by Calculated Risk on 5/06/2015 08:19:00 AM

Wednesday, May 06, 2015

ADP: Private Employment increased 169,000 in April

Private sector employment increased by 169,000 jobs from March to April according to the March ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 205,000 private sector jobs added in the ADP report.

...

Goods-producing employment declined by 1,000 jobs in April, down from 3,000 jobs gained in March. The construction industry added 23,000 jobs, up from 21,000 last month. Meanwhile, manufacturing lost 10,000 jobs in April, after losing 3,000 in March.

Service-providing employment rose by 170,000 jobs in April, down slightly from 172,000 in March. The ADP National Employment Report indicates that professional/business services contributed 34,000 jobs in April, up from March’s 28,000. Expansion in trade/transportation/utilities grew by 44,000, up from March’s 41,000. The 7,000 new jobs added in financial activities is a drop from last month’s 12,000.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “Fallout from the collapse of oil prices and the surging value of the dollar are weighing on job creation. Employment in the energy sector and manufacturing is declining. However, this should prove temporary and job growth will reaccelerate this summer."

The BLS report for April will be released on Friday and the consensus is for 220,000 non-farm payroll jobs added in April.

MBA: Mortgage Purchase Applications increase, Refinance Applications in Latest Weekly Survey

by Calculated Risk on 5/06/2015 07:01:00 AM

From the MBA: Mortgage Applications Decrease 4.6 % in Latest MBA Weekly Survey

Mortgage applications decreased 4.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 1, 2015. ...

The Refinance Index decreased 8 percent from the previous week to the lowest level since January 2015. The seasonally adjusted Purchase Index increased 1 percent from one week earlier to its highest level since June 2013. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 12 percent higher than the same week one year ago.

...

“Refinance volume dropped last week as rates in the US increased sharply towards the end of the week, with signs of recovery in Europe lifting rates across the globe. Purchase activity increased slightly over the week, and the average loan amount for a purchase application reached a record high, a sign that the mix of purchase activity is still skewed toward higher priced homes,” said Mike Fratantoni, MBA’s Chief Economist.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.93 percent from 3.85 percent, with points remaining unchanged from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

It would take much lower rates - below 3.5% - to see a significant refinance boom this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 12% higher than a year ago.

Tuesday, May 05, 2015

Mortgage News Daily: Mortgage Rates Near 2015 Highs, Several major Lenders at 4%

by Calculated Risk on 5/05/2015 05:56:00 PM

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 205,000 payroll jobs added in April, up from 189,000 in March.

• At 9:15 AM, Speech by Fed Chair Janet Yellen, Finance and Society, At the Institute for New Economic Thinking Conference on Finance and Society, Washington, D.C

From Matthew Graham at Mortgage News Daily: Mortgage Rates Dangerously Close to 2015 Highs

In terms of conventional 30yr fixed rate quotes, several major lenders are now up to 4.0%, even for top tier scenarios, though many remain at 3.875%. Just one short week ago, 3.625% was widely available.Here is a table from Mortgage News Daily:

In the broader context, there has only been one day in 2015 where rates were any higher. Before that, you'd need to go back to November to see higher rates.

Final Update: Recovery Measures

by Calculated Risk on 5/05/2015 03:17:00 PM

I posted these graphs regularly during the recession and recovery.

Here is a final update (until the next recession) to four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

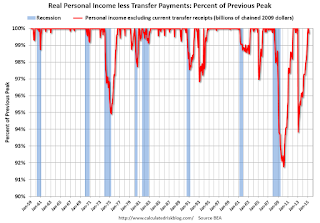

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

All four of the indicators are above pre-recession levels (GDP and Personal Income less Transfer Payments, Industrial Production, and employment).

The first graph is for real GDP through Q1 2015.

Real GDP returned to the pre-recession peak in Q3 2011, and is at a new post-recession high (although Q1 2015 GDP might be revised down).

At the worst point - in Q2 2009 - real GDP was off 4.2% from the 2007 peak.

This indicator was off 8.3% at the worst point.

Real personal income less transfer payments reached the pre-recession peak in January 2012. Then real personal income less transfer payments increased sharply in December 2012 due to a one time surge in income as some high income earners accelerated earnings to avoid higher taxes in 2013. This is why there is a second dip in this indicator in 2013.

Real personal income less transfer payments are now above the pre-recession peak - and above the December 2012 surge.

Industrial production was off 16.9% at the trough in June 2009.

There has been a little weakness recently (mostly related to oil and gas), and now industrial production is 4.4% above the pre-recession peak.

The final graph is for employment through March 2015.

Payroll employment is now 2.0% above the pre-recession peak.

CoreLogic: House Prices up 5.9% Year-over-year in March

by Calculated Risk on 5/05/2015 11:59:00 AM

Notes: This CoreLogic House Price Index report is for March. The recent Case-Shiller index release was for February. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports National Homes Prices Rose by 5.6 Percent Year Over Year in February 2015

CoreLogic® ... today released its March 2015 CoreLogic Home Price Index (HPI®) which shows that home prices nationwide, including distressed sales, increased by 5.9 percent in March 2015 compared with March 2014. This change represents 37 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased by 2 percent in March 2015 compared with February 2015.

Including distressed sales in March, 27 states plus the District of Columbia were at or within 10 percent of their peak prices. Seven states, including Colorado, Nebraska, New York, Oklahoma, Tennessee, Texas and Wyoming, reached new home price highs since January 1976 when the CoreLogic HPI started.

Excluding distressed sales, home prices increased by 6.1 percent in March 2015 compared with March 2014 and increased by 2 percent month over month compared with February 2015. ...

“The homes for sale inventory continues to be limited while buyer demand has picked up with low mortgage rates and improving consumer confidence,” said Frank Nothaft, chief economist for CoreLogic. “As a result, there has been continued upward pressure on prices in most markets, with our national monthly index up 2 percent for March 2015 and up approximately 6 percent from a year ago.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 2.0% in March, and is up 5.9% over the last year.

This index is not seasonally adjusted, and this was a solid month-to-month increase.

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty seven consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty seven consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).The YoY increase had mostly moved sideways over the last eight months, but might be increasing a little faster now.