by Calculated Risk on 3/04/2014 09:21:00 AM

Tuesday, March 04, 2014

Mortgage Monitor: Mortgage Loan originations declined to the lowest point since Nov. 2008

Black Knight Financial Services (BKFS, formerly the LPS Data & Analytics division) released their Mortgage Monitor report for January today. According to LPS, 6.27% of mortgages were delinquent in January, down from 6.47% in December. BKFS reports that 2.35% of mortgages were in the foreclosure process, down from 3.41% in January 2013.

This gives a total of 8.62% delinquent or in foreclosure. It breaks down as:

• 1,851,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,289,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,175,000 loans in foreclosure process.

For a total of 4,315,000 loans delinquent or in foreclosure in January. This is down from 5,208,000 in January 2013.

This graph from BKFS shows percent of loans delinquent and in the foreclosure process over time.

Delinquencies and foreclosures are moving down - and might be back to normal levels in a couple of years.

“In January, we saw origination volume continue to decline to its lowest point since 2008, with prepayment speeds pointing to further drops in refinance-related originations,” said Herb Blecher, senior vice president of Black Knight Financial Services’ Data & Analytics division. “Overall originations were down almost 60 percent year-over-year, with HARP volumes (according to the most recent FHFA report) down 70 percent over the same period. These declines are largely tied to the increased mortgage interest rate environment, which is having a significant impact on the number of borrowers with incentive to refinance. A high-level view of this refinancible population shows a decline of about 13 percent just over the last two months.There is much more in the mortgage monitor.

“Of course, in addition to higher interest rates, a good deal of this decline can be attributed to the fact that a majority of those who could refinance at historically low rates in recent years already have, and we see a similar dynamic in terms of HARP-eligible loans. The volume of HARP refinances over the past year has driven this population down to about 700,000 loans in January 2014, as compared to over 2.3 million at the same time last year. From a geographic perspective, outside of Florida and Nevada, we see the Midwestern states of Illinois, Michigan, Missouri and Ohio have among the highest percentage of HARP eligibility.”

emphasis added

Monday, March 03, 2014

Weekly Update: Housing Tracker Existing Home Inventory up 5.9% year-over-year on March 3rd

by Calculated Risk on 3/03/2014 06:24:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for January). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2014 is now 5.9% above the same week in 2013 (red is 2014, blue is 2013).

Inventory is still very low, but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

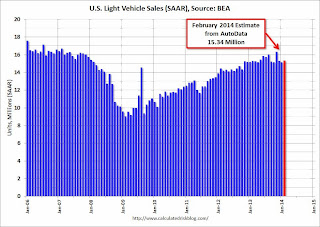

U.S. Light Vehicle Sales increase to 15.3 million annual rate in February

by Calculated Risk on 3/03/2014 02:55:00 PM

Based on an AutoData estimate, light vehicle sales were at a 15.34 million SAAR in February. That is up slightly from February 2013, and up 1.8% from the sales rate last month.

This was slightly below the consensus forecast of 15.4 million SAAR (seasonally adjusted annual rate).

Click on graph for larger image.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for February (red, light vehicle sales of 15.34 million SAAR from AutoData).

Weather had an impact in February, from WardsAuto:

"John Felice, [Ford] vice president-U.S. Marketing, Sales and Service, says (delayed) orders should be filled this month, which will help March results. The executive also says February started slow, but built momentum as the month progressed, which also bodes well for sales this month."The second graph shows light vehicle sales since the BEA started keeping data in 1967.

...

“Weather continued to impact the industry in February, but GM sales started to thaw during the Winter Olympic Games as our brand and marketing messages took hold,” Kurt McNeil, GM vice president-Sales Operations, says in a statement.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.Unlike residential investment, auto sales bounced back fairly quickly following the recession and were a key driver of the recovery.

Looking forward, the growth rate will slow for auto sales, and most forecasts are for around a small gain in 2014 to around 16.1 million light vehicles. Of course 2014 is off to a slow start.

Construction Spending increased in January

by Calculated Risk on 3/03/2014 10:45:00 AM

The Census Bureau reported that overall construction spending increased in January:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during January 2014 was estimated at a seasonally adjusted annual rate of $943.1 billion, 0.1 percent above the revised December estimate of $941.9 billion. The January figure is 9.3 percent above the January 2013 estimate of $863.1 billion.Private spending increased in January, but public spending was down:

Spending on private construction was at a seasonally adjusted annual rate of $670.8 billion, 0.5 percent above the revised December estimate of $667.5 billion. Residential construction was at a seasonally adjusted annual rate of $359.9 billion in January, 1.1 percent above the revised December estimate of $356.0 billion. Nonresidential construction was at a seasonally adjusted annual rate of $310.9 billion in January, 0.2 percent below the revised December estimate of $311.5 billion. ...

In January, the estimated seasonally adjusted annual rate of public construction spending was $272.3 billion, 0.8 percent below the revised December estimate of $274.4 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 47% below the peak in early 2006, and up 57% from the post-bubble low.

Non-residential spending is 25% below the peak in January 2008, and up about 39% from the recent low.

Public construction spending is now 16% below the peak in March 2009 and up just about 3% from the recent low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 15%. Non-residential spending is up 9% year-over-year. Public spending is up 2% year-over-year.

To repeat a few key themes:

1) Private residential construction is usually the largest category for construction spending, and is now the largest category once again. Usually private residential construction leads the economy, so this is a good sign going forward.

2) Private non-residential construction spending usually lags the economy. There was some increase this time for a couple of years - mostly related to energy and power - but the key sectors of office, retail and hotels are still at very low levels. Based on the architecture billings index, I expect private non-residential to increase this year.

3) Public construction spending was down in January, but is up 3% from the low in April. It appears that the drag from public construction spending is over. Public spending has declined to 2006 levels (not adjusted for inflation) and was a drag on the economy for 4+ years. In real terms, public construction spending has declined to 2001 levels.

Looking forward, all categories of construction spending should continue to increase. Residential spending is still very low, non-residential should start to pickup, and public spending appears to have bottomed.

ISM Manufacturing index increased in February to 53.2

by Calculated Risk on 3/03/2014 10:00:00 AM

The ISM manufacturing index indicated faster expansion in February than in January. The PMI was at 53.2% in February, up from 51.3% in January. The employment index was at 52.3%, unchanged from 52.3% in January, and the new orders index was at 54.5%, up from 51.2% in January.

From the Institute for Supply Management: February 2014 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in February for the ninth consecutive month, and the overall economy grew for the 57th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The February PMI® registered 53.2 percent, an increase of 1.9 percentage points from January's reading of 51.3 percent indicating expansion in manufacturing for the ninth consecutive month. The New Orders Index registered 54.5 percent, an increase of 3.3 percentage points from January's reading of 51.2 percent. The Production Index registered 48.2 percent, a decrease of 6.6 percentage points compared to January's reading of 54.8 percent. Inventories of raw materials increased by 8.5 percentage points to 52.5 percent. As in January, several comments from the panel mention adverse weather conditions as a factor impacting their businesses in February. Other comments reflect optimism in terms of demand and growth in the near term."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 51.9%.