by Calculated Risk on 5/07/2015 10:31:00 AM

Thursday, May 07, 2015

Las Vegas Real Estate in April: Sales Increased 5.1% YoY

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports local housing market seeing steady growth this spring

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in April was 3,379, up from 3,358 in March and up from 3,215 one year ago. Compared to the previous month, GLVAR reported that sales were up 1.7 percent for single-family homes, but down 3.8 percent for condos and townhomes. Compared to April 2014, 5.3 percent more homes and 4.3 percent more condos and townhomes sold this April.There are several key trends that we've been following:

...

GLVAR has been reporting fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. In April, 7.2 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 8.3 percent in March and from 12.4 percent one year ago. Another 8.3 percent of April sales were bank-owned, down from 9.3 percent in March and down from 11.4 percent last April.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in April was 13,750, up 1.6 percent from 13,532 in March, but down 0.6 percent from one year ago. GLVAR tracked a total of 3,626 condos, high-rise condos and townhomes listed for sale on its MLS in April, up 0.4 percent from 3,613 in March, but down 1.9 percent from one year ago.

By the end of April, GLVAR reported 7,296 single-family homes listed without any sort of offer. That’s up 0.5 percent from March and up 13.6 percent from one year ago. For condos and townhomes, the 2,437 properties listed without offers in April represented a 0.3 percent decrease from March and a 7.6 percent increase from one year ago.

emphasis added

1) Overall sales were up 5.1% year-over-year.

2) Conventional(equity, not distressed) sales were up 16.5% year-over-year. In April 2014, only 76.2% of all sales were conventional equity. In April 2015, 84.5% were standard equity sales. Note: In April 2013 (two years ago), only 57.5% were equity! A significant change.

3) The percent of cash sales has declined year-over-year from 41.4% in April 2014 to 30.4% in April 2015. (investor buying appears to be declining).

4) Non-contingent inventory is up 7.6% year-over-year. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build is slowing - but still ongoing.

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |

| Nov-14 | 20.0% |

| Dec-14 | 18.0% |

| Jan-15 | 12.9% |

| Feb-15 | 15.8% |

| Mar-15 | 12.2% |

| Apr-15 | 7.6% |

Weekly Initial Unemployment Claims increased to 265,000, Lowest 4-Week average in 15 years

by Calculated Risk on 5/07/2015 08:30:00 AM

The DOL reported:

In the week ending May 2, the advance figure for seasonally adjusted initial claims was 265,000, an increase of 3,000 from the previous week's unrevised level of 262,000. The 4-week moving average was 279,500, a decrease of 4,250 from the previous week's unrevised average of 283,750. This is the lowest level for this average since May 6, 2000 when it was 279,250.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 279,500.

This was well below the consensus forecast of 285,000, and the low level of the 4-week average suggests few layoffs. This is the lowest 4-week average in 15 years (since May 2000).

Wednesday, May 06, 2015

Demographics are Now Improving

by Calculated Risk on 5/06/2015 06:46:00 PM

The Financial Times blogs has a blog post about the demographic impact on the U.S. economy: The US economy’s demographic dividend is fast turning into a deficit. A few excerpts.

Demographic change is creating major headwinds for the US economy ... One key factor is that there are more older people than ever before, due to a combination of the ageing of the US baby boomer generation (those born between 1946 and 1964) and increasing life expectancy. Older people tend to spend less, as they already own most of what they need and their incomes decline as they enter retirement.If this post had been written a decade ago, it would make more sense.

Equally important is the collapse that has occurred in US fertility rates since the peak of the baby boom. These have nearly halved from the 3.33 babies/woman level of the mid-1950s to just 1.97 babies/woman today, below the level required to replace the population. As a result, the size of the 25-54 age group, historically the main wealth creators, has plateaued in the US.

Last year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group, Decline in the Labor Force Participation Rate: Mostly Demographics and Long Term Trends, and The Future's so Bright ...

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through March 2015.

Click on graph for larger image.

Click on graph for larger image.There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The prime working age population peaked in 2007, and appears to have bottomed at the end of 2012. The good news is the prime working age group has started to grow again, and should be growing solidly by 2020 - and this should boost economic activity in the years ahead.

Demographics are improving in the U.S.!

MBA: Mortgage Delinquency and Foreclosure Rates Decrease in Q1, Lowest since Q2 2007

by Calculated Risk on 5/06/2015 02:47:00 PM

Earlier from the MBA: Mortgage Delinquencies and Foreclosures Fall in First Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 5.54 percent of all loans outstanding at the end of the first quarter of 2015. This was the lowest level since the second quarter of 2007. The delinquency rate decreased 14 basis points from the previous quarter, and 57 basis points from one year ago, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 2.22 percent, down five basis points from the fourth quarter of 2014 and 43 basis points lower than the same quarter one year ago. This was the lowest foreclosure inventory rate since the fourth quarter of 2007.

...

"Delinquency rates and the percentage of loans in foreclosure continued to fall in the first quarter and are now at their lowest levels since 2007," said Joel Kan, MBA's Associate Vice President of Industry Surveys and Forecasting. "The job market continues to grow, and this is the most important fundamental improving mortgage performance. Additionally, home prices continued to rise, as did the pace of sales, thus increasing equity levels and enabling struggling borrowers to sell if needed."

