by Calculated Risk on 1/15/2014 03:04:00 PM

Wednesday, January 15, 2014

Fed's Beige Book: Economic activity increased "at a moderate pace" in Most Districts

Fed's Beige Book "Prepared at the Federal Reserve Bank of Boston and based on information collected on or before January 6, 2014."

Reports from the twelve Federal Reserve Districts suggest economic activity continued to expand across most regions and sectors from late November through the end of the year. Nine Districts indicated the local economy was expanding at a moderate pace; among these, the Atlanta and Chicago Districts saw conditions improve compared with the previous reporting period. Boston and Philadelphia cited modest growth, while Kansas City reported the economy held steady in December. The economic outlook is positive in most Districts, with some reports citing expectations of "more of the same" and some expecting a pickup in growth.And on real estate:

Most Districts reported increases in home sales in the closing months of 2013 compared with last year, but the Atlanta, Cleveland, and Kansas City Districts indicated that year-over-year residential sales growth had slowed relative to earlier quarters in 2013. The Boston, Philadelphia, Minneapolis, and Dallas reports noted that at least some areas within those Districts saw home sales below year-earlier levels. Home selling prices continued their upward trend in the Boston, Atlanta, Chicago, Minneapolis, Kansas City, and San Francisco Districts, while remaining stable in the Cleveland and Richmond Districts; New York noted mixed changes in sale prices across the District. Residential construction saw slight to moderate increases in most Districts; by contrast, Dallas cited a slight decline, New York reported no change, and Cleveland cited strong growth. Notwithstanding its decrease in overall residential construction, the Dallas District noted elevated construction levels for multi-family units; the Atlanta, Cleveland, and Chicago Districts also cited strong multifamily construction. Reporting Districts indicated that residential real estate contacts remained optimistic looking forward, while voicing concerns about declining inventory and potential changes in the mortgage market. The Richmond, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, Dallas, and San Francisco Districts reported that contacts expected residential construction to pick up in the near term.Some pretty positive comments on real estate. This is a minor upgrade to the previous beige book.

District reports on commercial real estate contained much good news, although performance within some Districts was uneven across locations and property types. ... Excepting the New York and Dallas Districts, which gave no information on recent construction, all other Districts reported increases in commercial construction activity in recent weeks. In the Boston and Richmond Districts, construction activity increased in the education and healthcare sectors. A significant number of commercial high-rise structures are being built (or planned) in the San Francisco District. Information concerning the commercial real estate outlook was largely positive where it was reported. Contacts in the Boston, Atlanta, and Kansas City Districts were optimistic that commercial real estate fundamentals would continue to improve at least slowly in 2014. The outlook for commercial construction activity was positive in the Philadelphia, Cleveland, Minneapolis, and Dallas Districts.

emphasis added

DataQuick: Bay Area Home Sales Drop to Six-Year Low in December

by Calculated Risk on 1/15/2014 01:42:00 PM

This decline in sales - due to fewer distressed sales - is an important theme. This is a step towards a more normal housing market, NOT a sign that the housing recovery is faltering.

From DataQuick: Bay Area Home Sales Drop to Six-Year Low; Prices Still Up Sharply Yr/Yr

Last month’s Bay Area home sales were the slowest for a December in six years, the result of a constrained supply of homes for sale. ...Even though overall sales declined, conventional sales were up about 15% year-over-year. Also, as prices increase, more inventory should come on the market.

A total of 6,714 new and resale houses and condos sold in the nine-county Bay Area last month. That was the lowest for any December since 2007, when 5,065 homes sold. Last month’s sales were up 0.8 percent from 6,659 in November, and down 12.7 percent from 7,688 in December 2012, according to San Diego-based DataQuick.

Sales almost always increase from November to December, usually around 8 percent. Last month’s sales were 21.3 percent below the December average of 8,529 since 1988, when when DataQuick’s statistics begin. ...

Foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 4.5 percent of resales in December, up from 3.7 percent the month before, and down from 12.1 percent a year ago. Foreclosure resales peaked at 52.0 percent in February 2009. The monthly average for foreclosure resales over the past 17 years is 10 percent.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 10.5 percent of Bay Area resales last month. That was up from an estimated 9.5 percent in November and down from 23.6 percent a year earlier.

Last month absentee buyers – mostly investors – purchased 23.0 percent of all Bay Area homes. That was up from November’s revised 20.6 percent and down from 26.0 percent in December 2012. Absentee buyers paid a median $439,000 last month, up 35.1 percent from $325,000 a year earlier.

FNC: House prices increased 6.7% year-over-year in November

by Calculated Risk on 1/15/2014 11:31:00 AM

From FNC: FNC Index: November Home Prices Up Steadily by 0.5%

The latest FNC Residential Price Index™ (RPI) shows U.S. home prices continuing to rise at a modest pace despite at a flatter rate when compared to the spring and summer months. This trend largely reflects a decline in housing activity. The index, constructed to gauge underlying property value based on non-distressed home sales only, was up 0.5% in November despite greater downward pressure from rising foreclosure sales during the month. In November, completed foreclosure sales nationwide rebounded to 16.8% of total home sales, up from October’s 14.4% or August’s post-crisis lows of 12.6%.The 100-MSA composite was up 6.7% compared to November 2012. The FNC index turned positive on a year-over-year basis in July, 2012.

Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC national composite index shows that in November home prices rose at a seasonally unadjusted rate of 0.5%, which slightly outpaced October’s price gain. The two narrower indices (30- and 10-MSA composites) likewise show a small uptick in November’s price increase in the nation’s top housing markets. The indices’ year-over-year trends show that as of November 2013 (or 21 months into the housing recovery), annual home price appreciation has reached about 7.0% -- a pace last observed in August 2006.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes.

Even with the recent increase, the FNC composite 100 index is still off 24.8% from the peak.

I'm expecting the year-over-year change in house prices to slow.

NY Fed: Empire State Manufacturing Activity indicates faster expansion in January

by Calculated Risk on 1/15/2014 08:45:00 AM

From the NY Fed: Empire State Manufacturing Survey

The January 2014 Empire State Manufacturing Survey indicates that business activity expanded for New York manufacturers, and did so at a faster pace than in recent months. The general business conditions index rose ten points to 12.5, its highest level in more than a year. The new orders index climbed thirteen points to 11.0, a two-year high, and the shipments index rose to 15.5. ...This is the first of the regional surveys for January. The general business conditions index was above the consensus forecast of a reading of 3.3, and indicates faster expansion. The internals were solid too, with new orders at a two year high, and the employment index increasing.

Employment indexes suggested an improvement in labor market conditions. The index for number of employees rose twelve points to 12.2, indicating a modest increase in employment levels, and the average workweek index rose to 1.2—a sign that hours worked held steady.

emphasis added

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 1/15/2014 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 11.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 10, 2014. The previous week’s results included an adjustment for the New Year’s holiday. ...

The Refinance Index increased 11 percent from the previous week. The seasonally adjusted Purchase Index increased 12 percent from one week earlier, but is at a level similar to what was observed in mid-November 2013. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.66 percent from 4.72 percent, with points increasing to 0.33 from 0.28 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down sharply - and down 70% from the levels in early May.

With the rate increases, refinance activity will be significantly in 2014.

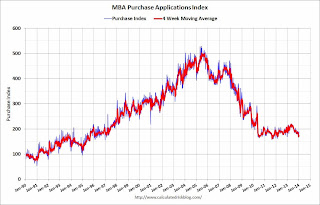

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 8% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index.