by Calculated Risk on 3/30/2015 07:51:00 PM

Monday, March 30, 2015

Tuesday: Case-Shiller House Prices, Chicago PMI

From the WSJ: Fed’s Fischer Floats Ideas for Regulating Shadow Banks

The Federal Reserve’s No. 2 official floated a series of ideas for regulating nonbank financial companies, the latest indication that top U.S. policy makers are focusing on risks in the so-called shadow banking sector.Tuesday:

“While there has been progress on the financial reform front, we should not be complacent about the stability of the financial system,” said Fed Vice Chairman Stanley Fischer in remarks prepared for a conference here hosted by the Federal Reserve Bank of Atlanta. He noted existing rules create an incentive for risky activities to move into less-regulated financial firms and said “we should expect that further reforms will certainly be needed down the road.”

• 9:00 AM ET, the S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January prices. The consensus is for a 4.6% year-over-year increase in the National Index for January. The Zillow forecast is for the National Index to increase 4.6% year-over-year in January, and for prices to increase 0.5% month-to-month seasonally adjusted.

• At 9:45 AM, the Chicago Purchasing Managers Index for March. The consensus is for a reading of 50.2, up from 45.8 in February.

Demographics and GDP: 2% is the new 4%

by Calculated Risk on 3/30/2015 03:08:00 PM

Note: This is a repeat of a post I wrote early this year. Based on some recent comments I've seen, I think this is worth repeating.

For amusement, I checked out the WSJ opinion page comments on the Q4 GDP report. As usual, the WSJ opinion is pure politics - but it does bring up an excellent point (that the WSJ conveniently ignores).

First, from the WSJ opinion page:

The fourth quarter report means that growth for all of 2014 clocked in at 2.4%, which is the best since 2.5% in 2010. It also means another year, an astonishing ninth in a row, in which the economy did not grow by 3%.This period of low growth isn't "astonishing". First, usually following a recession, there is a brief period of above average growth - but not this time due to the financial crisis and need for households to deleverage. So we didn't see a strong bounce back (sluggish growth was predicted on the blog for the first years of the recovery).

And overall, we should have been expecting slower growth this decade due to demographics - even without the housing bubble-bust and financial crisis (that the WSJ opinion page missed).

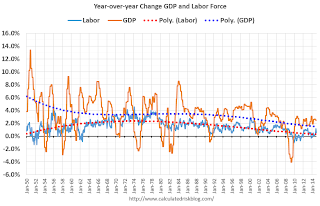

One simple way to look at the change in GDP is as the change in the labor force, times the change in productivity. If the labor force is growing quickly, GDP will be higher with the same gains in productivity. And the opposite is true.

So here is a graph of the year-over-year change in the labor force since 1950 (data from the BLS).

Click on graph for larger image

Click on graph for larger imageThe data is noisy - because of changes in population controls and the business cycle - but the pattern is clear as indicated by the dashed red trend line. The labor force has been growing slowly recently after declining for some time.

We could also look at just the prime working age population - I've pointed out before the that prime working age population has just started growing again after declining for a few years (see Prime Working-Age Population Growing Again)

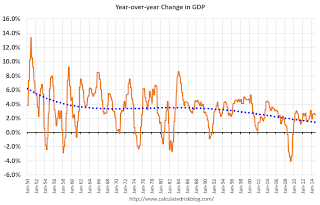

Now here is a look at GDP for the same period.

The GDP data (year-over-year quarterly) is also noisy, and the dashed blue line shows the trend.

The GDP data (year-over-year quarterly) is also noisy, and the dashed blue line shows the trend. GDP was high in the early 50s - and early-to-mid 60s because of government spending (Korean and Vietnam wars). As in example, in 1951, national defense added added 6.5 percentage points to GDP. Of course we don't want another war ...

Now lets put the two graphs together.

It isn't a surprise. Other than the early period with a boost from government spending, the growth in GDP has been tracking the growth in the labor force pretty well. The difference in growth between the dashed blue and red lines is due to gains in productivity.

