by Calculated Risk on 2/04/2014 12:18:00 PM

Tuesday, February 04, 2014

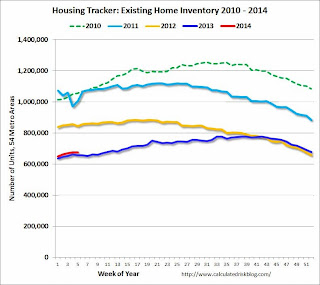

Weekly Update: Housing Tracker Existing Home Inventory up 2.7% year-over-year on Feb 3rd

Here is another weekly update on housing inventory ... for the 16th consecutive week housing inventory is up year-over-year (but not by much). This suggests inventory bottomed early in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for December). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2014 is now 2.7% above the same week in 2013 (red is 2014, blue is 2013).

Inventory is still very low - and barely up year-over-year - but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

CBO Projection: Budget Deficit to be below 3% of GDP for next four years

by Calculated Risk on 2/04/2014 10:52:00 AM

The Congressional Budget Office (CBO) released their new The Budget and Economic Outlook: 2014 to 2024

The federal budget deficit has fallen sharply during the past few years, and it is on a path to decline further this year and next year. CBO estimates that under current law, the deficit will total $514 billion in fiscal year 2014, compared with $1.4 trillion in 2009. At that level, this year’s deficit would equal 3.0 percent of the nation’s economic output, or gross domestic product (GDP)—close to the average percentage of GDP seen during the past 40 years.The CBO projects the deficit will decline further in 2014 and 2015, and be below 3% of GDP for the next four years.

As it does regularly, CBO has prepared baseline projections of what federal spending, revenues, and deficits would look like over the next 10 years if current laws governing federal taxes and spending generally remained unchanged. Under that assumption, the deficit is projected to decrease again in 2015—to $478 billion, or 2.6 percent of GDP. After that, however, deficits are projected to start rising—both in dollar terms and relative to the size of the economy—because revenues are expected to grow at roughly the same pace as GDP whereas spending is expected to grow more rapidly than GDP. In CBO’s baseline, spending is boosted by the aging of the population, the expansion of federal subsidies for health insurance, rising health care costs per beneficiary, and mounting interest costs on federal debt. By contrast, all federal spending apart from outlays for Social Security, major health care programs, and net interest payments is projected to drop to its lowest percentage of GDP since 1940 (the earliest year for which comparable data have been reported).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

After 2015, the deficit will start to increase again according to the CBO.

From a policy perspective and using these projections, further short term deficit reduction is not a priority.

CoreLogic: House Prices up 11% Year-over-year in December

by Calculated Risk on 2/04/2014 09:32:00 AM

Notes: This CoreLogic House Price Index report is for December. The recent Case-Shiller index release was for November. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rise by 11 Percent Year Over Year in December

Year over year, home prices nationwide, including distressed sales, increased 11 percent in December 2013 compared to December 2012. This change represents the 22nd consecutive monthly year-over-year increase in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, decreased by 0.1 percent in December 2013 compared to November 2013.

Excluding distressed sales, home prices increased 9.9 percent in December 2013 compared to December 2012 and 0.2 percent month over month compared to November 2013. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that January 2014 home prices, including distressed sales, are projected to increase 10.2 percent year over year from January 2013. On a month-over-month basis, home prices are expected to dip 0.8 percent from December 2013 to January 2014.

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down seasonally 0.1% in December, and is up 11.0% over the last year. This index is not seasonally adjusted, and the month-to-month changes will be negative for a few months.

The index is off 18.0% from the peak - and is up 21.8% from the post-bubble low set in February 2012.

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty two consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty two consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This is a smaller year-over-year gain than in October or November, and I expect the year-over-year price increases to slow in the coming months.

Monday, February 03, 2014

Tuesday: CBO Annual Budget and Economic Outlook

by Calculated Risk on 2/03/2014 08:33:00 PM

From the WSJ: Treasury's Lew Says 'Time Is Short' for Debt-Ceiling Fix

Treasury Secretary Jacob Lew on Monday urged Congress to intervene quickly to raise the debt limit, the latest in a drumbeat of warnings from the Obama administration that dawdling could potentially lead to delays or cuts in Social Security benefits and military pay.The "debt limit" is about paying the bills - nothing else. And Congress will pay the bills. Everything else Congress does is political posturing, and the smart move would be to eliminate the "debt ceiling" and stop this circus.

Tuesday:

• At 10:00 AM ET, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for December. The consensus is for a 1.8% decrease in December orders.

• Also at 10:00 AM, the Congressional Budget Office will release its annual Budget and Economic Outlook. The report will include updated economic and budget projections spanning the period from 2014 to 2024.

U.S. Light Vehicle Sales decrease to 15.1 million annual rate in January

by Calculated Risk on 2/03/2014 03:17:00 PM

Based on an estimate from WardsAuto, light vehicle sales were at a 15.14 million SAAR in January. That is down slightly from January 2013, and down 2.5% from the sales rate last month.

This was below the consensus forecast of 15.7 million SAAR (seasonally adjusted annual rate).

Click on graph for larger image.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for January (red, light vehicle sales of 15.14 million SAAR from WardsAuto).

The automakers reported January sales were impacted by the unusually cold weather.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and were a key driver of the recovery.

Looking forward, the growth rate will slow for auto sales, and most forecasts are for around a small gain in 2014 to around 16.1 million light vehicles. Of course 2014 is off to a slow start.