by Calculated Risk on 6/09/2014 02:01:00 PM

Monday, June 09, 2014

Phoenix Real Estate in May: Sales down 21%, Cash Sales down 40%, Inventory up 47%

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in May were down 21% year-over-year and at the lowest for May since 2008.

2) Cash Sales (frequently investors) were down 40%, so investor buying appears to be declining. Non-cash sales were down about 9% year-over-year.

3) Active inventory is now increasing rapidly and is up 47% year-over-year - and at the highest level for May since 2011.

Inventory has clearly bottomed in Phoenix (A major theme for housing in 2013). And more inventory (a theme this year) - and less investor buying - suggests price increases should slow sharply in 2014.

According to Case-Shiller, Phoenix house prices bottomed in August 2011 (mostly flat for all of 2011), and then increased 23% in 2012, and another 15% in 2013. Those large increases were probably due to investor buying, low inventory and some bounce back from the steep price declines in 2007 through 2010. Now, with more inventory, price increases should flatten out in 2014.

We only have Case-Shiller through March, but the Zillow index shows Phoenix prices down slightly year-to-date through April.

| May Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Inventory | YoY Change Inventory | |

| May-08 | 5,6371 | --- | 1,062 | 18.8% | 54,1611 | --- |

| May-09 | 9,284 | 64.7% | 3,592 | 38.7% | 39,902 | -26.3% |

| May-10 | 9,067 | -2.3% | 3,341 | 36.8% | 41,326 | 3.6% |

| May-11 | 9,8112 | 8.2% | 4,523 | 46.1% | 31,661 | -23.4% |

| May-12 | 8,445 | 13.5% | 3,907 | 46.3% | 20,162 | -36.3% |

| May-13 | 9,440 | 11.8% | 3,669 | 38.9% | 19,734 | -2.1% |

| May-14 | 7,442 | -21.2% | 2,193 | 29.5% | 29,091 | 47.4% |

| 1 May 2008 does not include manufactured homes, ~100 more 2 Error corrected for 2011 sales and percent cash sales. | ||||||

Update: 41-Year-Olds and the Labor Force Participation Rate

by Calculated Risk on 6/09/2014 11:00:00 AM

To make a few simple points on the Labor Force Participation Rate, yesterday I posted 41-Year-Olds and the Labor Force Participation Rate . In the previous post I only used men for each age group to simplify.

By request here is a look at the participation rate of women in the prime working age groups over time.

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the trends for each prime working age women 5-year age group.

Note: This is a rolling 12 month average to remove noise (data is NSA), and the scale doesn't start at zero to show the change.

For women, the participation rate increased significantly until the late 90s, and then started declining slowly. This is a more complicated story than for men, and that is why I used prime working age men only yesterday to show the gradual downward decline in participation that has been happening for decades (and is not just recent economic weakness).

The second graph shows the same data for women but with the full scale (0% to 100%). The upward participation until the late 80s is very clear, and the decline since then has been gradual.

The second graph shows the same data for women but with the full scale (0% to 100%). The upward participation until the late 80s is very clear, and the decline since then has been gradual.

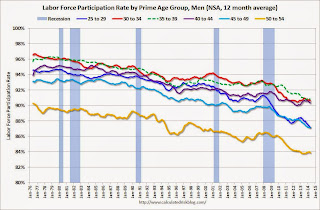

The third graph is a repeat of the full scale graph for prime working age men. The participation rate has been trending down for decades.

To repeat: The bottom line is that the participation rate was declining for prime working age workers before the recession, there are several reasons for this decline (not just recent "economic weakness") and many estimates of "missing workers" are probably way too high.

To repeat: The bottom line is that the participation rate was declining for prime working age workers before the recession, there are several reasons for this decline (not just recent "economic weakness") and many estimates of "missing workers" are probably way too high.

Sunday, June 08, 2014

Sunday Night Futures

by Calculated Risk on 6/08/2014 08:10:00 PM

On the Employment Report:

• May Employment Report: 217,000 Jobs, 6.3% Unemployment Rate

• Comment: U.S. Employment at All Time High

• Employment Recovery: Great Recession, Great Depression, and other Financial Crises

Weekend:

• 41-Year-Olds and the Labor Force Participation Rate

• Schedule for Week of June 8th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up slightly and DOW futures are up 11 (fair value).

Oil prices moved mostly sideways over the last week with WTI futures at $102.67 per barrel and Brent at $108.61 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.64 per gallon (might have peaked for the Spring / early Summer, and at about the same level as a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

41-Year-Olds and the Labor Force Participation Rate

by Calculated Risk on 6/08/2014 12:00:00 PM

On Friday, Dean Baker wrote: The Question on People Leaving the Labor Force is 41-Year-Olds, Not 61-Year-Olds

In his discussion of today's employment report Neil Irwin notes that the unemployment rate is considerably lower than would otherwise be the case because so many people have simply given up looking for work and are therefore not counted as being unemployed. Irwin then adds that the big question is that if the economy eventually recovers is:This brings up a few key points:

"How many of the 61-year-olds who gave up looking for a job in the last few years are going to return to the labor force when they smell opportunity, and how many have retired for good?"

Actually, the story of people leaving the labor force is not primarily one of older workers who are near retirement age, it is primarily a story of prime age workers. ...

It is difficult to envision any obvious reason why people in their prime working years would suddenly decide that they did not want to work other than the weakness of the labor market. Most of these workers will presumably come back into the labor market if they see opportunities for employment.

1) Analyzing and forecasting the labor force participation requires looking at a number of factors. Everyone is aware that there is a large cohort has moved into the 50 to 70 age group, and that that has pushing down the overall participation rate. Another large cohort has been moving into the 16 to 24 year old age group - and many in this cohort are staying in school (a long term trend that has accelerated recently) - and that is another key factor in the decline in the overall participation rate.

2) But there are other long term trends. One of these trends is for a decline in the participation rate for prime working age men (25 to 54 years old).

3) Although Dr. Baker argues that the decline in prime working age workers is due to "weakness of the labor market", this decline was happening long before the Great Recession. For some reasons, see: Possible Reasons for the Decline in Prime-Working Age Men Labor Force Participation and on demographics from researchers at the Atlanta Fed: "Reasons for the Decline in Prime-Age Labor Force Participation"

Lets take a look at Dean Bakers "41-Year-Olds". I used the BLS data on 40 to 44 year old men (only available Not Seasonally Adjusted since 1976). I choose men only to simplify.

Click on graph for larger image.

Click on graph for larger image.This graph shows the 40 to 44 year old men participation rate since 1976 (note the scale doesn't start at zero to better show the change).

There is a clear downward trend, and a researcher looking at this trend in the year 2000 might have predicted the 40 to 44 year old men participation rate would about the level as today (see trend line).

Clearly there are other factors than "economic weakness" causing this downward trend. I listed some reasons a few months ago, and new research from Pew Research suggests stay-at-home dads is one of the reasons: Growing Number of Dads Home with the Kids

Just looking at this graph, I don't think there are many "missing 41-Year-Old" men that will be returning to the labor force.

The second graph shows the trends for each prime working age men 5-year age group.

The second graph shows the trends for each prime working age men 5-year age group.Note: This is a rolling 12 month average to remove noise (data is NSA), and the scale doesn't start at zero to show the change.

Clearly there is a downward trend for all 5 year age groups. When arguing about how many workers are "missing", we need to take these long term trends into account.

The third graph shows the same data but with the full scale (0% to 100%). The trend is still apparent, but the decline has been gradual.

The third graph shows the same data but with the full scale (0% to 100%). The trend is still apparent, but the decline has been gradual.The bottom line is that the participation rate was declining for prime working age workers before the recession, there are several reasons for this decline (not just recent "economic weakness") and many estimates of "missing workers" are probably way too high.

Saturday, June 07, 2014

Schedule for Week of June 8th

by Calculated Risk on 6/07/2014 01:11:00 PM

This will be a light week for economic data.

The key report this week is May retail sales on Thursday.

No economic releases scheduled.

7:30 AM ET: NFIB Small Business Optimism Index for May.

10:00 AM: Job Openings and Labor Turnover Survey for April from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for April from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

In March, the number of job openings (yellow) were up 3.5% year-over-year compared to March 2013, and Quits were up sharply year-over-year.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for April. The consensus is for a 0.5% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM ET: The Monthly Treasury Budget Statement for May. Note: The CBO's estimate is the deficit through May in fiscal 2014 was $439 billion, compared to $626 billion for the same period in fiscal 2013.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 309 thousand from 312 thousand.

8:30 AM ET: Retail sales for May will be released.

8:30 AM ET: Retail sales for May will be released.This graph shows retail sales since 1992 through March 2014. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales increased 0.1% from March to April (seasonally adjusted), and sales were up 3.8% from April 2013.

The consensus is for retail sales to increase 0.6% in May, and to increase 0.4% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for April. The consensus is for a 0.4% increase in inventories.

8:30 AM: The Producer Price Index for May from the BLS. The consensus is for a 0.1% increase in prices.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for June). The consensus is for a reading of 83.0, up from 81.9 in May.