It isn't a surprise. Other than the early period with a boost from government spending, the growth in GDP has been tracking the growth in the labor force pretty well. The difference in growth between the dashed blue and red lines is due to gains in productivity.The good news is that will change going forward (prime working age population will grow faster next decade). The bad news is the political hacks will continue to ignore demographics.

Right now, due to demographics, 2% GDP growth is the new 4%.

NAR: Pending Home Sales Index increased 3.1% in February, up 12% year-over-year

by Calculated Risk on 3/30/2015 10:08:00 AM

From the NAR: Pending Home Sales Rise in February Behind Solid Gains in Midwest, West

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 3.1 percent to 106.9 in February from a slight downward revision of 103.7 in January and is now 12.0 percent above February 2014 (95.4). The index is at its highest level since June 2013 (109.4), has increased year-over-year for six consecutive months and is above 100 – considered an average level of activity – for the 10th consecutive month.This was well above the consensus forecast, but as expected by housing economist Tom Lawler.

...

The PHSI in the Northeast fell 2.3 percent to 81.7 in February, but is 4.1 percent above a year ago. In the Midwest the index leaped 11.6 percent to 110.4 in February, and is now 13.8 percent above February 2014.

Pending home sales in the South decreased 1.4 percent to an index of 120.2 in February, but is still 10.8 percent above last February. The index in the West climbed 6.6 percent in February to 102.1 (highest since June 2013 at 111.4) and is now 18.3 percent above a year ago.

Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in March and April.

Personal Income increased 0.4% in February, Spending increased 0.1%

by Calculated Risk on 3/30/2015 08:30:00 AM

The BEA released the Personal Income and Outlays report for February:

Personal income increased $58.6 billion, or 0.4 percent ... in February, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE)increased $11.8 billion, or 0.1 percent.The following graph shows real Personal Consumption Expenditures (PCE) through February 2015 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- decreased 0.1 percent in February, in contrast to an increase of 0.2 percent in January. ... The price index for PCE increased 0.2 percent in February, in contrast to a decrease of 0.4 percent in January. The PCE price index, excluding food and energy, increased 0.1 percent in February, the same increase as in January.

The February price index for PCE increased 0.3 percent from February a year ago. The February PCE price index, excluding food and energy, increased 1.4 percent from February a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was higher than expected, The increase in PCE was below the 0.2% increase consensus.

On inflation: The PCE price index increased 0.3 percent year-over-year due to the sharp decline in oil prices. The core PCE price index (excluding food and energy) increased 1.4 percent year-over-year in February.

Using the two-month method to estimate Q1 PCE growth, PCE was increasing at a 2.0% annual rate in Q1 2015 (using the mid-month method, PCE was increasing 0.8%). This is a slowdown in PCE.

Sunday, March 29, 2015

Monday: Personal Income and Outlays, Pending Home Sales, Dallas Fed Mfg

by Calculated Risk on 3/29/2015 08:08:00 PM

From the NY Times: A Deadline for Greece, and U.S. Jobs Data

Greece hopes to gain approval on Monday for a detailed list of economic changes that its international creditors have demanded ...Monday:

... recent economic data has been anemic, and it is likely that hiring has not kept up with the blistering pace of gains reached in late 2014. In fact, some economists say hiring could fall below the 200,000 level because of a combination of bad weather and weakness in certain sectors like drilling and energy production.

• 8:30 AM ET, Personal Income and Outlays for February. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 10:00 AM, the Pending Home Sales Index for February. The consensus is for a 0.3% increase in the index.

• At 10:30 AM, Dallas Fed Manufacturing Survey for March.

Weekend:

• Schedule for Week of March 29, 2015

• Lawler: Possible Upside Surprise for Pending Home Sales Index

• Merrill and Nomura Forecasts for March Employment Report

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down slightly and DOW futures are flat (fair value).

Oil prices were up slightly over the last week with WTI futures at $48.34 per barrel and Brent at $55.97 per barrel. A year ago, WTI was at $101, and Brent was at $106 - so prices are down 50% or so year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are up to $2.42 per gallon (down more than $1.10 per gallon from a year ago). Prices in California are now declining following a refinery fire in February and a strike that is now over.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |