by Calculated Risk on 2/24/2014 08:51:00 AM

Monday, February 24, 2014

Chicago Fed: "Economic growth slowed in January"

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth slowed in January

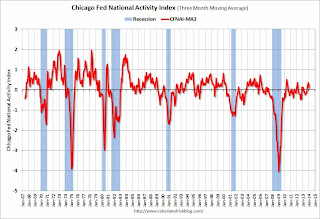

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) decreased to –0.39 in January from –0.03 in December.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to +0.10 in January from +0.26 in December, marking its fifth consecutive reading above zero. January’s CFNAI-MA3 suggests that growth in national economic activity was above its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was above the historical trend in January (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, February 23, 2014

Sunday Night Futures

by Calculated Risk on 2/23/2014 08:25:00 PM

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for January. This is a composite index of other data.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for February. The general business activity index was at 3.8 in January.

Weekend:

• Schedule for Week of Feb 23rd

• Housing Weakness: Temporary or Enduring?

From MarketWatch: Asia Markets live blog: Stocks rolling higher

Both Japan’s Nikkei Average and Australia’s S&P/ASX 200 spent a little time in negative territory during the opening minutes, but both are higher now, up 0.5% and 0.3%, respectively.From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 4 and DOW futures are up 37(fair value).

Oil prices are up with WTI futures at $102.58 per barrel and Brent at $110.19 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.40 per gallon (up sharply over the last two weeks, but down significantly from the same week a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Housing Weakness: Temporary or Enduring?

by Calculated Risk on 2/23/2014 12:29:00 PM

The recent data for housing has been weak, with new home sales and housing starts mostly moving sideways over the last year (with plenty of ups and downs, and I expect downward revisions to Q4 new home sales). Existing home sales have declined 14% from a peak of 5.38 million in July 2013 on a seasonally adjusted annual rate basis (SAAR), to just 4.62 million SAAR in January.

There are several reasons for the recent weakness:

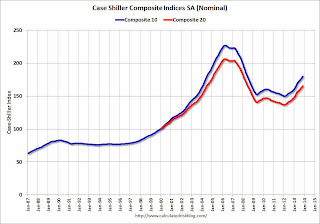

1) Higher prices. Case-Shiller reported prices were up 13.7% year-over-year in November. Other indexes had smaller increases, but all showed significant price increases in 2013.

2) Higher mortgage rates. 30 year fixed mortgage rates increased last summer from around 3.5% in May 2013 to 4.4% in July 2013. Since then, mortgage rates have mostly moved sideways, but some of the weakness since last summer is probably related to higher mortgage rates.

3) Fewer distressed sales. Although the decline in foreclosures, short sales, and mortgage delinquencies is good news, this has meant fewer overall existing home sales (this isn't a surprise - I've been predicting a decline in overall existing home sales for exactly this reason). Even though overall sales have been declining, equity sales (aka conventional transactions), are actually up year-over-year. Note: Of course fewer distressed sales should be a positive for new home sales, so this doesn't explain some of the recent weakness for new home sales.

4) Less investor buying. This is related to fewer distressed sales. If we use cash buyers as an indicator of the level of investor buying, then the decline in cash buyers in areas like Las Vegas, Phoenix, and Sacramento suggests investors are pulling back.

5) Limited inventory. The sharp decline in inventory over the last few years was a key story for housing (I beat that horse into the ground). There are several reasons inventory has been low: a) Most of the recent investor buying has been "buy-to-rent" and these investors aren't selling, Note: Economist Tom Lawler discussed this two year ago, and he concluded that a significant "share of the decline in the share of homes for sale reflects the acquisition of SF (and condo) properties by investors as multi-year rental properties", b) Is it difficult for people who are underwater (negative equity) to sell, c) Seller psychology: When the expectation is that prices will fall further, marginal sellers will try to sell their homes immediately. And marginal buyers will decide to wait for a lower price. This leads to more inventory on the market. But when the expectation is that prices are stabilizing (the current situation), sellers will wait until it is convenient to sell. d) Low inventory can keep some potential sellers from listing their homes because they can't find a move-up home to buy.

