by Calculated Risk on 2/14/2014 09:15:00 AM

Friday, February 14, 2014

Fed: Industrial Production decreased 0.3% in January

From the Fed: Industrial production and Capacity Utilization

Industrial production decreased 0.3 percent in January after having risen 0.3 percent in December. In January, manufacturing output fell 0.8 percent, partly because of the severe weather that curtailed production in some regions of the country. Additionally, manufacturing production is now reported to have been lower in the fourth quarter; the index is now estimated to have advanced at an annual rate of 4.6 percent in the fourth quarter rather than 6.2 percent. The output of utilities rose 4.1 percent in January, as demand for heating was boosted by unseasonably cold temperatures. The production at mines declined 0.9 percent following a gain of 1.8 percent in December. At 101.0 percent of its 2007 average, total industrial production in January was 2.9 percent above its level of a year earlier. The capacity utilization rate for total industry decreased in January to 78.5 percent, a rate that is 1.6 percentage points below its long-run (1972–2013) average.

emphasis added

Click on graph for larger image.

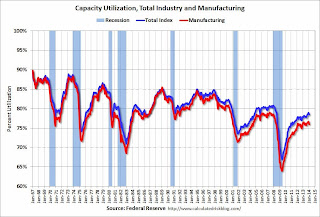

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.6 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.5% is still 1.6 percentage points below its average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.3% in January to 101.0. This is 21% above the recession low, and slightly above the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were well below expectations, and previous months were revised down.

Thursday, February 13, 2014

Friday: Industrial Production, Consumer Sentiment

by Calculated Risk on 2/13/2014 09:22:00 PM

First, here is a price index for commercial real estate that I follow. From CoStar: Commercial Real Estate Pricing Gains Momentum in 2013

COMMERCIAL REAL ESTATE RECOVERY ADVANCES IN 2013: The recovery in U.S. commercial real estate advanced in 2013 as broad gains in net absorption, rents, sales activity and pricing extended across markets and property types. Driven by steady economic growth and solid job gains of 2.2 million in 2013, aggregate net absorption across the four major property types was the highest since the recovery began. Meanwhile, new supply remained well in hand, with the exception of the multifamily property sector, which has seen a notable increase in new construction. Vacancy rates fell across the board, reaching new cyclical lows in both the apartment and industrial sectors over the last year.Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

...

RENTS TRENDING UP AS VACANCY DECLINES: The improvement in market fundamentals has tilted pricing power in the favor of landlords. Rents have surged 14% from the trough of the cycle in the apartment market, with more modest rent recoveries of near 6% in the office and industrial segments since bottoming out in late 2010/early 2011. Even the beleaguered retail property sector, which experienced rent losses into 2012, saw a turnaround in the last year, with retail rents growing a modest 1.9% in 2013. Investor demand for all commercial property types also remained strong, as overall sales volume increased 16% from 2012.

...

IMPROVING MARKET FUNDAMENTALS FUEL PRICING GAINS: The two broadest measures of commercial property pricing in the CCRSI, the U.S. value-weighted index and U.S. equal-weighted index, each posted strong gains of 11.2% and 7.6%, respectively, in 2013. Reflecting the stronger price appreciation of larger properties in core markets, pricing in the value-weighted index has now risen to within 5.5% below the previous peak level set in 2007. Meanwhile, the equal-weighted index, which is more heavily influenced by smaller transactions, is still 25% below the prior peak

emphasis added

Friday:

• At 9:15 AM ET, the The Fed will release Industrial Production and Capacity Utilization for January. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.3%.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 80.0, down from 81.2 in January.

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in January

by Calculated Risk on 2/13/2014 04:14:00 PM

Economist Tom Lawler sent me the preliminary table below of short sales, foreclosures and cash buyers for several selected cities in January.

From CR: This is just a few markets - more to come - but total "distressed" share is down significantly in these markets, mostly because of a decline in short sales.

And foreclosures are down in all of these areas too.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back in markets the share of all cash buyers will probably decline.

