by Calculated Risk on 1/30/2014 08:43:00 PM

Thursday, January 30, 2014

Friday: Personal Income, Chicago PMI, Consumer Sentiment,

Jed Kolko, writing at Economix, explains why the "headship rate" is more important than the homeownership rate: Why the Homeownership Rate Is Misleading

At this stage of the housing recovery, the falling homeownership rate turns out to be misleading. In fact, for young adults, who were hit especially hard in the recession and housing crisis, the decline in their homeownership rate might paradoxically be a sign of improvement.Friday:

...

When the homeownership rate steers us wrong, the “headship rate” ... can come to the rescue. It’s the percent of adults who head a household. Put another way, it is the ratio of households to adults. If there are 200 million adults living in 100 million households, the headship rate is 50 percent. A higher headship rate means fewer adults, on average, per household. Over the longer term, demographics explain shifts in the headship rate (and in labor force participation, for that matter). An aging population, for instance, typically increases the headship rate because older adults are more likely to head their household than younger adults are because many young adults live in their parents’ home or with housemates.

...

In fact, the headship rate is the key to how much the housing recovery contributes to economic growth. The headship rate and the population determine the total number of households, so a rise in the headship rate means more new households, all else equal.

...

Headship is poised to increase. Young adults still living with their parents won’t do so forever, and the Current Population Survey headship rate in 2013 – even with its recent rise — is still below its 20-year average. That will prompt more new construction.

• At 8:30 AM ET, the Personal Income and Outlays for December. The consensus is for a 0.2% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:45 AM, the Chicago Purchasing Managers Index for January. The consensus is for an increase to 59.5, up from 59.1 in December.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (final for January). The consensus is for a reading of 81.0, up from the preliminary reading of 80.4, and down from the December reading of 82.5.

• At 10:00 AM ET, Q4 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS).

Lawler on Homebuilders: Weak Net Orders, "Considerable optimism about the prospects for home sales in 2014"

by Calculated Risk on 1/30/2014 07:35:00 PM

From economist Tom Lawler:

Below is a summary table of some stats from large publicly-traded builders who have reported results for last quarter. Note that for the six builders in the table, “home sales” based on net orders in 2013 were up 5.7% from 2012, while “home sales” defined as closed sales were up 20.1% on the year.

The combination of higher mortgage rates and unusually aggressive home price increases in many parts of the country led to a substantial dip in new home contract signings in the second half of last year.

Most builders expressed considerable optimism about the prospects for home sales in 2014, and are planning accordingly, and most increased significantly their land/lot positions over the last year or two. Most builders also reported gross margins in the last quarter of 2013 that were at or near seven year highs. The combination of elevated land/lot positions and elevated margins suggests that any slower-than-expected pace of home sales would likely lead to little or no home price growth in 2014.

Builder results reported so far suggest that Census’ new home sales estimates for the fourth quarter of 2013 are likely to be revised downward.

M/I Homes reported that net home orders in the quarter ended December 31, 2013 totaled 793, up 17.8% from the comparable quarter of 2012. M/I’s average community county last quarter was up 16.9% from a year earlier. The company’s sales cancellation rate, expressed as a % of gross orders, was 19% last quarter, down from 21% a year ago. Home deliveries totaled 1,120 last quarter, up 26.3% from the comparable quarter of 2012, at an average sales price of $292,000, up $273,000 from a year ago. The company’s order backlog at the end of 2013 was 1,280, up 32.6% from the end of 2012.

M/I Homes has moved aggressively to increase market share over the last year, by increasing its “geographic footprint” and substantially increasing its land/lot holdings. At the end of 2012 the company owned or controlled 19,831 lots, up 39.6% from the end of 2012 and up 91.5% from the end of 2011.

PulteGroup reported that net home orders in the quarter ended December 31, 2013 totaled 3,214, down 18.1% from the comparable quarter of 2012. Home deliveries last quarter totaled 4,964, down 3.7% from the comparable quarter of 2012, at an average sales price of $325,000, up 13.2% from a year ago. The company’s order backlog at the end of 2013 was 5,772, down 10.6% from the end of 2012.

Pulte has been “de-leveraging” and focusing on “value creation” and cost control, meaning that the company has focused on profitability at the expense of market share (and has virtually eliminated its “spec” business). Pulte said that last quarter’s gross margin was its highest since 2005. On its conference call an official said that net orders were “flat” in December relative to November (orders normally fall MOM in December), and said that the company “liked what we’ve seen” so far in January. Pulte noted that it planned to increase its “land spend” in 2014.

On the home price front, Pulte noted that the YOY increase in average home prices was 6% for its Centex division, which focuses on first-time buyers, 13% for its Pulte division, which focuses on move-up buyers, and 11% for its Del Webb division, which focuses on the “active adult” market.

The Ryland Group reported that net home orders (including discontinued operations) in the quarter ended December 31, 2013 totaled 1,428, down 4.9% from the comparable quarter. The company’s community count at the end of 2013 was up 21,8% from a year earlier. Ryland’s sales cancellation rate, expressed as a % of gross orders, was 20.0% last quarter, up from 17.9% a year ago. Sales per community were down about 19% from a year ago. Home deliveries last quarter totaled 2,178, up 38% from the comparable quarter of 2012, at an average sales price of $314,000, up 16.3% from a year earlier. The company’s order backlog at the end of December was 2,626, up 9.5% from the end of 2012. Ryland owned or controlled 38,770 lots (including jvs) at the end of December, up 35.5% from the end of 2012 and up 76.9% from the end of 2012. Ryland’s orders last quarter were “disappointing” given its sharp increase in community count and appeared to reflect slower buying in response to the company’s aggressive price hikes, particularly in the West and Southeast.

In slides that went along with its earnings conference call, Ryland said it plans to increase its active community count in 2014 “in excess” of 20%.

Beazer Homes reported that net home orders in the quarter ended December 31, 2013 totaled 895, down 4.0% from the comparable quarter of 2012. Beazer’s average community count last quarter was down 8.6% from a year ago. The company’s sales cancellation rate, expressed as a % of gross orders, ws 21.8% last quarter, down 26.4% from a year earlier. Home deliveries last quarter totaled 1,038, unchanged from the comparable quarter of 2012, at an average sales price of $279,500, up 18.6% from a year ago. The company’s order backlog at the end of 2013 was 1,750, down 3.7% from the end of 2012.

Beazer owned or controlled 28,978 lots at the end of 2013, up 15.4% from the end of 2012. Beazer’s “land spend” increased significantly beginning last spring, but the “conversion” to active communities has been slower than hoped for. In slides that went along with its earnings conference call, Beazer said that it expected its average community count in the quarter ending September 30, 2014 to be up by about 16% from the latest quarter.

Meritage Homes, MDC Holdings, and Standard Pacific Corp. are scheduled to release their quarterly results next week (February 5th.)

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 12/13 | 12/12 | % Chg | 12/13 | 12/12 | % Chg | 12/13 | 12/12 | % Chg |

| D.R. Horton | 5,454 | 5,259 | 3.7% | 6,188 | 5,182 | 19.4% | $263,542 | $236,067 | 11.6% |

| PulteGroup | 3,214 | 3,926 | -18.1% | 4,964 | 5,154 | -3.7% | $325,000 | $287,000 | 13.2% |

| NVR | 2,631 | 2,625 | 0.2% | 3,342 | 2,788 | 19.9% | $365,300 | $331,900 | 10.1% |

| The Ryland Group | 1,428 | 1,502 | -4.9% | 2,178 | 1,578 | 38.0% | $314,000 | $270,000 | 16.3% |

| Beazer Homes | 895 | 932 | -4.0% | 1,038 | 1,038 | 0.0% | $279,300 | $235,500 | 18.6% |

| M/I Homes | 793 | 673 | 17.8% | 1,120 | 887 | 26.3% | $292,000 | $273,000 | 7.0% |

