by Calculated Risk on 3/06/2014 08:09:00 PM

Thursday, March 06, 2014

Friday: Employment Report, Trade Deficit

From Nelson Schwartz at the NY Times Economix: On February Jobs Data, It’s Anybody’s Guess. Here is my guess: Employment Preview for February: Another Weak Report

Another great piece from Tim Duy at Economist's View: Fed Watch: Tapering is Sooo 2013

Bottom Line: Barring the outlier outcomes of either recession or explosive growth, tapering is on autopilot. Rate guidance is now qualitative and actual policy is discretionary. Incoming data is interesting for what it says about the timing of the first rate hike. So far, though, it is not telling us much given the Fed's belief that weak data is largely weather related. The degree to which asset bubbles are a concern varies greatly accross Fed officials but the general consensus is that such concerns are of second or third order magnitude compared to missing on both sides of the dual mandate.Friday:

• At 8:30 AM ET, the Employment Report for February. The consensus is for an increase of 150,000 non-farm payroll jobs in February, up from the 113,000 non-farm payroll jobs added in January. The consensus is for the unemployment rate to be unchanged at 6.6% in February.

• At 8:30 AM, the Trade Balance report for January from the Census Bureau. The consensus is for the U.S. trade deficit to increase to $39.0 billion in January from $38.7 billion in December.

• At 3:00 PM, Consumer Credit for January from the Federal Reserve. The consensus is for credit to increase $14.5 billion in January.

Trulia: Asking House Prices up 10.4% year-over-year in February, Price increases "Slowdown"

by Calculated Risk on 3/06/2014 02:53:00 PM

From Trulia chief economist Jed Kolko: What The Home-Price Slowdown Really Looks Like

Nationally, asking home prices rose 10.4% year-over-year in February 2014, down slightly after peaking in November 2013. But the year-over-year change is an average of the past twelve months and therefore obscures the most recent trends in prices. Looking at quarter-over-quarter changes instead, it’s clear that price gains have been slowing for most of the last year: asking home prices rose just 1.9% in February – a rate similar to those recorded in January and December – compared with increases near 2.5% from July 2013 to November 2013 and over 3% from April 2013 to June 2013. The quarter-over-quarter change in asking prices topped out at 3.5% in April 2013 and now, at 1.9%, the increase is just over half of that peak.It appears the year-over-year asking price gains are slowing, but asking prices are still increasing.

...

The 10 U.S. metros with the biggest year-over-year price increases in February 2014 all experienced a severe housing bust after the bubble popped (by “severe,” we mean a price drop from peak to trough of at least 30%, according to the Federal Housing Finance Agency index). Why? After prices fell in these markets, homes looked like bargains to investors and other buyers. At the same time, price drops also spurred foreclosures, which forced many families to become renters. Price drops and stronger rental demand together create the ideal conditions for investors to buy and rent out single-family homes, which helped boost home prices.

In February, rents rose 3.4% year-over-year nationally. In 20 the 25 largest rental markets, February’s increase was larger than the year-over-year rent increase from three months earlier, in November. emphasis added

In November 2013, year-over-year asking prices were up 12.2%. In December, the year-over-year increase in asking home prices slowed slightly to 11.9%. In January, the year-over-year increase was 11.4%, and now, in February, the increase was 10.4%.

As Kolko notes, the slowdown has started - but prices are still increasing.

Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases, but at a slower rate, over the next few months on a seasonally adjusted basis.

Fed's Q4 Flow of Funds: Household Net Worth at Record High

by Calculated Risk on 3/06/2014 12:00:00 PM

The Federal Reserve released the Q4 2013 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q4 compared to Q3, and is at a new record high. Net worth peaked at $68.8 trillion in Q2 2007, and then net worth fell to $55.6 trillion in Q1 2009 (a loss of $13.2 trillion). Household net worth was at $80.7 trillion in Q4 2013 (up $25.1 trillion from the trough in Q1 2009).

The Fed estimated that the value of household real estate increased to $19.4 trillion in Q4 2013. The value of household real estate is still $3.2 trillion below the peak in early 2006.

Click on graph for larger image.

Click on graph for larger image.

