by Calculated Risk on 4/30/2015 09:09:00 AM

Thursday, April 30, 2015

Employment Cost Index increases 0.7% in Q1, Up 2.6% YoY

Note: On a monthly basis, the focus is on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") employment report.

There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation. All three data series are different.

Here is the Q1 ECI from the BLS: EMPLOYMENT COST INDEX - MARCH 2015

Compensation costs for civilian workers increased 0.7 percent, seasonally adjusted, for the 3-month period ending March 2015, the U.S. Bureau of Labor Statistics reported today. Wages and salaries (which make up about 70 percent of compensation costs) increased 0.7 percent, and benefits (which make up the remaining 30 percent of compensation) increased 0.6 percent.

Compensation costs for civilian workers increased 2.6 percent for the 12-month period ending March 2015, rising from the March 2014 increase in compensation costs of 1.8 percent. Wages and salaries increased 2.6 percent for the 12-month period ending March 2015, which was higher than the 1.6-percent increase in March 2014. Benefit costs increased 2.7 percent for the 12-month period ending March 2015, compared with a 2.1-percent increase for the 12-month period ending March 2014.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in Total Compensation and Wages and Salaries using the quarterly wage data from the Employment Cost Index. Both increased 2.6 year-over-year in Q1 and suggest compensation is increasing.

Weekly Initial Unemployment Claims decreased to 262,000, Lowest since April 2000

by Calculated Risk on 4/30/2015 08:30:00 AM

The DOL reported:

In the week ending April 25, the advance figure for seasonally adjusted initial claims was 262,000, a decrease of 34,000 from the previous week's revised level. This is the lowest level for initial claims since April 15, 2000 when it was 259,000. The previous week's level was revised up by 1,000 from 295,000 to 296,000. The 4-week moving average was 283,750, a decrease of 1,250 from the previous week's revised average. The previous week's average was revised up by 500 from 284,500 to 285,000.The previous week was revised up 1,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 283,750.

This was well below the consensus forecast of 290,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, April 29, 2015

Brief comments on the FOMC Statement and ECI

by Calculated Risk on 4/29/2015 06:39:00 PM

For the first time in probably 10 years, I had a personal time conflict at the time of the FOMC statement release. Luckily I wasn't worried about a "surprise" ... but the next few meetings could be very interesting (I don't want to miss those releases)!

From Tim Duy: FOMC Snoozer

The FOMC concluded their meeting today, and the result left Fed watchers struggling to find something interesting to say. ...And on the Employment Cost Index tomorrow from Business Insider: DEUTSCHE BANK: 'Hold on to your chair...'

The FOMC statement provides little new information about the timing or pace of future rates hikes. Even if you believe, as I do, that the first quarter weakness will prove to be largely transitory, the Fed is not willing to take that chance. They will need better data to justify a rate hike, and that need is pushing the timing of a policy change ever-deeper into 2015. There just isn't that much data between now and June to move the needle on policy. You need the jobs and inflation data to turn sharply better to pull the Fed back to June. It could happen, but I am not confident it will happen.

Bottom Line: Wait and see - that's the message of this statement.

In an email blast with the subject line "Hold on to your chair," Deutsche Bank's Torsten Slok warns Thursday's report could once again be a catalyst for volatility as it could have implications for monetary policy, in particular the timing of the Federal Reserve's first interest rate hike.CR Note: I don't think this ranks as "hold on to your chair", but a consensus reading might be a sign that wages are picking up a little.

"Because of year-over-year base effects we could see a solid uptrend in wages," Slok wrote. "This kind of increase would have to make the Fed feel better about its inflation forecast, and recall that Chair Yellen has said that rising wage and price inflation is not a precondition for liftoff."

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 290 thousand from 295 thousand.

• Also at 8:30 AM, Personal Income and Outlays for March. The consensus is for a 0.2% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• Also at 8:30 AM, the Q1 Employment Cost Index. The consensus is for a 0.6% increase in this index.

• At 9:45 AM, Chicago Purchasing Managers Index for April. The consensus is for a reading of 50.0, up from 46.3 in March.

FOMC Statement: Slowdown "in part reflecting transitory factors"

by Calculated Risk on 4/29/2015 03:17:00 PM

I was out, but no surprises.

FOMC Statement:

Information received since the Federal Open Market Committee met in March suggests that economic growth slowed during the winter months, in part reflecting transitory factors. The pace of job gains moderated, and the unemployment rate remained steady. A range of labor market indicators suggests that underutilization of labor resources was little changed. Growth in household spending declined; households' real incomes rose strongly, partly reflecting earlier declines in energy prices, and consumer sentiment remains high. Business fixed investment softened, the recovery in the housing sector remained slow, and exports declined. Inflation continued to run below the Committee's longer-run objective, partly reflecting earlier declines in energy prices and decreasing prices of non-energy imports. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. Although growth in output and employment slowed during the first quarter, the Committee continues to expect that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate. The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced. Inflation is anticipated to remain near its recent low level in the near term, but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of declines in energy and import prices dissipate. The Committee continues to monitor inflation developments closely.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Jeffrey M. Lacker; Dennis P. Lockhart; Jerome H. Powell; Daniel K. Tarullo; and John C. Williams.

Q1 GDP: Investment

by Calculated Risk on 4/29/2015 11:59:00 AM

Note: I'll probably be late to the FOMC analysis party today. No change in policy is expected. Here is the link for the statement at 2:00 PM ET.

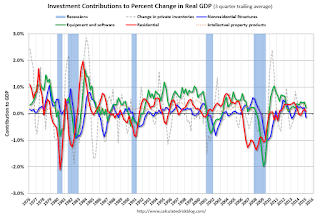

The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Note: This can't be used blindly. Residential investment is so low as a percent of the economy that the small decline early last year was not a concern.

Residential investment (RI) increased at a 1.3% annual rate in Q1. Equipment investment increased at a 0.1% annual rate, and investment in non-residential structures decreased at a 23.1% annual rate. On a 3 quarter trailing average basis, RI is slightly positive (red), equipment is a slower positive (green), and nonresidential structures are down (blue).

Note: Nonresidential investment in structures typically lags the recovery, however investment in energy and power provided a boost early in this recovery - and is now causing a decline.

I expect investment to be solid going forward (except for energy and power), and for the economy to grow at a decent pace for the remained of 2015.

The second graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP has been increasing, but it still below the levels of previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

I'll add details for investment in offices, malls and hotels after the supplemental data is released.