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Calendar Year | '13 | '12 | % Chg | '13 | '12 | % Chg | '13 | '12 | % Chg |

| D.R. Horton | 25,315 | 22,513 | 12.4% | 25,161 | 19,954 | 26.1% | $255,646 | $228,395 | 11.9% |

| PulteGroup | 17,080 | 19,039 | -10.3% | 17,766 | 16,505 | 7.6% | $305,000 | $276,000 | 10.5% |

| NVR | 11,800 | 10,954 | 7.7% | 11,834 | 9,843 | 20.2% | $349,043 | $317,073 | 10.1% |

| The Ryland Group | 7,263 | 5,781 | 25.6% | 7,035 | 4,897 | 43.7% | $296,000 | $262,000 | 13.0% |

| Beazer Homes | 4,989 | 5,111 | -2.4% | 5,056 | 4,603 | 9.8% | $262,004 | $229,126 | 14.3% |

| M/I Homes | 3,787 | 3,020 | 25.4% | 3,472 | 2,765 | 25.6% | $286,000 | $264,000 | 8.3% |

| Total | 70,234 | 66,418 | 5.7% | 70,324 | 58,567 | 20.1% | $289,824 | $261,263 | 10.9% |

Vehicle Sales Forecasts: Decent Sales Expected for January

by Calculated Risk on 1/30/2014 04:09:00 PM

Note: The automakers will report January vehicle sales on Monday, February 3rd.

Here are a few forecasts:

From Edmunds.com: Winter Weather Freezes January Auto Sales ... Says Edmunds.com

Edmunds.com forecasts that 1,036,533 new cars and trucks will be sold in the U.S. in January for an estimated Seasonally Adjusted Annual Rate (SAAR) of 15.6 million. ...From Kelley Blue Book: New-Car Sales To Improve Nearly 2 Percent From Last Year; Kelley Blue Book Projects Best January Since 2007

January's weather complications mean that sales will likely be made up in February.

New-vehicle sales are expected to improve 1.6 percent year-over-year in January to a total of 1.06 million units, and an estimated 15.9 million seasonally adjusted annual rate (SAAR), according to Kelley Blue Book. ... At 15.9 million, this would be the highest recorded January SAAR since 2007, when it was 16.4 million. ...From J.D. Power: Strong January New-Vehicle Sales Produce Sunny Forecast for Auto Industry

"January is typically the weakest sales month of the year as many consumers take advantage of holiday deals in December. However, winter storms also could impact new-vehicle sales this month, as much of the country deals with historically cold weather and snowstorms," said Alec Gutierrez, senior analyst for Kelley Blue Book. "Early estimates indicate fleet sales will be down as well."

New-vehicle sales for January 2014 are expected to rise 3%, according to a sales forecast jointly issued by the Power Information Network (PIN) from J.D. Power and LMC Automotive. According to the forecast, consumers are expected to purchase 847,000 new vehicles in January 2014, meaning that dealerships would move more metal than in any January since 2004.It appears sales in January were OK even with the cold weather (January is usually the weakest month of the year, so there is a large seasonal adjustment).

A Comment on the Pending Home Sales Index

by Calculated Risk on 1/30/2014 12:09:00 PM

From the NAR: December Pending Home Sales Fall

The Pending Home Sales Index, a forward-looking indicator based on contract signings, fell 8.7 percent to 92.4 in December from a downwardly revised 101.2 in November, and is 8.8 percent below December 2012 when it was 101.3. The data reflect contracts but not closings, and are at the lowest level since October 2011, when the index was 92.2.A few comments:

Lawrence Yun, NAR chief economist, said several factors are working against buyers. “Unusually disruptive weather across large stretches of the country in December forced people indoors and prevented some buyers from looking at homes or making offers,” he said. “Home prices rising faster than income is also giving pause to some potential buyers, while at the same time a lack of inventory means insufficient choice. Although it could take several months for us to get a clearer read on market momentum, job growth and pent-up demand are positive factors.”

