by Calculated Risk on 2/13/2014 09:35:00 AM

Thursday, February 13, 2014

Retail Sales decreased 0.4% in January

On a monthly basis, retail sales decreased 0.4% from December to January (seasonally adjusted), and sales were up 2.6% from January 2013. Sales in November were revised down from a 0.2% increase to a 0.1% decrease. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for January, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $427.8 billion, a decrease of 0.4 percent from the previous month, but 2.6 percent above January 2013. ... The November to December 2013 percent change was revised from +0.2 percent to -0.1 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-autos were unchanged.

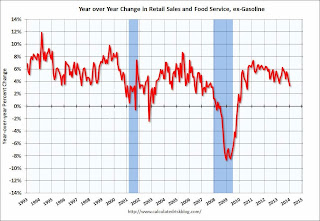

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 3.3% on a YoY basis (2.6% for all retail sales).

Retail sales ex-gasoline increased by 3.3% on a YoY basis (2.6% for all retail sales).The decrease in January was below consensus expectations.

Weekly Initial Unemployment Claims increase to 339,000

by Calculated Risk on 2/13/2014 09:20:00 AM

The DOL reports:

In the week ending February 8, the advance figure for seasonally adjusted initial claims was 339,000, an increase of 8,000 from the previous week's unrevised figure of 331,000. The 4-week moving average was 336,750, an increase of 3,500 from the previous week's revised average of 333,250.The previous week was unrevised.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 336,750.

This was the higher than the consensus forecast of 330,000.

Wednesday, February 12, 2014

Thursday: Yellen, Retail Sales, Unemployment Claims

by Calculated Risk on 2/12/2014 08:03:00 PM

What a surprise ... Congress will pay the bills! (not a surprise to anyone paying attention). From the WSJ: Senate Approves Suspension of U.S. Debt Ceiling

The bill was sent to the White House, where President Barack Obama was expected to sign it, after the Senate voted 55-43 along party lines to approve a suspension of the federal debt limit through March 2015.And another non-surprise ... from Reuters: U.S. budget deficit smaller than expected in January

The United States posted a smaller budget deficit than expected in January, a sign that a stronger economy is helping government coffers through a rise in tax receipts.I think the deficit will be smaller than the CBO expects this year.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 330 thousand from 331 thousand.

• Also at 8:30 AM, Retail sales for January will be released. The consensus is for retail sales to decrease 0.1% in December, and to increase 0.1% ex-autos.

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales (business inventories) report for December. The consensus is for a 0.4% increase in inventories.

• Also at 10:00 AM, Testimony, Fed Chair Janet L. Yellen, Semiannual Monetary Policy Report to the Congress, Before the Senate Banking, Housing, and Urban Affairs Committee, Washington, D.C.

DataQuick on SoCal: January Home Sales down 9.9% Year-over-year, Conventional Sales up Sharply

by Calculated Risk on 2/12/2014 01:16:00 PM

From DataQuick: Southland Home Sales Drop in January; Price Picture Mixed

Southern California logged its lowest January home sales in three years as buyers continued to wrestle with a tight inventory of homes for sale, a fussy mortgage market and the highest prices in years. ... A total of 14,471 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 21.4 percent from 18,415 in December, and down 9.9 percent from 16,058 sales in January 2013, according to San Diego-based DataQuick.Generally both distress sales and investor buying is declining - and this is dragging down overall sales (plus inventory is still very low). However conventional sales are up about 25% year-over-year.

...

Last month’s Southland sales were 17.3 percent below the average number of sales – 17,493 – in the month of January since 1988. Sales haven’t been above average for any particular month in more than seven years. January sales have ranged from a low of 9,983 in January 2008 to a high of 26,083 in January 2004.

The economy is growing, but Southland home sales have fallen on a year-over-year basis for four consecutive months now and remain well below average. Why? We’re still putting a lot of the blame on the low inventory. But mortgage availability, the rise in interest rates and higher home prices matter, too,” said John Walsh, DataQuick president.

"Two of the bigger questions hanging over the housing market right now are,‘How much pent-up demand is left out there?’ and, ‘Will inventory skyrocket this year as more owners take advantage of the price run-up?’” Walsh continued. “Unfortunately, we’ll probably have to wait until spring for the answers. When it comes to statistical trends, January and February are atypical months that haven’t proven to be predictive over the years.”

Foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 6.6 percent of the Southland resale market in January. That was up slightly from 5.8 percent the prior month and was down from 17.2 percent a year earlier. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 12.2 percent of Southland resales last month. That was down from 13.1 percent the prior month and down from 24.2 percent a year earlier.

Absentee buyers – mostly investors and some second-home purchasers – bought 27.5 percent of the Southland homes sold last month, up slightly from 27.2 percent in December and down from a record 32.4 percent a year earlier.

emphasis added

It is important to recognize that declining existing home sales is NOT a negative indicator for the housing recovery. The reason for the decline in overall existing home sales is fewer distressed sales and less investor buying. Those are positive trends!

FNC: Residential Property Values increased 8.7% year-over-year in December

by Calculated Risk on 2/12/2014 12:40:00 PM

In addition to Case-Shiller, CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their December index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.3% from November to December (Composite 100 index, not seasonally adjusted). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased between 0.4% and 0.5% in December. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Since these indexes are NSA, this is a strong month-to-month increase.

The year-over-year change continued to increase in December, with the 100-MSA composite up 8.7% compared to December 2012.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the year-over-year change based on the FNC index (four composites) through December 2012. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

There is still no clear evidence of a slowdown in price increases yet.

The December Case-Shiller index will be released on Tuesday, February 25th.