by Calculated Risk on 3/26/2015 05:24:00 PM

Thursday, March 26, 2015

Mortgage News Daily: Mortgage Rates increased Today

Earlier I posted the results of the weekly Freddie Mac survey that showed rates declined recently. However mortgage rates increased today.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Increase Rapidly

Mortgage rates rose rapidly today, almost completely erasing the improvement following last week's Fed Announcement. This is especially ironic considering most major media outlets are running Freddie Mac's weekly mortgage rate survey headline. Because that survey receives most of its responses on Monday and Tuesday, it fully benefited from the stronger levels earlier in the week after having totally missed out on last Wednesday and Thursday's big move lower. As such, the headlines suggest that rates are significantly lower this week. That was certainly true on Tuesday afternoon, but rates have risen roughly an eighth of a point since then. That's a big move considering we've gone entire months without moving more than an eighth.Here is a table from Mortgage News Daily:

Specifically, what had been 3.625 to 3.75% is now 3.75 to 3.875% in terms of the most prevalently-quoted conventional 30yr fixed rates for top tier scenarios. The upfront costs associated with moving down to 3.75 from 3.875% are still quite low.

Freddie Mac: 30 Year Mortgage Rates decrease to 3.69% in Latest Weekly Survey

by Calculated Risk on 3/26/2015 02:01:00 PM

From Freddie Mac today: Mortgage Rates Move Down Again

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving down again across the board. Average fixed rates that continue to run below four percent will help keep affordability high for those in the market to buy a home as we head into the spring homebuying season. ...

30-year fixed-rate mortgage (FRM) averaged 3.69 percent with an average 0.6 point for the week ending March 26, 2015, down from last week when it averaged 3.78 percent. A year ago at this time, the 30-year FRM averaged 4.40 percent.

15-year FRM this week averaged 2.97 percent with an average 0.6 point, down from last week when it averaged 3.06 percent. A year ago at this time, the 15-year FRM averaged 3.42 percent

Click on graph for larger image.

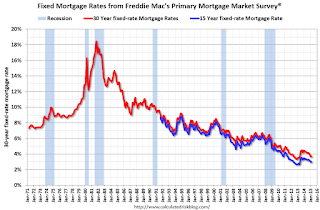

Click on graph for larger image.This graph shows the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®.

30 year mortgage rates are up a little (34 bps) from the all time low of 3.35% in late 2012, but down from 4.40% a year ago.

The Freddie Mac survey started in 1971. Mortgage rates were below 5% back in the 1950s.

Kansas City Fed: Regional Manufacturing Activity Declined in March

by Calculated Risk on 3/26/2015 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Declined

The Federal Reserve Bank of Kansas City released the March Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity declined in March, and producers’ expectations moderated somewhat but remained slightly positive.Some of this decline was due to lower oil prices (Oklahoma was especially weak), however overall, lower oil prices will a positive for the economy. Also some of this decline was related to the West Coast port labor issues that are now resolved.

“We saw our first monthly decline in regional factory activity in over a year," said Wilkerson. “Some firms blamed the West Coast port disruptions, while producers of oil and gas-related equipment blamed low oil prices.”

Tenth District manufacturing activity declined in March, and producers’ expectations moderated somewhat but remained slightly positive. Most price indexes continued to decrease, with several reaching their lowest level since 2009. In a special question about the West Coast port disruptions, 32 percent of firms said it had affected them negatively.

The month-over-month composite index was -4 in March, down from 1 in February and 3 in January. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The overall slower growth was mostly attributable to declines in plastics, food, and chemical production and continued weakness in metals and machinery. Looking across District states, the largest decline was in Oklahoma, with moderate slowdowns in Kansas and Nebraska. ... the employment and new orders for exports indexes inched higher but remained negative.

emphasis added

This was another weak regional manufacturing report (the Richmond Fed survey released earlier this week also showed contraction in March). The Dallas Fed survey for March will be released this coming Monday and will probably show contraction too.

Weekly Initial Unemployment Claims decreased to 282,000

by Calculated Risk on 3/26/2015 08:34:00 AM

The DOL reported:

In the week ending March 21, the advance figure for seasonally adjusted initial claims was 282,000, a decrease of 9,000 from the previous week's unrevised level of 291,000. The 4-week moving average was 297,000, a decrease of 7,750 from the previous week's unrevised average of 304,750.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 297,000.

This was below the consensus forecast of 293,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, March 25, 2015

Thursday: Unemployment Claims, Kansas City Mfg Survey

by Calculated Risk on 3/25/2015 07:05:00 PM

Some excerpts from a research piece by Goldman Sachs economist Kris Dawsey: Core Inflation Still Has Room to Fall

... With the PPI and CPI reports already in hand for the month, we think that the core PCE price index—the Fed’s preferred inflation measure—will post an above-trend 0.20% increase in February. ... In light of the latest news, one might be tempted to wonder whether we have seen the bottom on core inflation, which could help the Fed to be "reasonably confident" that inflation will be moving back to its target over the medium term—a precondition for the first rate hike.Thursday:

We ... find that in the near term downward pressure on core inflation from the effects of the stronger dollar and energy price pass-through are likely to overwhelm upward pressure from diminished slack in the economy. ... Recent firmness in shelter inflation—which appears insensitive to dollar and oil effects—is likely to persist, but we think that core goods inflation will probably move down further. Our bottom-up analysis suggests that headline and core consumer prices will probably bottom around the middle of the year ...

• 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 293 thousand from 291 thousand.

• At 11:00 AM, the Kansas City Fed manufacturing survey for March.