...

The PHSI in the Northeast dropped 10.3 percent to 74.1 in December, and is 5.5 percent below a year ago. In the Midwest the index declined 6.8 percent to 93.6 in December, and is 6.9 percent lower than December 2012. Pending home sales in the South fell 8.8 percent to an index of 104.9 in December, and are 6.9 percent below a year ago. The index in the West, which is most impacted by constrained inventory, dropped 9.8 percent in December to 85.7, and is 16.0 percent below December 2012.

Total existing-home sales this year should hold close to 5.1 million, essentially the same as 2013, but inventory remains limited in much of the country.

emphasis added

• Mr. Yun blamed some of the decline on the weather (the weather was unusually bad in December), but the index was down sharply in the South too (probably not weather), and in the West (partially related to low inventories).

• My view is there were several reasons for the decline in this index: weather in some areas, fewer distressed sales, less investor buying, fewer "pending" short sales, and low inventories. I think fewer distressed sales, fewer "pending" short sales, and less investor buying are all signs of a healthier market - even if overall sales decline.

• Mr Yun is forecasting 5.1 million existing home sales in 2014, about the same as in 2013. I'll take the under on that forecast, and I think it would be a positive sign if sales were under 5 million in 2014 as long as distressed sales continue to decline and conventional sales increase.

• Of course, for housing, what really matters for the economy and employment is new home sales (not existing), and housing starts.

Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in January and February.

Q4 GDP: Solid Report, Positives Looking Forward

by Calculated Risk on 1/30/2014 09:34:00 AM

The advance Q4 GDP report, with 3.2% annualized growth, was slightly above expectations. Personal consumption expenditures (PCE) increased at a 3.3% annualized rate - a solid pace.

However the Federal Government subtracted 0.98 percentage points from growth in Q4, and residential investment subtracted 0.32 percentage points. Imagine no Federal austerity - Q4 GDP would have been above 4%. Luckily it appears austerity at the Federal level will diminish in 2014, and of course I expect that residential investment will make a solid contribution this year.

Change in private inventories made another positive contributions in Q4 (added 0.42 percentage points). I expect inventories will probably be a drag in 2014.

On a Q4-over-Q4 basis, real GDP increased 2.7% (above the Fed's December projections of 2.2% to 2.3%). On an annual basis, real GDP increased 1.9%. Note: See GDP: Annual and Q4-over-Q4 for the difference in calculations.

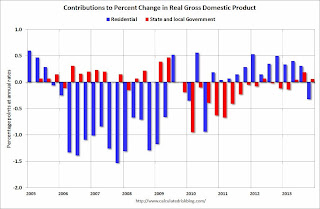

The first graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.

The drag from state and local governments appears to have ended after an

unprecedented period of state and local austerity (not seen since the

Depression). State and local governments have added to GDP for three consecutive

quarters now.

I expect state and local governments to continue to make small positive contributions to GDP going forward.

The blue bars are for residential investment (RI). RI added to GDP growth for 12 consecutive quarters, before subtracting in Q4. However since RI is still very low, I expect RI to make a solid positive contribution to GDP in 2014.

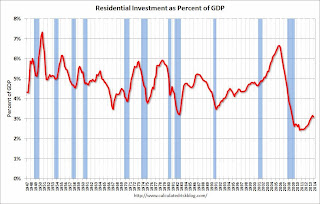

Residential Investment as a percent of GDP has bottomed, but it still below the levels of previous recessions.

Residential Investment as a percent of GDP has bottomed, but it still below the levels of previous recessions.

I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The third graph shows non-residential investment in structures, equipment and "intellectual property products".

The third graph shows non-residential investment in structures, equipment and "intellectual property products".

I'll add details for investment in offices, malls and hotels next week.

Overall this was a solid report, and there are several positives going forward: RI should make a positive contribution in 2014, the drag from the Federal Government should diminish, state and local governments should make a small positive contribution again this year, and investment in equipment and software and non-residential structures should also be positive in 2014.