by Calculated Risk on 2/25/2014 09:15:00 AM

Tuesday, February 25, 2014

Case-Shiller: Comp 20 House Prices increased 13.4% year-over-year in December

S&P/Case-Shiller released the monthly Home Price Indices for December ("December" is a 3 month average of October, November and December prices).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities) and the quarterly national index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: ome Prices Lose Momentum According to the S&P/Case-Shiller Home Price Indices

Data through December 2013, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices, the leading measure of U.S. home prices, showed that National home prices closed the year of 2013 up 11.3%. This represents a slight improvement over last quarter’s annual rate of 11.2%. In the fourth quarter of 2013, the National Index declined 0.3%.

In December, the 10-City Composite remained relatively unchanged while the 20-City Composite showed its second consecutive monthly decline of 0.1%. Year-over-year, the 10-City and 20-City Composites posted gains of 13.6% and 13.4%, approximately 30 basis points lower than their November rates. Chicago showed its highest year-over-year return since December 1988. Dallas set a new peak and posted its largest annual gain since its inception in 2000. Denver declined 0.1% and is now 0.7% below its all-time index level high set in September 2013.

“The S&P/Case-Shiller Home Price Index ended its best year since 2005,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “However, gains are slowing from month-to-month and the strongest part of the recovery in home values may be over. Year-over-year values for the two monthly Composites weakened and the quarterly National Index barely improved. The seasonally adjusted data also exhibit some softness and loss of momentum.

After 26 months of consecutive gains, Phoenix posted -0.3% for the month of December, its largest decline since March 2011. Phoenix once led the recovery from the bottom in 2012, but Las Vegas, Los Angeles and San Francisco were the top three performing cities of 2013 with gains of over 20%. The Sun Belt, with the exception of Dallas, Miami and Tampa, saw lower annual rates in December when compared to their November numbers. The six cities with the highest year-over-year figures saw their rates decline (Las Vegas, San Francisco, Los Angeles, Atlanta, San Diego and Detroit) and most cities ranked at the bottom improved (Denver, Washington and New York) – Charlotte and Cleveland were the two exceptions."

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 20.1% from the peak, and up 0.8% in December (SA). The Composite 10 is up 21.0% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 19.3% from the peak, and up 0.8% (SA) in December. The Composite 20 is up 21.7% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 13.6% compared to December 2012.

The Composite 20 SA is up 13.4% compared to December 2012.

Prices increased (SA) in 19 of the 20 Case-Shiller cities in December seasonally adjusted. (Prices increased in 6 of the 20 cities NSA) Prices in Las Vegas are off 45.5% from the peak, and prices in Dallas are at new highs (SA).

This was at the consensus forecast for a 13.3% YoY increase. I'll have more on prices later.

Monday, February 24, 2014

Tuesday: Case-Shiller and FHFA House Prices, Richmond Fed

by Calculated Risk on 2/24/2014 09:13:00 PM

An excellent article from Jared Bernstein: Lessons From the Recovery Act. A few excerpts:

A deeper understanding of the economic damage should have prevented the precipitous pivot away from stimulus toward deficit reduction.One of my key complaints was that policy pivoted to austerity way too soon. I never understood why infrastructure spending was only on "shovel ready" programs. Since recoveries from financial crisis recessions are always sluggish, the investments in infrastructure could have been significantly higher and over a longer period.

[I]in those days I learned the power of the single worst analogy I know: “just as families have to tighten their belts in tough times, so does the government.” It’s not just that this is wrong; it’s that it’s backward. When families are tightening, government (including the Federal Reserve) must loosen, and vice versa. But the phrase, uttered by no less than the president himself at times, makes so much folksy sense that it too infected the policy and precipitated the pivot.Absolutely correct. Every time I hear this - including from President Obama - I cringe. And more:

About one-third of the stimulus package went to tax cuts. There’s an excellent political rationale for that apportionment, but particularly given the diagnosis noted above, tax cuts’ bang-for-buck in terms of jobs is less than optimal. First, for the cuts to stimulate the economy, recipients have to spend the extra money, not save it. In a deleveraging cycle, that’s a heavier lift. Second, when they do spend the money, they need to spend it on domestic goods. So there’s a lot of potential leakage.I've argued before that even though the stimulus package was an obvious success, some parts of the package (like certain tax cuts) were not very effective. The debate now should be on how well each part of the package performed.

