by Calculated Risk on 2/15/2014 01:11:00 PM

Saturday, February 15, 2014

Unofficial Problem Bank list declines to 586 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for February 14, 2014.

Changes and comments from surferdude808:

Some minor changes were made to the Unofficial Problem Bank List this week. Three removals and one addition leave the list at 586 institutions with assets of $194.9 billion. A year ago, the list held 812 institutions with assets of $303.0 billion.

Removed this week were Trans-Pacific National Bank, San Francisco, CA ($126 million); Conway Bank, National Association, Conway Springs, KS ($66 million); and First Security Bank of Malta, Malta, MT ($31 million). Conway Bank, N.A. had been under a formal action the longest of any banking as the OCC placed under a Formal Agreement in January 2005 that was subsequently replaced by a Consent Order in March 2011. There are five banks on the list that first became subject to a formal action in 2007.

The addition this week is Allied First Bank, SB, Oswego, IL ($121 million). Other changes to list were the termination of a Prompt Corrective Action order against Community Shores Bank, Muskegon, MI ($183 million).

Next Friday, the OCC should release its enforcement action activity through mid-January 2014. We may be able to update assets through year-end 2013. The FDIC will likely release industry results and update to the official list during the last full week of the month at the earliest.

Schedule for Week of Feb 16th

by Calculated Risk on 2/15/2014 08:05:00 AM

The key reports this week are January housing starts on Wednesday, and existing home sales for January on Friday.

For manufacturing, the NY Fed (Empire State), and Philly Fed January surveys will be released this week.

For prices, CPI will be released on Thursday.

All US markets will be closed in observance of Presidents' Day.

8:30 AM ET: NY Fed Empire Manufacturing Survey for February. The consensus is for a reading of 9.8, down from 12.5 in January (above zero is expansion).

10:00 AM: The February NAHB homebuilder survey. The consensus is for a reading of 56, unchanged from January. Any number above 50 indicates that more builders view sales conditions as good than poor.

11:00 AM: The Q4 2013 Quarterly Report on Household Debt and Credit will be released by the Federal Reserve Bank of New York.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for January.

8:30 AM: Housing Starts for January. Total housing starts were at 999 thousand (SAAR) in December. Single family starts were at 667 thousand SAAR in December.

The consensus is for total housing starts to decrease to 950 thousand (SAAR) in January.

8:30 AM: Producer Price Index for January. The consensus is for a 0.2% decrease in producer prices (and 0.2% increase in core PPI).

During the day: The AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes for the Meeting of January 28-29, 2014.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 335 thousand from 339 thousand.

8:30 AM: Consumer Price Index for January. The consensus is for a 0.1% increase in CPI in January and for core CPI to increase 0.1%.

10:00 AM: the Philly Fed manufacturing survey for February. The consensus is for a reading of 10.0, up from 9.4 last month (above zero indicates expansion).

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for sales of 4.70 million on seasonally adjusted annual rate (SAAR) basis. Sales in December were at a 4.87 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.67 million SAAR.

As always, a key will be inventory of homes for sale.

Friday, February 14, 2014

The New LA Skyline

by Calculated Risk on 2/14/2014 06:14:00 PM

A couple of articles ...

From Thomas Curwen at the LA Times: They'll be pouring it on at New Wilshire Grand site

The latest addition to the Los Angeles skyline — the New Wilshire Grand, the tallest structure to be built west of the Mississippi — takes a major step forward Saturday when more than 2,000 truckloads of concrete are driven through downtown for what is being billed as the world's largest continuous concrete pour.And from Roger Vincent at the LA Times: Chinese developer unveils plans for Metropolis project in L.A.

...

The New Wilshire Grand will feature five levels of subterranean parking, convention space, office suites and a 900-room hotel in the signature tower, which will rise 1,100 feet from the street to the top of its architectural spire.

Chinese real estate developer Greenland Group revealed plans Friday for a quick start on the first phase of its $1-billion Metropolis Los Angeles project that is expected to redefine the downtown skyline.One of the reasons I think economic growth will increase in 2014 is that there should be a pickup in Commercial Real Estate (CRE) development this year.

Work is set to begin shortly on a high-rise hotel and a residential skyscraper on what is now a vast parking lot along the 110 Freeway north of Staples Center and LA Live. The buildings should be open by 2016.

Hotel Occupancy Rate increased 0.3% year-over-year in latest Survey

by Calculated Risk on 2/14/2014 02:06:00 PM

From HotelNewsNow.com: STR: US results for week ending 8 February

The U.S. hotel industry posted positive results in the three key performance measurements during the week of 2-8 February 2014, according to data from STR.The 4-week average of the occupancy rate is close to normal levels.

In year-over-year measurements, the industry’s occupancy increased 0.3 percent to 56.2 percent. Average daily rate rose 2.9 percent to finish the week at US$110.40. Revenue per available room for the week was up 3.2 percent to finish at US$62.06.

emphasis added

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014 and black is for 2009 - the worst year since the Great Depression for hotels.

Through Feb 8th, the 4-week average of the occupancy rate is slightly higher than the same period last year and is tracking at pre-recession levels.

It looks like 2014 should be a solid year for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

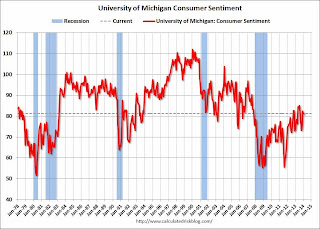

Preliminary February Consumer Sentiment unchanged at 81.2

by Calculated Risk on 2/14/2014 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for February was at 81.2, unchanged from January.

This was above the consensus forecast of 80.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011, and another smaller spike down last October and November due to the government shutdown.

I expect to see sentiment at post-recession highs very soon.