by Calculated Risk on 1/06/2014 10:00:00 AM

Monday, January 06, 2014

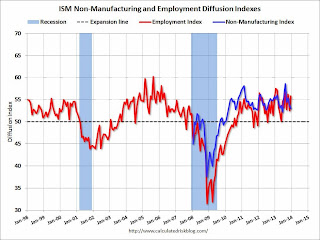

ISM Non-Manufacturing Index at 53.0 indicates slower expansion in December

The December ISM Non-manufacturing index was at 53.0%, down from 53.9% in November. The employment index increased in December to 55.8%, up from 52.5% in November. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: December 2013 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in December for the 48th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI® registered 53 percent in December, 0.9 percentage point lower than November's reading of 53.9 percent. This indicates continued growth at a slightly slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index decreased to 55.2 percent, which is 0.3 percentage point lower than the 55.5 percent reported in November, reflecting growth for the 53rd consecutive month, but at a slightly slower rate. The New Orders Index contracted after 52 consecutive months of growth for the first time since July 2009, when it registered 48 percent. The index decreased significantly by 7 percentage points to 49.4 percent, and the Employment Index increased 3.3 percentage points to 55.8 percent, indicating growth in employment for the 17th consecutive month and at a faster rate. The Prices Index increased 2.9 percentage points to 55.1 percent, indicating prices increased at a faster rate in December when compared to November. According to the NMI®, eight non-manufacturing industries reported growth in December. Despite the substantial decrease in the New Orders Index, respondents' comments predominately reflect that business conditions are stable."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 54.8% and indicates slower expansion in December than in November.

The stronger employment index is a positive, but new orders contracted for the first time in over four years.

Reis: Office Vacancy Rate unchanged in Q4 at 16.9%

by Calculated Risk on 1/06/2014 08:40:00 AM

Reis released their Q4 2013 Office Vacancy survey this morning. Reis reported that the office vacancy rate was unchanged at 16.9% in Q4. This is down from 17.1% in Q4 2012, and down from the cycle peak of 17.6%.

There has been a pick up in demand, but construction has also increased - so the vacancy rate was unchanged.

From Reis Senior Economist Ryan Severino:

The national vacancy rate was unchanged during the fourth quarter at 16.9%. This is slightly worse than the performance from last quarter, but not out of line with the performance that has persisted since the office market began to recover in mid‐2011. Not since the third quarter of 2007 has the national vacancy rate declined by more than 10 basis points. For 2013, the vacancy rate fell by just 20 basis points, 10 basis points worse than the market's performance in 2012. National vacancies remain elevated at 440 basis points above the sector's cyclical low, recorded in the third quarter of 2007 before the recession began that December. Supply and demand have remained largely in balance during this recovery, accounting for the slow pace of vacancy compression.On new construction:

emphasis added

Occupied stock increased by 8.521 million SF in the fourth quarter. This is an increase from the 7.641 million SF that were absorbed during the third quarter. However, this was largely due to a jump in completions. For the quarter, 9.126 million SF were completed, up from last quarter's 6.301 million SF. This dynamic between net absorption and construction held throughout the year. For 2013, quarterly net absorption averaged 7.042 million SF, a 67% increase from 2012's average of 4.225 million SF. For construction, the quarterly average was 6.471 million SF, a 108% increase from 2012's average of 3.110. So while demand certainly increased during 2013, it did so more or less in lockstep with the increase in construction. This clearly intimates the ongoing use of pre‐leasing that is being required by lenders of construction and development financing. Moreover, and possibly more meaningfully for the office market, it also indicates that tenants looking for space clearly preferred newly completed inventory in 2013.On rents:

Asking and effective rents both grew by 0.7% during the fourth quarter. This a reversal of the trend that we have observed in recent quarters with rent growth slowing gradually. Asking and effective rents have now risen for thirteen consecutive quarters. During 2013 asking rent grew by 2.1% while effective rent grew by 2.2%. This was somewhat better than 2012's performance when asking rents grew by 1.8% while effective rents grew by 2.0%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was unchanged at 16.9% in Q4, and was down from 17.1% in Q4 2012. The vacancy rate peaked in this cycle at 17.6% in Q3 and Q4 2010, and Q1 2011.

Office vacancy data courtesy of Reis.

Sunday, January 05, 2014

Monday: ISM Service Index, Q4 Office Vacancy Survey

by Calculated Risk on 1/05/2014 07:34:00 PM

From Stephen Fidler at the WSJ: Where Deflation Risks Stir Concerns

Anxieties are rising in the euro zone that deflation—the phenomenon of persistent falling prices across the economy that blighted the lives of millions in the 1930s—may be starting to take root as it did in Japan in the mid-1990s. "Deflation: the hidden threat," ran a headline emblazoned across a December research note by economists at HSBC.The article lists several problems caused by deflation (too low inflation has many of the same problems). Germany's policies - and their fear of inflation - have really damaged Europe. Europe has been "Schäubled" (Germany's finance minister is Wolfgang Schäuble who is always wrong, but never in doubt).

