by Calculated Risk on 3/05/2014 08:23:00 AM

Wednesday, March 05, 2014

ADP: Private Employment increased 139,000 in February

Private sector employment increased by 139,000 jobs from January to February according to the February ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 158,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "February was another soft month for the job market. Employment was weak across a number of industries. Bad winter weather, especially in mid-month, weighed on payrolls. Job growth is expected to improve with warmer temperatures.”

Note: ADP hasn't been very useful in directly predicting the BLS report on a monthly basis, but it might provide a hint. The BLS report for February will be released on Friday.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 3/05/2014 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 9.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 28, 2014. ...

The Refinance Index increased 10 percent from the previous week. The seasonally adjusted Purchase Index increased 9 percent from one week earlier. ...

The seasonally adjusted Purchase Index was 6 percent higher than its level two weeks earlier, but was still 19 percent lower than the same week one year ago. Despite the increase observed this week, the Refinance Index is still 3 percent lower than it was two weeks ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.47 percent from 4.53 percent, with points decreasing to 0.28 from 0.31 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,000) decreased to 4.37 percent from 4.47 percent, with points increasing to 0.20 from 0.13 (including the origination fee) for 80 percent LTV loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 69% from the levels in May 2013.

With the mortgage rate increases, refinance activity will be significantly lower in 2014 than in 2013.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 17% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index - but this is still very weak.

Note: Jumbo rates are still below conforming rates.

Tuesday, March 04, 2014

Wednesday: ISM Service Index, ADP Employment, Fed's Beige Book

by Calculated Risk on 3/04/2014 08:19:00 PM

Note on the previous post: I've contacted the FHA and will post the quarterly FHA REO data soon.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 158,000 payroll jobs added in January, down from 175,000 in January.

• At 10:00 AM, the ISM non-Manufacturing Index for February. The consensus is for a reading of 53.6, down from 54.0 in January. Note: Above 50 indicates expansion, below 50 contraction.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Fannie, Freddie, FHA REO inventory increased in Q4

by Calculated Risk on 3/04/2014 02:01:00 PM

EDIT: Ooops. The FHA data is for a year ago.

In their Q4 SEC filing, Fannie reported their Real Estate Owned (REO) increased to 103,229 single family properties, up from 100,941 at the end of Q3.

Freddie reported their REO increased to 47,308 in Q4, up from 44,623 at the end of Q3.

The FHA reported their REO increased to 37,977 in Q4, up from 37,445 in Q3. (EDIT: wrong year)

The combined Real Estate Owned (REO) for Fannie, Freddie and the FHA increased to 188,514, up from 185,505 at the end of Q3 2013. The peak for the combined REO of the F's was 295,307 in Q4 2010.

This following graph shows the REO inventory for Fannie, Freddie and the FHA.

Click on graph for larger image.

Click on graph for larger image.

This is only a portion of the total REO. There is also REO for private-label MBS, FDIC-insured institutions (declined in Q4), VA and more. REO has been declining for those categories.

Although REO is down slightly from Q4 2012, REO has increased for two consecutive quarters - and is still at a high level.

EDIT: Incorrect FHA data.

CoreLogic: House Prices up 12% Year-over-year in January

by Calculated Risk on 3/04/2014 10:50:00 AM

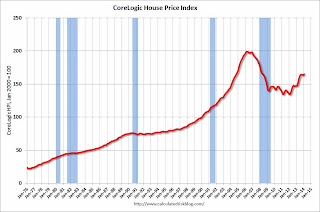

Notes: This CoreLogic House Price Index report is for January. The recent Case-Shiller index release was for December. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: Home Prices Nationwide Increased 12 Percent Year Over Year In January

Home prices, including distressed sales, increased by 12.0 percent in January 2014 compared to December 2013. January marks the 23nd consecutive month of year-over-year home price gains.

Excluding distressed sales, home prices increased by 9.8 percent year over year.

... Despite gains in December, home prices nationwide remain 17.3 percent below their peak, which was set in April 2006.

“Polar vortices and a string of snow storms did not manage to weaken house price appreciation in January. The last time January month-over-month and year-over-year price appreciation was this strong was at the height of the housing bubble in 2006.” [said Dr. Mark Fleming, chief economist for CoreLogic]

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.9% in January, and is up 12.0% over the last year. This index is not seasonally adjusted, so this was a strong month-to-month gain during the "weak" season.

The index is off 17.3% from the peak - and is up 22.9% from the post-bubble low set in February 2012.

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty three consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty three consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).I expect the year-over-year increases to slow - but it isn't showing up in the CoreLogic index yet.