are citing the recent surge as support for projections of sustained growth at around 3 percent starting later this year. It's worth pointing out, however, that this has been true at virtually every point in this expansion. Ever since the recovery began, most forecasters have the economy picking up speed in the next couple of quarters with the easing of headwinds that have been temporarily restraining growth. My own forecasts (at least initially) followed this script as well.CR Note: I was forecasting 2% in 2013, as were several key forecasters. So not everyone was overly optimistic last year.

Lacker:

Although consumption grew rapidly at the end of last year, we have seen similar surges since the last recession, only to see spending return to a more moderate trend. Consumer spending trends are likely to depend on whether the dramatic events of the last few years are only a temporary disturbance to household sentiment or if they instead represent a more persistent shift in attitudes about borrowing and saving. At this point, I am inclined toward the latter view.Lacker is referring to the NFIB index. What he fails to mention is that during good times, small business owners complain about "government regulations and red tape". This is usually a good sign. It could be a bad sign this time, but I expect small business growth to improve in 2014.

Businesses also appear to be quite reticent to hire and invest. A widely followed index of small business optimism fell sharply during the recession and has only partially recovered since then. Interestingly, when small business owners were asked about the single most important problem they face, the most frequent answer in the latest survey was "government regulations and red tape." This observation accords with reports we've been hearing from many business contacts for several years now. They've seen a substantial increase in the pace of regulatory change and a substantial increase in uncertainty about the shape of new regulations. Both are said to discourage new hiring and investment commitments.

Lacker:

I've discussed consumer spending and business investment, which together account for about four-fifths of the economy. Residential investment is one area in which we have seen strong growth. Real residential investment increased by more than 15 percent in 2012, and through the third quarter of last year it increased at a 12 percent annual rate. Many housing market indicators, such as housing starts and new home sales, remain well below levels that were typical during the expansions of the Great Moderation, so there is a reasonable basis to expect residential investment to continue to grow. But since this category is only 3 percent of GDP, it has only a marginal effect on the overall outlook.CR: This is something I've been writing about since I started the blog in 2005, but it is worth repeating ... even though Residential Investment usually only accounts for around 4% to 5% GDP (3% right now), it isn't the size of the sector, but the contribution during a recovery that matters - and housing is usually a large contributor to economic and employment growth in a recovery. And there also many ripple effects from housing. (see: Professor Leamer's presentation from the 2007 Jackson Hole Symposium: Housing and the Business Cycle )

Lacker:

Adding up all these categories of spending yields a forecast for GDP growth of just a little above 2 percent — not much different from what we've seen for the last three years.Could be ... but I'm more optimistic.