by Calculated Risk on 6/10/2014 10:00:00 AM

Tuesday, June 10, 2014

BLS: Jobs Openings increase sharply to 4.5 million in April

From the BLS: Job Openings and Labor Turnover Summary

There were 4.5 million job openings on the last business day of April, up from 4.2 million in March, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) increased over the 12 months ending in April for total nonfarm and total private and was little changed for government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for April, the most recent employment report was for May.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in April to 4.455 million from 4.166 million in March.

The number of job openings (yellow) are up 17% year-over-year compared to April 2013.

Quits are up 11% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

It is a good sign that job openings are over 4 million for the third consecutive month, and that quits are increasing.

NFIB: Small Business Optimism Index increases in May, Highest since 2007

by Calculated Risk on 6/10/2014 08:33:00 AM

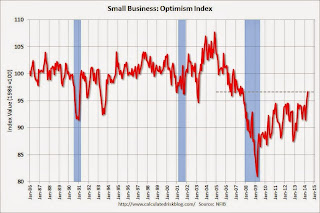

From the National Federation of Independent Business (NFIB): Small Business Sentiment: Improves a Bit But Is No Sign Of A Surge

NFIB Optimism Index rose 1.4 points in May to 96.6, the highest reading since September 2007. ...In another good sign, the percent of firms reporting "poor sales" as the single most important problem has fallen to 12, down from 16 last year - and "taxes" are the top problem at 25 (taxes are usually reported as the top problem during good times).

Labor Markets. NFIB owners increased employment by an average of 0.11 workers per firm in May (seasonally adjusted), the eighth positive month in a row and the best string of gains since 2006.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 96.6 in May from 95.2 in April.

Monday, June 09, 2014

Tuesday: Job Openings, Small Business Optimism

by Calculated Risk on 6/09/2014 08:58:00 PM

From Fannie Mae: Spring-Summer Buying and Selling Season Sputters Despite Drop in Mortgage Rates

"Consumers’ lukewarm income expectations and reticence about the economy seem to be holding back housing demand," said Doug Duncan, senior vice president and chief economist at Fannie Mae. "This year’s spring and summer home buying season has gotten off to a slow start, even as mortgage rates have trended lower over the past two months. Our National Housing Survey data show that economic conditions continue to be the top concern among consumers who think it’s a bad time to buy or sell a home. While recent housing activity suggests that the worst of the housing slump may be behind us, this caution among consumers supports our expectation that the rebound in home sales will likely be too modest to pull sales for all of 2014 ahead of last year."As a reminder: a decline in existing home sales this year is not "bad news". With fewer distressed sales and less investor buying, it is no surprise that existing home sales are down. I expect housing starts and new home sales (the key for GDP and employment growth) to increase this year and also in 2015.

Tuesday:

• At 7:30 AM ET, NFIB Small Business Optimism Index for May.

• At 10:00 AM, Job Openings and Labor Turnover Survey for April from the BLS. In March, the number of job openings (yellow) were up 3.5% year-over-year compared to March 2013, and Quits were up sharply year-over-year.

• Also at 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for April. The consensus is for a 0.5% increase in inventories.

Weekly Update: Housing Tracker Existing Home Inventory up 10.9% year-over-year on June 9th

by Calculated Risk on 6/09/2014 04:27:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for April). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY compared to 2012.

Inventory in 2014 (Red) is now 10.9% above the same week in 2013.

Inventory is still very low - but I expect inventory to be above the same week in 2012 in July (prices bottomed in early 2012). This increase in inventory should slow price increases, and might lead to price declines in some areas.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess was inventory would be up 10% to 15% year-over-year at the end of 2014. Right now it looks like inventory might increase a little more than I expected.

Lawler on Hovnanian: Home Sales Soft without “Big Deals”

by Calculated Risk on 6/09/2014 03:24:00 PM

From housing economist Tom Lawler:

Hovnanian Enterprises, the 7th largest US home builder in 2013, reported that net home orders, including unconsolidated joint ventures, totaled 1,907 in the quarter ending April 30, 2014, down 2.2% from the comparable quarter of 2013. Sales per community were down 8.5% from a year ago. The average net order price last quarter was $368,668, up 3.3% from a year ago. Home deliveries last quarter including JVs) totaled 1,331 last quarter, down 6.5% from the comparable quarter of 2013, at an average sales price of $354,405, up 4.3% from a year ago. The company’s order backlog at the end of April was 3,032, up 7.3% from last April, at an average order price of $374,584, up 3.4% from a year ago.

Here is an excerpt from the company’s press release.

"We launched our national sales campaign, Big Deal Days, in March and were encouraged by the 728 net contracts signed during the month of March 2014, the highest level of monthly net contracts since April 2008. In addition, the 3.6 net contracts per active selling community in March was the highest level of monthly net contracts per community since September 2007," stated Ara K. Hovnanian, Chairman of the Board, President and Chief Executive Officer. "However, our sales pace during April and May was choppy and the total monthly sales pace per active selling community in both months fell short of last year's levels."Hovnanian’s “Big Deal Days” campaign, which offered “the biggest savings of the year” on a selection of “quick move-in” homes, ended at the end of March.

In the company’s conference call presentation Hovnanian broke out net orders by month, and included net orders for May. Net orders for April and May combined were down 12.4% from net orders in April and May of 2013.

Hovnanian owned or controlled 37,787 lots (including JVs) at the end of April, up 25.8% from last April.