6) Supply chain constraints for New Homes. I noted at the beginning of 2013 "I've heard some builders might be land constrained in 2013 (not enough finished lots in the pipeline)." That was correct - some builders had limited entitled land and there were other constraints too (material shortages, skilled labor in certain areas) - and this limited the number of new home sales last year (sales were only up 16.3% in 2013).

7) And some of the recent weakness in December and January (and February) might have been weather related.

Here are a few graphs to show the recent weakness:

Click on graph for larger image.

Click on graph for larger image.

Total housing starts in January were at a seasonally adjusted annual rate of 880,000 - only 2% above January 2013, and single-family housing starts in January were at a rate of 573,000 - down 6% from January 2013.

Although starts have been up and down over the last year, starts have mostly moved sideways. Of course starts were up 18.7% in 2013 compared to 2012, so there was little "weakness" on an annual basis.

New home sales followed the same pattern has housing starts: up solidly in 2013 compared to 2012, but with sales mostly moving sideways all year (with ups and downs).

New home sales followed the same pattern has housing starts: up solidly in 2013 compared to 2012, but with sales mostly moving sideways all year (with ups and downs).

New Home Sales in December were at a seasonally adjusted annual rate (SAAR) of 414 thousand up only 4.5% from December 2012.

New home sales for January 2014 will be released this coming Wednesday, and I expect sales to be down year-over-year, and to see some downward revisions for Q4 sales.

Existing home sales in January were at a 4.62 million SAAR, and were 5.1% below the January 2013 rate.

Existing home sales in January were at a 4.62 million SAAR, and were 5.1% below the January 2013 rate.

So what should we make of this "weakness"?

First, the decline in existing home sales is not bad news. See: Home Sales Reports: What Matters. Fewer distressed sales - and more equity sales (conventional sales) - is a positive.

Second, we need to put the recent "weakness" for starts and new home sales in perspective. New home sales were up 16.3% in 2013 - a solid year of growth - and 2013 was still the sixth weakest year since 1963 when the Census Bureau started tracking new home sales. For housing starts, even after increasing 28.2% in 2012 and 18.7% in 2013, the 927 thousand housing starts in 2013 were the sixth lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the three lowest years were 2008 through 2012). Also, this was the fifth lowest year for single family starts since 1959 (only 2009 through 2012 were lower).

These low levels of housing starts and new home sales, combined with a growing population and new household formation, suggests new home sales and housing starts should increase over the next few years.

Also higher prices should lead to more inventory (the NAR reported inventory was up 7.6% year-over-year in January). More inventory should mean slower price increases (maybe even flat of declining prices in certain markets), and also more non-distressed sales. For new homes, the builders are reporting more selling communities in 2014, and it appears some of the land constraints have diminished. As Lawler recently wrote:

First, fueled by low mortgage rates, low new and existing home inventories, and some “pent-up” demand, builders as a group experienced a significant increase in net home orders starting in the latter part of 2012 and continuing into the spring of 2013. While many builders responded by increasing significantly land acquisitions and development spending in 2012 and 2013, many builders were unable to meet demand, partly reflecting longer-than-normal development timelines related to “supply-chain” issues. Many responded by increasing prices substantially, in some areas at a pace seldom seen. When mortgage rates subsequently rose sharply, the combination of higher mortgage rates and substantially higher new home prices resulted in a significant slowdown in net home orders. While mortgage rates eased somewhat in the latter part of last year, orders did not rebound much (or for some builders at all), mainly reflecting potential buyers balking at the higher home prices.The bottom line is the housing weakness should be temporary. There should be more inventory this year, price increases should slow, and sales volumes increase.

