by Calculated Risk on 4/01/2015 12:35:00 PM

Wednesday, April 01, 2015

Construction Spending decreased 0.1% in February

Earlier today, the Census Bureau reported that overall construction spending decreased in February:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during February 2015 was estimated at a seasonally adjusted annual rate of $967.2 billion, 0.1 percent below the revised January estimate of $967.9 billion. The February figure is 2.1 percent above the February 2014 estimate of $947.1 billion.Private spending increased and public spending decreased:

Spending on private construction was at a seasonally adjusted annual rate of $698.2 billion, 0.2 percent above the revised January estimate of $696.9 billion. ...Note: Non-residential for offices and hotels is generally increasing, but spending for oil and gas is generally declining. Early in the recovery, there was a surge in non-residential spending for oil and gas (because prices increased), but now, with falling prices, oil and gas is a drag on overall construction spending.

In February, the estimated seasonally adjusted annual rate of public construction spending was $268.9 billion, 0.8 percent below the revised January estimate of $271.0 billion.

emphasis added

As an example, construction spending for lodging is up 10% year-over-year, whereas spending for power (includes oil and gas) construction peaked in mid-2014 and is down 17% year-over-year.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending dipped a little last year, but is increasing again.

Non-residential spending is 16% below the peak in January 2008.

Public construction spending is now 17% below the peak in March 2009 and about 3% above the post-recession low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 2%. Non-residential spending is up 6% year-over-year. Public spending is up 3% year-over-year.

Looking forward, all categories of construction spending should increase in 2015. Residential spending is still very low, non-residential is starting to pickup (except oil and gas), and public spending has probably hit bottom after several years of austerity.

This was below the consensus forecast of a 0.2% increase, and spending for January was revised down (December was revised up).

ISM Manufacturing index declined to 51.5 in March

by Calculated Risk on 4/01/2015 10:04:00 AM

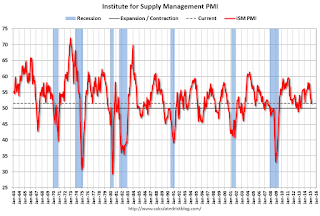

The ISM manufacturing index suggests slower expansion in March than in February. The PMI was at 51.5% in March, down from 52.9% in February. The employment index was at 50.0%, down from 51.4% in February, and the new orders index was at 51.8%, down from 52.5%.

From the Institute for Supply Management: March 2015 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in March for the 27th consecutive month, and the overall economy grew for the 70th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.On that last sentence - the good news is the West Cost port slowdown has been resolved, although it will take a few months to catch up.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The March PMI® registered 51.5 percent, a decrease of 1.4 percentage points from February’s reading of 52.9 percent. The New Orders Index registered 51.8 percent, a decrease of 0.7 percentage point from the reading of 52.5 percent in February. The Production Index registered 53.8 percent, 0.1 percentage point above the February reading of 53.7 percent. The Employment Index registered 50 percent, 1.4 percentage points below the February reading of 51.4 percent, reflecting unchanged employment levels from February. Inventories of raw materials registered 51.5 percent, a decrease of 1 percentage point from the February reading of 52.5 percent. The Prices Index registered 39 percent, 4 percentage points above the February reading of 35 percent, indicating lower raw materials prices for the fifth consecutive month. Comments from the panel refer to continuing challenges from the West Coast port issue, lower oil prices having both positive and negative impacts depending upon the industry, residual effects of the harsh winter, higher costs of healthcare premiums, and challenges associated with the stronger dollar on international business."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 52.5%, but still indicates expansion in March.

Reis: Office Vacancy Rate declined in Q1 to 16.6%

by Calculated Risk on 4/01/2015 08:59:00 AM

Reis released their Q1 2015 Office Vacancy survey this morning. Reis reported that the office vacancy rate declined in Q1 to 16.6% from 16.7% in Q4 2014. This is down from 16.9% in Q1 2014, and down from the cycle peak of 17.6%.

From Reis:

The national vacancy rate declined by 10 basis points during the quarter to 16.6%, its lowest level since the third quarter of 2009. Although the vacancy decline was just 10 basis points, this is the third consecutive quarter with a vacancy decline, another sign of more consistent improvement from the office market.

...

With net absorption continuing to outpace construction by a wide enough margin, vacancy rate declines are now becoming more consistent, emblematic of a strengthening office market. As office leases that were signed at the bottom of the market expire over the next couple of years, many tenants will find their current space insufficient and will sign larger leases.

...

Asking and effective rents grew by 0.9% and 1.0%, respectively, during the first quarter, marking the eighteenth consecutive quarter of asking and effective rent growth. Superficially, this is a slight decrease from last quarter when both metrics increased by 1.1%. However, this is still strong performance from a market still grappling with a high vacancy rate.

...

[W]e continue to expect that the national vacancy rate will fall by roughly 50 basis points in 2015 while effective rents grow by approximately 3.6%. That would be a solid showing for an office market that is still in recovery mode.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.6% in Q1.

Net absorption is picking up, but there will not be a significant pickup in new construction until the vacancy rate falls much further.

Office vacancy data courtesy of Reis.

ADP: Private Employment increased 189,000 in March

by Calculated Risk on 4/01/2015 08:21:00 AM

Private sector employment increased by 189,000 jobs from February to March according to the March ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 225,000 private sector jobs added in the ADP report.

...

Goods-producing employment rose by only 5,000 jobs in March, down from 22,000 jobs gained in February. The construction industry added 17,000 jobs, down from 28,000 last month. Meanwhile, manufacturing lost 1,000 jobs in March, after adding 2,000 in February.

Service-providing employment rose by 184,000 jobs in March, down from 192,000 in February. ...

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth took a step back in March. The fallout from the collapse in oil prices and surge in value of the dollar is hitting the job market. Despite the slowdown, underlying job growth remains strong enough to reduce labor market slack.”

The BLS report for March will be released on Friday and the consensus is for 247,000 non-farm payroll jobs added in March.

MBA: Mortgage Applications Increase, Purchase Applications Up 8% YoY

by Calculated Risk on 4/01/2015 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 27, 2015. ...

The Refinance Index increased 4 percent from the previous week. The seasonally adjusted Purchase Index increased 6 percent from one week earlier. ... The unadjusted Purchase Index ... was 8 percent higher than the same week one year ago.

...

“There was a broad based increase in mortgage applications last week relative to the week prior. The increase in purchase volume was led by a nearly 6 percent increase in both conventional and government markets, perhaps signaling that households are finally ready to begin the home-buying season,” said Lynn Fisher, MBA’s Vice President of Research and Economics.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.89 percent from 3.90 percent, with points decreasing to 0.36 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

2015 will probably see a little more refinance activity than in 2014, but not a large refinance boom.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 8% higher than a year ago.