by Calculated Risk on 2/19/2014 08:24:00 PM

Wednesday, February 19, 2014

Thursday: Unemployment Claims, CPI, Philly Fed Mfg Survey

First an update on Sacramento: Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (conventional, REOs, and short sales). For a long time, not much changed. But over the last 2 years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market, although some of this is due to investor buying. Other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In January 2014, 19.5% of all resales (single family homes) were distressed sales. This was up from 18.8% last month, and down from 44.5% in January 2013.

The percentage of REOs was at 8.1%, and the percentage of short sales decreased to 11.5%. The increase in December and January was seasonal (happens at the end of every year).

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales recently (blue).

Active Listing Inventory for single family homes increased 96.3% year-over-year in January.

Cash buyers accounted for 26.6% of all sales, down from 37.4% a year ago (frequently investors). This has been trending down, and it appears investors are becoming less of a factor in Sacramento.

Total sales were down 24% from January 2013, but equity sales (non-distressed) were up compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increasing.

As I've noted before, we are seeing a similar pattern in other distressed areas. This suggests what will happen in other areas: 1) Flat or declining overall existing home sales, 2) but increasing conventional (equity) sales, 3) Less investor buying, 4) more inventory, and 5) slower price increases.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 335 thousand from 339 thousand.

• Also at 8:30 AM, the Consumer Price Index for January. The consensus is for a 0.1% increase in CPI in January and for core CPI to increase 0.1%.

• At 10:00 AM, the Philly Fed manufacturing survey for February. The consensus is for a reading of 10.0, up from 9.4 last month (above zero indicates expansion).

LA area Port Traffic: Imports up year-over-year in January

by Calculated Risk on 2/19/2014 04:41:00 PM

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for January since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 0.4% compared to the rolling 12 months ending in December. Outbound traffic was unchanged compared to 12 months ending in December.

Inbound traffic is increasing, and it appears outbound traffic is starting to pick up a little.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

![]() Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Inbound traffic was up 5% compared to January 2012 and outbound traffic was down slightly.

This suggests an increase in trade the trade deficit with Asia in January.

FOMC Minutes: "A clear presumption in favor" of Additional Tapering

by Calculated Risk on 2/19/2014 02:00:00 PM

From the Fed: Minutes of the Federal Open Market Committee, January 28-29, 2014 . Excerpt:

In their discussion of the path for monetary policy, most participants judged that the incoming information about the economy was broadly in line with their expectations and that a further modest step down in the pace of purchases was appropriate. A couple of participants observed that continued low readings on inflation and considerable slack in the labor market raised questions about the desirability of reducing the pace of purchases; these participants judged, however, that a pause in the reduction of purchases was not justified at this stage, especially in light of the strength of the economy in the second half of 2013. Several participants argued that, in the absence of an appreciable change in the economic outlook, there should be a clear presumption in favor of continuing to reduce the pace of purchases by a total of $10 billion at each FOMC meeting. That said, a number of participants noted that if the economy deviated substantially from its expected path, the Committee should be prepared to respond with an appropriate adjustment to the trajectory of its purchases.A few notes: 1) Tapering will continue unless the economy deviates "substantially from its expected path". 2) There is "a clear presumption in favor" of additional tapering. 3) the forward guidance will be changed soon, probably at the next meeting.

Participants agreed that, with the unemployment rate approaching 6-1/2 percent, it would soon be appropriate for the Committee to change its forward guidance in order to provide information about its decisions regarding the federal funds rate after that threshold was crossed. A range of views was expressed about the form that such forward guidance might take. Some participants favored quantitative guidance along the lines of the existing thresholds, while others preferred a qualitative approach that would provide additional information regarding the factors that would guide the Committee's policy decisions. Several participants suggested that risks to financial stability should appear more explicitly in the list of factors that would guide decisions about the federal funds rate once the unemployment rate threshold is crossed, and several participants argued that the forward guidance should give greater emphasis to the Committee's willingness to keep rates low if inflation were to remain persistently below the Committee's 2 percent longer-run objective. Additional proposals included relying to a greater extent on the Summary of Economic Projections as a communications device and including in the guidance an indication of the Committee's willingness to adjust policy to lean against undesired changes in financial conditions.