That slowdown did not dampen most builders’ optimism for the 2014 spring selling season, and most builders have the land/lots to increase substantially their community counts this year, and plan to do so. One reason for their optimism is that the previous hikes in prices have at many builders pushed margins up well above “normal” levels, meaning they can drive higher revenues with higher volumes without price increases, and in fact can be “quite profitable” by holding prices even if construction costs rise. As such, a reasonable assumption for new home prices from the end of 2013 to the end of 2014 would be “flattish.”

Saturday, February 22, 2014

Schedule for Week of Feb 23rd

by Calculated Risk on 2/22/2014 12:51:00 PM

The key reports this week are the second estimate of Q4 GDP on Friday, January New Home sales on Wednesday, and December Case-Shiller house prices on Tuesday.

For manufacturing, the February Dallas, Richmond and Kansas City Fed surveys will be released.

Note: The FDIC is expected to release the Q4 FDIC Quarterly Banking Profile during the week.

Also Fed Chair Janet Yellen will provide the Semiannual Monetary Policy Report to the Congress on Thursday.

8:30 AM ET: Chicago Fed National Activity Index for January. This is a composite index of other data.

10:30 AM: Dallas Fed Manufacturing Survey for February.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through November 2012 (the Composite 20 was started in January 2000).

The consensus is for a 13.3% year-over-year increase in the Composite 20 index (NSA) for December. The Zillow forecast is for the Composite 20 to increase 13.5% year-over-year, and for prices to increase 0.7% month-to-month seasonally adjusted.

9:00 AM: FHFA House Price Index for December 2013. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% increase.

9:00 AM: Chemical Activity Barometer (CAB) for January from the American Chemistry Council. This appears to be a leading economic indicator.

10:00 AM: Conference Board's consumer confidence index for February. The consensus is for the index to decrease to 80.0 from 80.7.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for January from the Census Bureau.

10:00 AM: New Home Sales for January from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the December sales rate.

The consensus is for a decrease in sales to 405 thousand Seasonally Adjusted Annual Rate (SAAR) in January from 414 thousand in December.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 335 thousand from 336 thousand.

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.0% decrease in durable goods orders.

10:00 AM: Testimony, Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

11:00 AM: the Kansas City Fed manufacturing survey for February. This is the last of the regional Fed surveys for February.

8:30 AM: Q4 GDP (second estimate). This is the second estimate of Q4 GDP from the BEA. The consensus is that real GDP increased 2.5% annualized in Q4, revised down from the advance estimate of 3.2%.

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a decrease to 57.8, down from 59.6 in January.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for February). The consensus is for a reading of 81.2, unchanged from the preliminary reading of 81.2, and unchanged from the January reading.

10:00 AM ET: Pending Home Sales Index for January. The consensus is for a 2.7% increase in the index.

Unofficial Problem Bank list declines to 578 Institutions

by Calculated Risk on 2/22/2014 08:05:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for February 21, 2014.

Changes and comments from surferdude808:

Late Friday, the OCC released an update on its recent enforcement action activity that contributed to many removals from the Unofficial Problem Bank List. During the week, there were eight removals that lowered the list institution count to 578 with assets of $193.0 billion. A year ago, the list held 809 institutions with $302.8 billion of assets.

The OCC terminated actions against Home Federal Savings Bank, Rochester, MN ($562 million Ticker: HMNF); The Farmers National Bank of Buhl, Buhl, ID ($391 million); 1st National Bank of South Florida, Homestead, FL ($307 million); American National Bank, Oakland Park, FL ($235 million); Liberty Bank, National Association, Twinsburg, OH ($203 million); Cherokee Bank, National Association, Canton, GA ($168 million Ticker: CHKJ); First Capital Bank, Bennettsville, SC ($58 million Ticker: FCPB); and The First National Bank of Fleming, Fleming, CO ($23 million).

Next week, the FDIC should release an update on its latest enforcement action activities and a report on industry results for the fourth quarter and full year of 2013. Included should be updated figures on the Official Problem Bank List. At the last quarterly release in November 2013, the count on the unofficial list exceeded the official by 130. Since then, the unofficial list has declined by 67 institutions. We are anticipating for the difference to narrow with this release.