This is the Households and Nonprofit net worth as a percent of GDP. Although household net worth is at a record high, as a percent of GDP it is still below the peak in 2006 (housing bubble), but above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was increasing gradually since the mid-70s, and then we saw the stock market and housing bubbles. The ratio has been trending up and increased again in Q4 with both stock and real estate prices increasing.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q4 2013, household percent equity (of household real estate) was at 51.7% - up from Q3, and the highest since Q2 2007. This was because of both an increase in house prices in Q4 (the Fed uses CoreLogic) and a reduction in mortgage debt.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 52+ million households with mortgages have far less than 50.7% equity - and millions have negative equity.

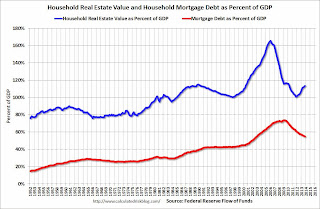

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt decreased by $11 billion in Q4, after increasing slightly in Q3.

Mortgage debt has now declined by $1.32 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up in Q4 (as house prices increased), but still close to the average of the last 30 years (excluding bubble). However household mortgage debt, as a percent of GDP, is still historically high, suggesting a little more deleveraging ahead for certain households.

CoreLogic: 4 Million Residential Properties Returned to Positive Equity in 2013

by Calculated Risk on 3/06/2014 09:51:00 AM

From CoreLogic: CoreLogic reports 4 Million Residential Properties Returned to Positive Equity in 2013

CoreLogic ... today released new analysis showing 4 million homes returned to positive equity in 2013, bringing the total number of mortgaged residential properties with equity to 42.7 million. The CoreLogic analysis indicates that nearly 6.5 million homes, or 13.3 percent of all residential properties with a mortgage, were still in negative equity at the end of 2013. Due to a small slowdown in the quarterly growth rate of the Home Price Index, the negative equity share was virtually unchanged from the end of the third quarter of 2013.

... Of the 42.7 million residential properties with positive equity, 10 million have less than 20-percent equity. Borrowers with less than 20-percent equity, referred to as “under-equitied,” may have a more difficult time obtaining new financing for their homes due to underwriting constraints. Under-equitied mortgages accounted for 21.1 percent of all residential properties with a mortgage nationwide in 2013, with more than 1.6 million residential properties at less than 5-percent equity, referred to as near-negative equity. Properties that are near-negative equity are considered at risk if home prices fall. ...

“The plight of the underwater borrower has improved dramatically since negative equity peaked in December 2009 when more than 12 million mortgaged homeowners were underwater,” said Mark Fleming, chief economist for CoreLogic. “Over the past four years, more than 5.5 million homeowners have regained equity, reducing their risk of foreclosure and unlocking pent-up supply in the housing market.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 30.4 percent, followed by Florida (28.1 percent), Arizona (21.5 percent), Ohio (19.0 percent) and Illinois (18.7 percent). These top five states combined account for 36.9 percent of negative equity in the United States."

Note: The share of negative equity is still very high in Nevada and Florida, but down significantly from a year ago (Q4 2012) when the negative equity share in Nevada was at 52.4 percent, and at 40.2 percent in Florida.

The second graph shows the distribution of home equity in Q4 compared to Q3. Close to 5% of residential properties have 25% or more negative equity, down slightly from Q3, and down from around 6% in Q2 and 8% in Q1.

The second graph shows the distribution of home equity in Q4 compared to Q3. Close to 5% of residential properties have 25% or more negative equity, down slightly from Q3, and down from around 6% in Q2 and 8% in Q1.In Q4 2012, there were 10.4 million properties with negative equity - now there are 6.5 million. A significant change.

Weekly Initial Unemployment Claims decline to 323,000

by Calculated Risk on 3/06/2014 08:35:00 AM

The DOL reports:

In the week ending March 1, the advance figure for seasonally adjusted initial claims was 323,000, a decrease of 26,000 from the previous week's revised figure of 349,000. The 4-week moving average was 336,500, a decrease of 2,000 from the previous week's revised average of 338,500.The previous week was revised up from 348,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 336,500.

This was below the consensus forecast of 338,000. The 4-week average is mostly moving sideways ...