A few participants raised the possibility that it might be appropriate to increase the federal funds rate relatively soon. One participant cited evidence that the equilibrium real interest rate had moved higher, and a couple of them noted that some standard policy rules tended to suggest that the federal funds rate should be raised above its effective lower bound before the middle of this year. Other participants, however, suggested that prescriptions from standard policy rules were not appropriate in current circumstances, either because the target federal funds rate had been constrained by the lower bound for some time or because the equilibrium real rate of interest was likely still being held down by various factors, including the lingering effects of the financial crisis, and was significantly below the value of the longer-run rate built into standard policy rules.

emphasis added

Housing Starts: Weakness, Weather, Fundamentals

by Calculated Risk on 2/19/2014 12:28:00 PM

Is the housing recovery over? Housing starts were down in January (and down slightly year-over-year). The MBA mortgage purchase index is at the lowest level since September 2011. Existing home sales were weak in January (to be released tomorrow). Oh no. Oh no. Is the sky falling?

Short answer: no.

There are several reasons for the recent weakness: weather (probably a small factor), higher mortgage rates, and higher prices (homebuilders raised prices sharply in 2013). But the fundamentals of household formation and housing supply suggest a significant increase in housing starts over the next few years.

So I'm not too concerned about short term weakness. As always, fundamentals will eventually rule, and I think that means housing starts will continue to increase for the next few years.

A few key points:

• Housing starts were revised up for 2013, and starts increased 18.7% in 2013 compared to 2012 (revised up from 18.3%).

• Even after increasing 28% in 2012 and 18% in 2013, the 927 thousand housing starts in 2013 were the sixth lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the three lowest years were 2008 through 2012). Also, this was the fifth lowest year for single family starts since 1959 (only 2009 through 2012 were lower). See bottom graphs for single family starts!

• Starts averaged 1.5 million per year from 1959 through 2000. Demographics and household formation suggests starts will return to close to that level over the next few years. That means starts will probably increase another 50%+ from the 2013 level.

The following table shows annual starts (total and single family) since 2005:

| Housing Starts (000s) | ||||

|---|---|---|---|---|

| Total | Change | Single Family | Change | |

| 2005 | 2,068.3 | --- | 1,715.8 | --- |

| 2006 | 1,800.9 | -12.9% | 1,465.4 | -14.6% |

| 2007 | 1,355.0 | -24.8% | 1,046.0 | -28.6% |

| 2008 | 905.5 | -33.2% | 622.0 | -40.5% |

| 2009 | 554.0 | -38.8% | 445.1 | -28.4% |

| 2010 | 586.9 | 5.9% | 471.2 | 5.9% |

| 2011 | 608.8 | 3.7% | 430.6 | -8.6% |

| 2012 | 780.6 | 28.2% | 535.5 | 24.4% |

| 2013 | 926.7 | 18.7% | 618.3 | 15.5% |

I expect another solid increase for housing starts in 2014.

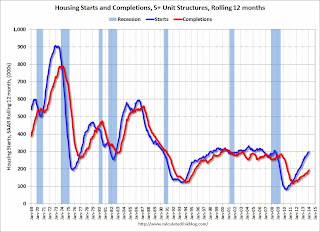

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) are lagging behind - but completions will continue to follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family completions in 2014, but probably still below the 1997 through 2007 level of multi-family completions. Multi-family starts will probably move more sideways in 2014.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Starts have been moving up, and completions have followed.

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

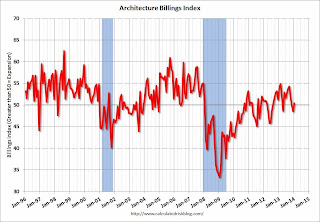

AIA: Architecture Billings Index increases slightly in January

by Calculated Risk on 2/19/2014 09:55:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Slight Rebound for Architecture Billings Index

ter consecutive months of contracting demand for design services, there was a modest uptick in the Architecture Billings Index (ABI). As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the January ABI score was 50.4, up from a mark of 48.5 in December. This score reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 58.5, down a bit from the reading of 59.2 the previous month.

“There is enough optimism in the marketplace that business conditions should return to steady growth as the year progresses,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “The suspension of the debt ceiling should ease some anxiety around projects for the federal government, at least for the time being. However, private sector spending should lead the construction upturn this year, which will depend more on employment growth and continued improvement in the overall economy."

Regional averages: South (53.5),West (51.1), Midwest (46.5), Northeast (43.6) [three month average]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.4 in January, up from 48.5 in December. Anything above 50 indicates expansion in demand for architects' services. This index has indicated expansion during 15 of the last 18 months.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. Even when positive, this index was not as strong as during the '90s - or during the bubble years of 2004 through 2006 - because the vacancy rates are still high for many CRE sectors. However, the readings over the last year suggest some increase in CRE investment in 2014.