It’s also the case that one-quarter of the tax cuts went to relief from the alternative minimum tax that would have happened anyway, so that part wasn’t even stimulus (which by definition means new spending or tax cuts).

Tuesday:

• At 9:00 AM ET, the S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December. The consensus is for a 13.3% year-over-year increase in the Composite 20 index (NSA) for December. The Zillow forecast is for the Composite 20 to increase 13.5% year-over-year, and for prices to increase 0.7% month-to-month seasonally adjusted.

• Also at 9:00 AM, the FHFA House Price Index for December 2013. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% increase.

• Also at 9:00 AM, the Chemical Activity Barometer (CAB) for January from the American Chemistry Council. This appears to be a leading economic indicator.

• At 10:00 AM, the Conference Board's consumer confidence index for February. The consensus is for the index to decrease to 80.0 from 80.7.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for February

Weekly Update: Housing Tracker Existing Home Inventory up 5.7% year-over-year on Feb 24th

by Calculated Risk on 2/24/2014 07:13:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for January). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2014 is now 5.7% above the same week in 2013 (red is 2014, blue is 2013).

Inventory is still very low, but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

DOT: Vehicle Miles Driven increased 1.1% year-over-year in December

by Calculated Risk on 2/24/2014 01:29:00 PM

The Department of Transportation (DOT) reported:

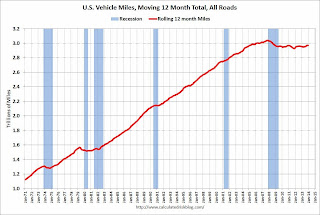

Travel on all roads and streets changed by 1.1% (2.7 billion vehicle miles) for December 2013 as compared with December 2012.The following graph shows the rolling 12 month total vehicle miles driven.

...

Cumulative Travel for 2013 changed by 0.6% (18.1 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways but has started to increase a little recently.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 73 months - 6+ years - and still counting. Currently miles driven (rolling 12 months) are about 2.2% below the previous peak.

The second graph shows the year-over-year change from the same month in the previous year.

In December 2013, gasoline averaged of $3.36 per gallon according to the EIA. that was down slightly from 2012 when prices in December averaged $3.38 per gallon.

In December 2013, gasoline averaged of $3.36 per gallon according to the EIA. that was down slightly from 2012 when prices in December averaged $3.38 per gallon.As we've discussed, gasoline prices are just part of the story. The lack of growth in miles driven over the last 6 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take a few more years before we see a new peak in miles driven - but it appears miles driven might be gradually increasing again.

Dallas Fed Manufacturing: General Business Index Flat, Production Increases, Employment Increases

by Calculated Risk on 2/24/2014 10:38:00 AM

From the Dallas Fed: Texas Manufacturing Picks Up Again but Less Optimism in Outlook

Texas factory activity increased for the tenth month in a row in February, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 7.1 to 10.8, indicating output grew at a slightly stronger pace than in January.A mixed report, but the employment indexes were positive.

Other measures of current manufacturing activity also reflected a pick up. The capacity utilization index edged up to 9.1, with a quarter of manufacturers noting an increase. The shipments index rose again in February, coming in at 13.3. The new orders index continued to indicate demand growth and was 9.5, down from 14.4 in January but above the levels seen toward the end of last year.

...

The general business activity index fell to zero after eight positive readings in a row. The company outlook index also declined, from 15.9 to 3.4, hitting its lowest reading since last spring.

Labor market indicators reflected continued employment growth and longer workweeks. The February employment index edged up for a third consecutive month, rising to 9.9. Eighteen percent of firms reported net hiring compared with 8 percent reporting net layoffs. The hours worked index shot up from 3.4 to 12, reaching its highest level in more than two and a half years.