In general it appears the housing market is slowly moving back to normal.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Jan-14 | Jan-13 | Jan-14 | Jan-13 | Jan-14 | Jan-13 | Jan-14 | Jan-13 | |

| Las Vegas | 17.0% | 36.2% | 11.0% | 12.5% | 28.0% | 48.7% | 46.3% | 56.1% |

| Reno** | 16.0% | 41.0% | 9.0% | 10.0% | 25.0% | 51.0% | ||

| Phoenix | 6.8% | 17.6% | 9.6% | 16.2% | 16.5% | 33.8% | 36.3% | 44.1% |

| Minneapolis | 5.4% | 10.3% | 24.0% | 31.9% | 29.4% | 42.2% | ||

| Mid-Atlantic | 8.5% | 13.1% | 12.2% | 12.7% | 20.7% | 25.8% | 22.9% | 22.0% |

| So. California* | 12.2% | 24.2% | 6.6% | 17.2% | 18.8% | 41.4% | 29.1% | 33.7% |

| Hampton Roads | 29.5% | 34.9% | ||||||

| Toledo | 43.9% | 44.4% | ||||||

| Des Moines | 22.2% | 26.8% | ||||||

| Tucson | 38.2% | 36.7% | ||||||

| Omaha | 26.4% | 21.3% | ||||||

| Memphis* | 19.1% | 25.9% | ||||||

| *share of existing home sales, based on property records **Single Family Only | ||||||||

MBA: New Home Purchases Up Sharply in January 2014

by Calculated Risk on 2/13/2014 12:51:00 PM

From the MBA: New Home Purchases Up Sharply in January 2014

MBA estimates that sales of new single-family homes were running at a seasonally adjusted annual rate of 543,000 units in January 2014, based on data from MBA’s Builder Applications Survey.A few comments:

“While the big jump may appear to conflict with other data, such as MBA’s purchase application index and NAR’s existing home sales data that point to a weak market for existing homes, our Builder Application Survey estimate is consistent with reports of homebuilder sentiment that show strength in the market for new homes,” said Mike Fratantoni, MBA’s Chief Economist. “It is also worth noting that the significant January increase also followed a particularly slow pace of sales in November and December.”

The estimated 543,000 unit sales pace for January was an increase of 35 percent from December’s pace of 402,000 units. On an unadjusted basis, the MBA estimates that there were 38,000 new home sales in January 2014, a 36 percent increase from the level of 28,000 units in December 2013. The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors.

1) The MBA Builder survey might be helpful in predicting Census Bureau reports, but there are larger swings in the MBA survey estimates (so the Census Bureau might report an increase for January, but not of the same magnitude as the MBA increase).

2) Last year, in January, the MBA estimates sales of 507 thousand (SAAR), and the Census Bureau reported sales at a 437 thousand pace (eventually revised up to 458 thousand). So there might be revisions too.

3) Note that for December, the Census Bureau reported sales of 414 thousand (SAAR), and the MBA estimated sales at a 402 thousand pace. I expect Census Bureau reported sales for December to be revised down.

Lawler: Early Read on Existing Home Sales in January

by Calculated Risk on 2/13/2014 11:01:00 AM

From housing economist Tom Lawler:

Based on local realtor/MLS results I have seen so far, I would estimate that existing home sales as estimated by the National Association of Realtors in January will be about 275,000 on an unadjusted basis, down 5.8% from last January’s unadjusted pace. “Guessing” NAR’s seasonally adjusted estimate this month, however, is trickier than usual, because in the January report the NAR incorporates annual revisions in the seasonal factors used to “transform” unadjusted estimates to seasonally adjusted estimates, and in lately these revisions have been considerable. While someone with the specific version of the seasonal adjustment program used by the NAR (as well as specifics about methodology – e.g., are regional estimates adjusted and then summed, or are national estimates first adjusted and then regional estimates are constrained to the national estimates) could produce the 2014 seasonal factors (and the revised factors for previous years), I am not such a person.

Based on what I THINK the seasonal factor for January should be (not much different from last January), I estimate that existing home sales as measured by the NAR will come in at a seasonally adjusted annual rate of about 4.67 million, down 4.1% from December’s SA pace, and down 5.5% from last January’s SA pace.

While this number might seem “low” – it would be the slowest SA sales pace since July 2012 – it’s not that surprising given (1) the big declines (adjusted for “seasonals”) in pending sales seen in many parts of the country in December; and (2) the unusually bad weather in many parts of the country last month.

While a number this low (or conceivably lower) will be attributed by many as being mainly weather related, in fact that is not the case. To be sure, sales were depressed by adverse weather conditions in many parts of the country last month. By the same token, however, the steep declines in pending sales in December in many parts of the country were not weather related. In fact, some of the biggest YOY declines in pending sales in December were in areas unaffected by weather but where (1) distressed sales AND investor buying were down sharply; and (2) where purchases by owners were flat to down. Some other areas, including the DC metro area, also saw unusually weak pending sales in December, when weather was not unusually “bad.”