by Calculated Risk on 2/03/2014 02:19:00 PM

Monday, February 03, 2014

NAHB: Builder Confidence improves year-over-year in the 55+ Housing Market in Q4

This is a quarterly index from the the National Association of Home Builders (NAHB) and is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008, so the readings have been very low.

From the NAHB: Builder Confidence in the 55+ Housing Market Ends Fourth Quarter on a Record High

Builder confidence in the 55+ housing market for the fourth quarter of 2013 is up sharply, according to the National Association of Home Builders’ (NAHB) latest 55+ Housing Market Index (HMI) released today. All segments of the market—single-family homes, condominiums and multifamily rental—registered strong increases compared to the same quarter a year ago. The single-family index increased 20 points to a level of 48, which is the highest fourth-quarter reading since the inception of the index in 2008 and the ninth consecutive quarter of year over year improvements. [CR Note: NAHB is reporting the year-over-year increase]

...

All of the components of the 55+ single-family HMI showed significant growth from a year ago: present sales climbed 26 points to 53, expected sales for the next six months rose 24 points to 62 and traffic of prospective buyers increased 9 points to 33.

...

“The 55+ segment of the housing market contains more discretionary purchases so as expected it has taken longer for that segment to join the housing recovery,” said NAHB Chief Economist David Crowe. “The 20 point year-over-year increase in 55+ HMI for single-family homes matches earlier gains in the NAHB/Wells Fargo HMI for the overall single-family market and surpasses the more recent gains in the other housing segments.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ HMI through Q4 2013. The index declined in Q4 to 48 from 50 in Q3 - however the index is up solidly year-over-year. This indicates that about the same numbers builders view conditions as good than as poor.

This is going to be a key demographic for household formation over the next couple of decades, but only if the baby boomers can sell their current homes.

There are two key drivers: 1) there is a large cohort moving into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group. So demographics should be favorable for the 55+ market.

Construction Spending increased slightly in December

by Calculated Risk on 2/03/2014 11:45:00 AM

The Census Bureau reported that overall construction spending increased slightly in December:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during December 2013 was estimated at a seasonally adjusted annual rate of $930.5 billion, 0.1 percent above the revised November estimate of $929.9 billion. The December figure is 5.3 percent above the December 2012 estimate of $883.6 billion.

...

Spending on private construction was at a seasonally adjusted annual rate of $663.9 billion, 1.0 percent above the revised November estimate of $657.1 billion. Residential construction was at a seasonally adjusted annual rate of $352.6 billion in December, 2.6 percent above the revised November estimate of $343.8 billion. Nonresidential construction was at a seasonally adjusted annual rate of $311.3 billion in December, 0.7 percent below the revised November estimate of $313.4 billion. ...

In December, the estimated seasonally adjusted annual rate of public construction spending was $266.6 billion, 2.3 percent below the revised November estimate of $272.8 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 48% below the peak in early 2006, and up 54% from the post-bubble low.

Non-residential spending is 25% below the peak in January 2008, and up about 38% from the recent low.

Public construction spending is now 18% below the peak in March 2009 and up just about 1% from the recent low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 25%. Non-residential spending is down 2% year-over-year. Public spending is down slightly year-over-year.

To repeat a few key themes:

1) Private residential construction is usually the largest category for construction spending, and is now the largest category once again. Usually private residential construction leads the economy, so this is a good sign going forward.

2) Private non-residential construction spending usually lags the economy. There was some increase this time for a couple of years - mostly related to energy and power - but the key sectors of office, retail and hotels are still at very low levels. Based on the architecture billings index, I expect private non-residential to increase in 2014

3) Public construction spending was down in December and is now only 1% above the low in April. However it appears that the drag from public construction spending is over. Public spending has declined to 2006 levels (not adjusted for inflation) and was a drag on the economy for 4+ years. In real terms, public construction spending has declined to 2001 levels.

Looking forward, all categories of construction spending should continue to increase. Residential spending is still very low, non-residential should start to pickup, and public spending appears to have bottomed.

ISM Manufacturing index declines sharply in January to 51.3 due to "adverse weather conditions"

by Calculated Risk on 2/03/2014 10:00:00 AM

The ISM manufacturing index indicated slower expansion in January than in December. The PMI was at 51.3% in January, down from 56.5% in December. The employment index was at 52.3%, down from 55.8%, and the new orders index was at 51.2%, down from 64.4% in December.

From the Institute for Supply Management: January 2014 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in January for the eighth consecutive month, and the overall economy grew for the 56th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The January PMI® registered 51.3 percent, a decrease of 5.2 percentage points from December's seasonally adjusted reading of 56.5 percent. The New Orders Index registered 51.2 percent, a significant decrease of 13.2 percentage points from December's seasonally adjusted reading of 64.4 percent. The Production Index registered 54.8 percent, a decrease of 6.9 percentage points compared to December's seasonally adjusted reading of 61.7 percent. Inventories of raw materials decreased by 3 percentage points to 44 percent, its lowest reading since December 2012 when the Inventories Index registered 43 percent. A number of comments from the panel cite adverse weather conditions as a factor negatively impacting their businesses in January, while others reflect optimism and increasing volumes in the early stages of 2014."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was well below expectations of 56.0%. A weak report, but probably weather related

Mortgage Monitor: Foreclosure Starts Lowest Since April 2007

by Calculated Risk on 2/03/2014 08:15:00 AM

Black Knight Financial Services (BKFS, formerly the LPS Data & Analytics division) released their Mortgage Monitor report for December today. According to LPS, 6.47% of mortgages were delinquent in December, up from 6.45% in November. BKFS reports that 2.48% of mortgages were in the foreclosure process, down from 3.44% in December 2012.

