by Calculated Risk on 3/25/2015 03:28:00 PM

Wednesday, March 25, 2015

Vehicle Sales Forecasts: Best March since 2005

The automakers will report March vehicle sales on Wednesday, April 1st. Sales in February were at 16.2 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales rebounded in March to close to 17.0 million SAAR. March sales (SA) will probably be the best since 2005.

Note: There were 25 selling days in March, one less than last year. Here are a couple of forecasts:

From WardsAuto: Forecast: March Sales Spring Forward

A WardsAuto forecast calls for U.S. automakers to deliver 1.52 million light vehicles this month. The forecasted daily sales rate (DSR) of 60,935 over 25 days represents a 3.5% improvement from like-2014 (26 days). ... The report puts the seasonally adjusted annual rate of sales for the month at 16.9 million units, compared with year-ago’s 16.4 million and February’s 16.2 million mark.From J.D. Power: J.D. Power and LMC Automotive Report: New-Vehicle Sales Rebound in March to Highest Levels for the Month since 2005

U.S. total new-vehicle sales in March 2015 are bouncing back from last month and are expected to reach their highest levels for the month in a decade, according to a monthly sales forecast from J.D. Power and LMC Automotive.Looks like a strong month for auto sales.

After winter storms stymied sales in February, total new light-vehicle sales in March 2015 are expected to reach 1,539,600 units, a 4 percent increase on a selling-day adjusted basis compared with March 2014 and their highest levels for the month since March 2005 when 1,572,909 new vehicles were sold. [17.0 million SAAR[

New Home Prices: More homes priced in the $200K to $300K range

by Calculated Risk on 3/25/2015 12:31:00 PM

Here are two graphs I haven't posted for some time ...

As part of the new home sales report, the Census Bureau reported the number of homes sold by price and the average and median prices.

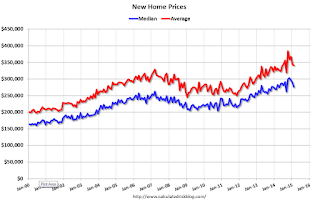

From the Census Bureau: "The median sales price of new houses sold in February 2015 was $275,500; the average sales price was $341,000."

The following graph shows the median and average new home prices.

During the housing bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. When housing started to recovery - with limited finished lots in recovering areas - builders moved to higher price points to maximize profits.

Recently some builders have announced new homes at lower price points.

The average price in February 2015 was $341,000 and the median price was $275,500. Both are above the bubble high (this is due to both a change in mix and rising prices), but are below the recent peak.

The second graph shows the percent of new homes sold by price.

However there has been a pickup in homes sold in the $200K to $300K range (Up to 37.8% of homes in February 2015).

Yesterday on New Home Sales:

• New Home Sales at 539,000 Annual Rate in February

• Comments on New Home Sales

Freddie Mac: Mortgage Serious Delinquency rate declined in February

by Calculated Risk on 3/25/2015 09:33:00 AM

Freddie Mac reported that the Single-Family serious delinquency rate declined in February to 1.81%, down from 1.86% in January. Freddie's rate is down from 2.29% in February 2014, and the rate in February was the lowest level since December 2008. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for February next week.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.48 percentage points over the last year - and the rate of improvement has slowed recently - but at that rate of improvement, the serious delinquency rate will not be below 1% until late 2016.

Note: Very few seriously delinquent loans cure with the owner making up back payments - most of the reduction in the serious delinquency rate is from foreclosures, short sales, and modifications.

So even though distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales for 2 more years (mostly in judicial foreclosure states).

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 3/25/2015 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 9.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 20, 2015. ...

The Refinance Index increased 12 percent from the previous week. The seasonally adjusted Purchase Index increased 5 percent from one week earlier to its highest level since January 2015.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.90 percent, its lowest level since February 2015, from 3.99 percent, with points decreasing to 0.37 from 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

2015 will probably see a little more refinance activity than in 2014, but not a large refinance boom.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 3% higher than a year ago.

Tuesday, March 24, 2015

DOT: Vehicle Miles Driven increased 4.9% year-over-year in January, Rolling 12 Months at All Time High

by Calculated Risk on 3/24/2015 08:01:00 PM

Wednesday:

• 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for February from the Census Bureau. The consensus is for a 0.5% increase in durable goods orders.

With lower gasoline prices, vehicle miles driven have reached a new high on a rolling 12 month basis.

The Department of Transportation (DOT) reported:

◦Travel on all roads and streets changed by 4.9% (11.1 billion vehicle miles) for January 2015 as compared with January 2014.The following graph shows the rolling 12 month total vehicle miles driven to remove the seasonal factors.

◦Travel for the month is estimated to be 237.4 billion vehicle miles.

◦The seasonally adjusted vehicle miles traveled for January 2015 is 257.9 billion miles, a 5.1% (12.5 billion vehicle miles) increase over January 2014. It also represents a -0.2% change (-0.5 billion vehicle miles) compared with December 2014.

The rolling 12 month total is moving up, after moving sideways for several years.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Miles driven had been below the previous peak for 85 months - an all time record.

The second graph shows the year-over-year change from the same month in the previous year.

In January 2015, gasoline averaged of $2.21 per gallon according to the EIA. That was down significantly from January 2014 when prices averaged $3.39 per gallon.

In January 2015, gasoline averaged of $2.21 per gallon according to the EIA. That was down significantly from January 2014 when prices averaged $3.39 per gallon. However gasoline prices are just part of the story. The lack of growth in miles driven over the last 7 years was probably also due to the lingering effects of the great recession (lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

Now, miles driven - on a rolling 12 month basis - is at a new high.