by Calculated Risk on 6/11/2014 11:19:00 AM

Wednesday, June 11, 2014

Will Congress "Pay the Bills" in 2015?

I wrote several posts about the "debt ceiling" debate in 2011 and again in 2013. Unfortunately "debt ceiling" sounds virtuous, but it isn't - it is actually a question of "paying the bills". And I've always argued that Congress would "pay the bills". So even though the debate in 2011 clearly scared many Americans and impacted the economy, I was confident that Congress would eventually do its job.

These political stunts always happen in off election years with the hope that most voters will forget about the nonsense by the next election. So there is a risk in 2015 - and right now I'm a little more concerned than in previous years. Most of the commentary concerning the upset of Congressman Eric Cantor has focused on immigration reform, but his opponent has also argued that the government should not pay the bills (default on payments to the American companies and people).

This is an economic risk for next year (and a political risk for the GOP). As Republican Senator Mitch McConnell noted in 2011, if the debt ceiling isn't raised the "Republican brand" would become toxic and synonymous with fiscal irresponsibility.

Back in 2013 I promised to start criticizing Congress earlier in the process since 2011 was ridiculous and reckless (2013 was also dumb). I think there is a general ignorance of how the budget works, and what it means to be fiscally responsible. I'll write more about these topics and start earlier this time!

Note: There are certain politicians who think it is OK to not pay the bills as long as the U.S. makes interest and principal payments on the debt. That is crazy talk. There is a name for people who don't pay their bills: deadbeats. If politicians don't pay their personal bills, they are deadbeats. But if they stop the government from paying the bills, we are all deadbeats. And there will be serious economic consequences for not paying the bills on time. The consequences will build over time, but after several months, not "paying the bills" in 2015 would ripple through the entire economy.

MBA:"Strong Growth in Mortgage Application Volume Following Memorial Day Holiday"

by Calculated Risk on 6/11/2014 07:00:00 AM

From the MBA: Strong Growth in Mortgage Application Volume Following Memorial Day Holiday

Mortgage applications increased 10.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 6, 2014. The previous week’s results included an adjustment for the Memorial Day holiday. ...

The Refinance Index increased 11 percent from the previous week. The seasonally adjusted Purchase Index increased 9 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.34 percent from 4.26 percent, with points increasing to 0.16 from 0.13 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 71% from the levels in May 2013.

As expected, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 13% from a year ago.

Tuesday, June 10, 2014

Update: Will Mortgage Rates be down year-over-year in late June?

by Calculated Risk on 6/10/2014 07:18:00 PM

It is fun to try to guess future headlines, and it looks like we might see "Mortgage Rates down year-over-year" in a couple of weeks.

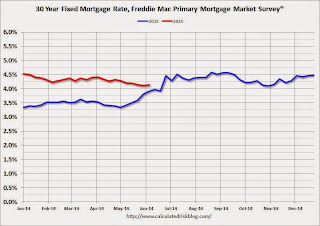

I use the weekly Freddie Mac Primary Mortgage Market Survey® (PMMS®) to track mortgage rates. The PMMS series started in 1971, so there is a fairly long historical series.

For daily rates, the Mortgage News Daily has a series that tracks the PMMS very well, and is usually updated daily around 3 PM ET. The MND data is based on actual lender rate sheets, and is mostly "the average no-point, no-origination rate for top-tier borrowers with flawless scenarios". (this tracks the Freddie Mac series).

MND reports that average 30 Year fixed mortgage rates increased today to 4.25% from 4.23% yesterday.

One year ago rates were at 4.05% and rising. If the current rate holds, mortgage rates will be down year-over-year in less than 2 weeks.

Here is a table from Mortgage News Daily:

Click on graph for larger image.

Click on graph for larger image.Here is a graph of 30 year fixed mortgage rates - according to the Freddie Mac PMMS® - for 2013 (blue) and 2014 (red).

Mortgage rates jumped to 4.46% in late June 2013, and it is possible that rates will be lower in late June 2014 (currently 4.25% according to Mortgage News Daily).

Las Vegas Real Estate in May: Year-over-year Non-contingent Inventory Doubles, Distressed Sales and Cash Buying down sharply

by Calculated Risk on 6/10/2014 01:12:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Southern Nevada home prices rebound in May, GLVAR reports

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in May was 3,450, up from 3,215 in April, but down from 3,884 one year ago.There are several key trends that we've been following:

GLVAR said 40.2 percent of all existing local homes sold in May were purchased with cash. That’s down from 41.4 percent in April, well short of the February 2013 peak of 59.5 percent and suggesting that investors are accounting for a smaller percentage of local buyers.

...

In May, 7.9 percent of all existing local home sales were short sales, down substantially from 12.4 in April. Another 9.1 percent of all May sales were bank-owned properties, down from 11.4 in April.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in May was 13,637. That’s down 1.4 percent from 13,833 in April and down 1.3 percent from one year ago.

By the end of May, GLVAR reported 6,615 single-family homes listed without any sort of offer. That’s up 3.0 percent from 6,420 such homes listed in April, and a 100.6 percent jump from one year ago. For condos and townhomes, the 2,258 properties listed without offers in May represented a 0.3 percent decrease from 2,264 such properties listed in April, but a 76.8 percent jump from one year ago.

emphasis added

1) Overall sales were down about 11% year-over-year.

2) Conventional (equity, not distressed) sales were up 27% year-over-year. In May 2013, only 57.9% of all sales were conventional equity. This year, in May 2014, 83.0% were equity sales.

3) The percent of cash sales has declined year-over-year from 57.9% in May 2013 to 40.2% in May 2014. (investor buying appears to be declining).

4) Non-contingent inventory is up 100.6% year-over-year (double)!

Inventory has clearly bottomed in Las Vegas (A major theme for housing last year). And fewer distressed sales and more inventory (a major theme for 2014) suggests price increases will slow.

FNC: Residential Property Values increased 8.4% year-over-year in April

by Calculated Risk on 6/10/2014 12:31:00 PM

In addition to Case-Shiller, CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their April index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.6% from March to April (Composite 100 index, not seasonally adjusted). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased between 0.6% and 0.7% in April. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

The year-over-year change slowed in April, with the 100-MSA composite up 8.4% compared to April 2013. The index is still down 21.7% from the peak in 2006.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the year-over-year change based on the FNC index (four composites) through April 2014. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

This might be the beginning of a slowdown in prices increases in the FNC index.

The April Case-Shiller index will be released on Tuesday, June 24th, and I expect Case-Shiller to show a slowdown in price increases.