This gives a total of 8.95% delinquent or in foreclosure. It breaks down as:

• 1,964,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,280,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,244,000 loans in foreclosure process.

For a total of 4,488,000 loans delinquent or in foreclosure in December. This is down from 5,292,000 in December 2012.

Click on graph for larger image.

Click on graph for larger image.

This graph from BKFS shows percent of loans delinquent and in the foreclosure process over time.

From BKFS:

• Delinquencies are now just 1.5x the pre-crisis average with foreclosures 4.6x (down from over 8)Delinquencies and foreclosures are moving down - and might be back to normal levels in a couple of years.

• Foreclosure starts ended the year at the lowest level since April 2007 and pipelines are clearing in most states

• Sizeable delinquent inventories remain in the north- and south-east

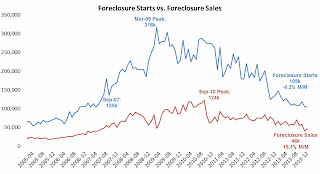

The second graph from BKFS shows foreclosure starts. From BKFS:

The second graph from BKFS shows foreclosure starts. From BKFS: Black Knight found that 2013 marked the fourth consecutive year of significant, sustained improvement in the nation’s inventory of delinquent mortgages, and the second consecutive year of significant improvement for those in foreclosure. Delinquencies were just 1.5 times their pre-crisis average, with foreclosures down to 4.6 times their pre-crisis levels (declining from more than eight times the historical norm).There is much more in the mortgage monitor.

“In many ways, 2013 marked an abatement to crisis conditions in the U.S. mortgage market,” said Herb Blecher, senior vice president of Black Knight Financial Services’ Data & Analytics division. “Delinquencies neared pre-crisis levels, foreclosure inventory declined 30 percent over the year, new problem loan rates improved in both judicial and non-judicial foreclosure states, and foreclosure starts ended the year at the lowest level since April 2007."

emphasis added

Sunday, February 02, 2014

Monday: Auto Sales, ISM Mfg Survey, Construction Spending

by Calculated Risk on 2/02/2014 10:34:00 PM

From Jon Hilsenrath and Victoria McGrane at the WSJ: Rate Decision to Drive Yellen's Early Agenda

After she is sworn in as Fed chairwoman Monday a new question will almost immediately crowd [Janet Yellen's] agenda: Why is unemployment falling so fast and what, if anything, should the central bank do about it?Understanding the decline in the labor force participation rate is very important. A decline was expected - even before the recession - but it isn't clear how much of the decline is related to demographic trends, and how much is due to the weak labor market (my view is that over half of the decline in participation is due to demographics - both people retiring, and more people staying in school).

...

[Yellen] and other Fed officials worry [the decline in the unemployment rate] masks large pockets of stress still plaguing the labor market, including millions of people who want work but aren't looking anymore and therefore are no longer counted as unemployed.

...

People are leaving the labor force for different reasons— they're retiring, going back to school, joining disability rolls, giving up looking for jobs or doing other things—reducing the number of people counted as unemployed.

The trend raises hard-to-answer questions for the Fed. Will some of these people come back to work when the economy improves or have they left permanently? Do these shifts mean there is less slack in labor markets—workers available to take jobs—than they realized, or is the slack still out there, hidden in these numbers?

For much more, see: Labor Force Participation Rate Update, Labor Force Participation Rate Research, Understanding the Decline in the Participation Rate and Update: Further Discussion on Labor Force Participation Rate.

Monday:

• All day, Light vehicle sales for January. The consensus is for light vehicle sales to increase to 15.7 million SAAR in January (Seasonally Adjusted Annual Rate) from 15.3 million SAAR in December.

• At 9:00 AM ET, the Markit US PMI Manufacturing Index for January. The consensus is for a decrease to 53.9 from 55.0 in December.

• At 10:00 AM, the ISM Manufacturing Index for January. The consensus is for a decrease to 56.0 from 57.0 in December. The ISM manufacturing index indicated expansion in December at 57.0%. The employment index was at 56.9%, and the new orders index was at 64.2%.

• Also at 10:00 AM, Construction Spending for December. The consensus is for no change in construction spending.

Weekend:

• Schedule for Week of February 2nd

The Nikkei is down about 0.8%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 4 and DOW futures are up 37 (fair value).

Oil prices are mostly moving sideways with WTI futures at $97.16 per barrel and Brent at $106.29 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.26 per gallon (about the same as a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |