by Calculated Risk on 1/24/2014 04:17:00 PM

Friday, January 24, 2014

Unemployment Rate falling in "Sand" States

The BLS will release December unemployment rates for all states next Tuesday. Here are a few "bubble" states rates that were released today by the states:

From the Orlando Sentinel: Florida unemployment dips to 6.2 percent for December

Florida's unemployment rate fell to 6.2 percent in December ... The state unemployment rate has been dropping steadily for three years and now stands at its lowest level since June 2008.From the Arizona Daily Sun: Arizona unemployment rate drops to 7.6 percent

At the height of the recession in early 2010, Florida's jobless rate peaked at 11.4 percent.

The state’s seasonally adjusted jobless rate dropped two-tenths of a point last month, to 7.6 percent, the lowest it’s been since November of 2008.The Arizona unemployment rate peaked at 10.7%, and this is the lowest since November 2008.

But it’s still more than double the historic low of 3.5 percent recorded in July 2007.

From the California EDD: Labor Force and Industry Employment Data for December 2013

California's seasonally adjusted unemployment rate was 8.3 percent in December, down 0.2 percentage point in November, and down 1.5 percentage points from 1 year ago.California's unemployment rate peaked at 12.8%, and this is the lowest level since October 2008.

Rhode Island (not "sand" state) is recovering slower. In November, Rhode Island was one of two states with an unemployment rate at or above 9.0% (Nevada was also at 9% in November, but they haven't reported for December yet). The unemployment rate in Rhode Island peaked at 11.9%.

From the Providence Journal: Rhode Island unemployment rate ticks up to 9.1 percent for December

The unemployment rate ticked up in December to 9.1 percent, from 9.0 percent ...Some of the so-called "sand" or "bubble" states (with the largest housing bubbles) are seeing improvement as housing recovers.

Mortgage Rates compared to Ten Year Treasury Yield and Refinance Activity

by Calculated Risk on 1/24/2014 11:49:00 AM

From Freddie Mac yesterday: Fixed Mortgage Rates Move Lower for Second Consecutive Week

Freddie Mac ... released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates drifting slightly lower for the second consecutive week amid recent reports that inflation remains subdued.

...

30-year fixed-rate mortgage (FRM) averaged 4.39 percent with an average 0.7 point for the week ending January 23, 2014, down from last week when it averaged 4.41 percent. A year ago at this time, the 30-year FRM averaged 3.42 percent.

15-year FRM this week averaged 3.44 percent with an average 0.7 point, down from last week when it averaged 3.45 percent. A year ago at this time, the 15-year FRM averaged 2.71 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The refinance index dropped sharply last year when mortgage rates increased (activity down 67% from last May).

The second graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

Currently the 10 year Treasury yield is at 2.72% and 30 year mortgage rates are at 4.39% (according to Freddie Mac). Based on the relationship from the graph, the 30 year mortgage rate (Freddie Mac survey) would be around 5% when 10-year Treasury yields are around 3.33% (unlikely any time soon).

Currently the 10 year Treasury yield is at 2.72% and 30 year mortgage rates are at 4.39% (according to Freddie Mac). Based on the relationship from the graph, the 30 year mortgage rate (Freddie Mac survey) would be around 5% when 10-year Treasury yields are around 3.33% (unlikely any time soon).Note: The yellow marker is the current (last week) relationship.

Q4 GDP Seen at 3.8%

by Calculated Risk on 1/24/2014 09:09:00 AM

Next week will be busy with another FOMC meeting (more tapering) and plenty of data releases.

From Merill Lynch on Q4 GDP:

We look for the first estimate of 4Q GDP to show solid growth of 3.8%. Of course, there is greater room for forecast error with the first release since a number of inputs are estimates (particularly trade and inventory data). That said, we forecast a strong gain in consumer spending, reflecting the healthy retail sales data and holiday shopping season. We also look for equipment and software investment to strengthen, as suggested by the pop higher in core capital goods orders. The trade deficit should narrow due to strong global growth but also a continued decline in US imports of petroleum. Inventory should remain little changed at very high levels, which we believe is unintentional. We think businesses will look to reduce inventories to more sustainable levels in the next few quarters. Overall, the report should show a healthy end to 2013 and momentum heading into 2014.That would put 2013 real GDP growth at about 2.0% (over 2012).

emphasis added

Thursday, January 23, 2014

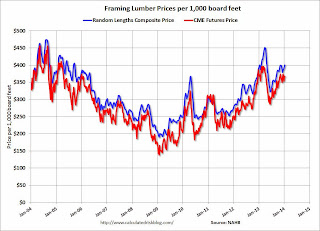

Framing Lumber Prices: Moving on Up

by Calculated Risk on 1/23/2014 06:42:00 PM

Here is another graph on framing lumber prices. Early last year lumber prices came close to the housing bubble highs. Then prices started to decline sharply, with prices declined over 25% from the highs by June.

The price increases early last year were due to stronger demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online). My understanding is capacity has increased, but demand has increased too.

Prices have been increasing since June (there is some seasonality to prices).

Prices in early January are at about the same level as last year.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through last week (via NAHB), and 2) CME framing futures.

We will probably see a further increase in prices over the next few months as housing starts increase (Not seasonally adjusted, housing starts usually peak during Q2 of the year).

Kansas City Fed: Manufacturing Survey shows "Activity rebounded moderately in January"

by Calculated Risk on 1/23/2014 03:19:00 PM

From the Kansas City Fed: Tenth District Manufacturing Survey Rebounded Moderately

The Federal Reserve Bank of Kansas City released the January Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity rebounded moderately in January, and factories’ production expectations continued to climb higher.All of the regional surveys have suggested somewhat faster growth in January than in December. The last of the regional Fed manufacturing surveys for January will be released early next week (Richmond and Dallas Fed).

“We were encouraged to see overall regional factory activity grow in January after dropping last month, said Wilkerson. Production fell slightly in January, which many firms again attributed to weather-related delays, but orders rose and optimism about the future increased.”

...

The month-over-month composite index was 5 in January, up from -3 December and similar to the reading of 6 in November ... The employment index jumped from 0 to 11–its highest level since October 2011–and the new orders for exports index moved into positive territory for the first time in five months. ...

emphasis added