At last count, prices are falling only in Latvia, Greece and Cyprus. And most forecasters, including those at HSBC, see low inflation as more likely than deflation on average in the euro zone.

Monday:

• Early: Reis Q4 2013 Office Survey of rents and vacancy rates.

• At 10:00 AM ET, the ISM non-Manufacturing Index for December. The consensus is for a reading of 54.8, up from 53.9 in November. Note: Above 50 indicates expansion, below 50 contraction.

• Also at 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for November. The consensus is for a 1.6% increase in orders.

Weekend:

• Schedule for Week of January 5th

The Nikkei is down about 1.4%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 2 and DOW futures are up 25 (fair value).

Oil prices have declined with WTI futures at $94.22 per barrel and Brent at $106.89 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.30 per gallon (about the same as a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Update: Extended unemployment benefits

by Calculated Risk on 1/05/2014 01:04:00 PM

Not extending unemployment benefits is a clear policy error, and extending the program has widespread support. This why doesn't Congress extend the program this week?

From CNBC: Facing cuts, long-term unemployed brace for grim new year

Nancy Shields is among the millions of unemployed Americans who are losing their extended unemployment benefits starting this month.From the NELP: New Poll Finds Strong Voter Support for Renewing Federal Jobless Aid

Many like Shields depend on these meager payments, a federal extension of state unemployment programs that expired Dec. 28, to stay afloat.

...

The National Employment Law Project estimates that more than a million Americans are in the same situation. "For a lot of people and a lot of families, this is their only income source," said NELP federal advocacy coordinator Judy Conti. "This could pull the rug out from under 1.3 million families," she said. Without an extension, an additional 2 million will fall off the rolls in the first half of the year.

Only one-third of voters believe Congress should allow federal jobless aid to end this week. By a strong 21-point margin, voters say Congress should act to maintain (55%) rather than cut off (34%) these benefits.Also from NELP: Congress’s Failure to Renew Federal Unemployment Insurance Means Share of Unemployed Receiving Jobless Aid Will Hit Record Low

There is also more intensity of feeling on the side favoring an extension. More than twice as many voters strongly favor maintaining benefits (43%) as strongly feel benefits should end (21%).

Voters reject the claim that unemployed workers are not trying to find work. Just 33% of voters agree that most of those receiving jobless aid “are not trying to find a job, and prefer to collect benefits without working.” Instead, 57% say that the unemployed “would rather work, but cannot find a job in today’s economy.”

As a result of Congress’s failure to renew federal jobless aid for the long-term unemployed in its budget agreement, the share of unemployed workers receiving jobless aid will drop to a record low of just one in four (26 percent) as of January 2014, according to an analysis released today by the National Employment Law Project. Not only is this the lowest share during this downturn, it is the lowest since the U.S. Department of Labor started recording this information in 1950.

The loss of federal jobless aid will not only be a tough hit on unemployed workers and their families, but will also hit the economies of struggling states.

Saturday, January 04, 2014

Housing Demolitions: The Return of the Bulldozers

by Calculated Risk on 1/04/2014 12:50:00 PM

Below is an interesting article from Andrew Khouri at the LA Times. As the article notes, demolitions and new construction in beach communities and other desirable areas in California has picked up significantly.

The article doesn't mention that many of these small cottages were built in the '20s, '30s, '40s and 50s as summer homes. An example in the article is "a 3,500-square-foot, three-level house that replaced a small 784-square-foot cottage near the beach."

The zoning hasn't changed. It just didn't make sense to build a 3,500 sq ft house as a summer home in the '30s. For the new owners, these are mostly primary residences and the owners work nearby. It makes sense that the new owners will want to max out the lot (the lots are very expensive), but, as expected, some existing residences don't want their communities to change.

From Andrew Khouri at the LA Times: Housing tear-downs on the rise as real estate rebounds

The front-end loader swung to the right and took a bite out of the shingled roof of the quaint cottage. The roar of the engine and crackle of buckling lumber carried down Elm Avenue in Manhattan Beach.

Within 40 minutes, a demolition crew reduced the 1950s one-story to rubble. The 782-square-foot house would be replaced by a 3,300-square-foot Cape Cod.

...

The upscale South Bay town of Manhattan Beach exemplifies the trend. Builders in the city pulled permits to demolish 84 residential units from July 2012 to June 2013, the latest available data. That's nearly double the number pulled for the same period a year earlier.

...

In the city of Los Angeles last year, builders received approval to raze 1,227 houses and duplexes from January through mid-December, according to Department of Building and Safety records. That's 29% higher than in all of 2012, though still well off the pace of more than 3,000 in 2006, during the housing bubble.