"The foreclosure inventory rate has decreased in the last twelve quarters, and now is at the lowest level since the fourth quarter of 2007. The rate, at 2.22 percent, was about half of where it was at its peak in 2010. With a declining 90+ day delinquency rate and the improving credit quality of new loans, we expect that the foreclosure inventory rate will continue to decline in coming quarters. Foreclosure starts decreased one basis point from the previous quarter, and continue to fluctuate from quarter to quarter mainly due to state-level differences in the speed of the foreclosure process. At 0.45 percent, the level of foreclosure starts is at its long run average.

...

Around 40 percent of loans serviced are in judicial states and these states continue to have a foreclosure inventory rate that is well above that of non-judicial states. For states where the judicial process is more frequently used, 3.64 percent of loans serviced were in the foreclosure process, compared to 1.22 percent in non-judicial states. States that utilize both judicial and non-judicial foreclosure processes had a foreclosure inventory rate closer that of to the non-judicial states at 1.43 percent.

...

"Legacy loans continue to account for the majority of all troubled mortgages. Within loans that were seriously delinquent (either more than 90 days delinquent or in the foreclosure process), 73 percent of those loans were originated in 2007 or earlier, even as the overall rate of serious delinquencies for those cohorts decreases. More recent loan vintages, specifically loans originated in 2012 and later, continue to exhibit low serious delinquency rates."

emphasis added

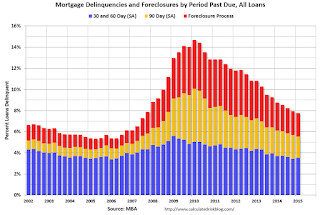

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

The percent of loans 30 and 60 days delinquent are back to normal levels.

The 90 day bucket peaked in Q1 2010, and is about 75% of the way back to normal.

The percent of loans in the foreclosure process also peaked in 2010 and and is about 70% of the way back to normal.

So it has taken about 5 years to reduce the backlog of seriously delinquent and in-foreclosure loans by over 70%, so a rough guess is that serious delinquencies and foreclosure inventory will be back to normal near the end of 2016 (although progress has slowed). Most other mortgage measures are already back to normal, but the lenders are still working through the backlog of bubble legacy loans.

Preview: Employment Report for April

by Calculated Risk on 5/06/2015 11:45:00 AM

Friday at 8:30 AM ET, the BLS will release the employment report for April. The consensus, according to Bloomberg, is for an increase of 220,000 non-farm payroll jobs in April (with a range of estimates between 180,000 and 335,000), and for the unemployment rate to decline to 5.4%.

The BLS reported 126,000 jobs added in March.

Here is a summary of recent data:

• The ADP employment report showed an increase of 169,000 private sector payroll jobs in April. This was below expectations of 205,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month (see table at bottom), but in general, this suggests employment growth below expectations.

• The ISM manufacturing employment index decreased in April to 48.3%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 30,000 in April. The ADP report indicated a 10,000 decrease for manufacturing jobs.

The ISM non-manufacturing employment index increased in April to 56.7%. A historical correlation (linear) between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 250,000 in April.

Combined, the ISM indexes suggests employment gains of 220,000. This suggests employment growth at expectations.

• Initial weekly unemployment claims averaged close to 283,000 in April, down slightly from March. For the BLS reference week (includes the 12th of the month), initial claims were at 296,000; this was up slightly from 293,000 during the reference week in March.

Generally this suggests about the same low level of layoffs in April as for the previous eight months (employment gains averaged 253,000 per month over that period).

• The final April University of Michigan consumer sentiment index increased to 95.9 from the March reading of 93.0. Sentiment is frequently coincident with changes in the labor market, but there are other factors too - like gasoline prices.

• On small business hiring: The small business index from Intuit showed a 15,000 increase in small business employment in April, the same strong level as in March.

• Trim Tabs reported that the U.S. economy added 327,000 jobs in April. This is up from their estimate of 268,000 last month. "TrimTabs’ employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from the paychecks of the 140 million U.S. workers subject to withholding" .

• Conclusion: Below is a table showing several employment indicators and the initial BLS report (the first column is the revised employment). Two key points:

1) Unfortunately none of the indicators below is very good at predicting the initial BLS employment report.

2) In general it looks like this should be another 200+ month (based on ISM, unemployment claims, and small business hiring).

There is always some randomness to the employment report. My guess is something close to the consensus this month.

| Employment Indicators (000s) | ||||||

|---|---|---|---|---|---|---|

| BLS Revised | BLS Initial | ADP Initial | ISM | Weekly Claims Reference Week1 | Intuit Small Business | |

| Jan 2014 | 166 | 113 | 175 | 236 | 329 | 10 |

| Feb 2014 | 188 | 175 | 139 | -6 | 334 | 0 |

| Mar 2014 | 225 | 192 | 191 | 153 | 323 | 0 |

| Apr 2014 | 330 | 288 | 220 | NA | 320 | 25 |

| May 2014 | 236 | 217 | 179 | 130 | 327 | 35 |

| Jun 2014 | 286 | 288 | 281 | NA | 314 | 20 |

| Jul 2104 | 249 | 209 | 218 | NA | 303 | 15 |

| Aug 2014 | 213 | 142 | 204 | 285 | 299 | 0 |

| Sep 2014 | 250 | 248 | 213 | NA | 281 | 10 |

| Oct 2014 | 221 | 214 | 230 | 340 | 284 | 15 |

| Nov 2014 | 423 | 321 | 208 | 260 | 292 | 30 |

| Dec 2014 | 329 | 252 | 241 | 252 | 289 | 30 |

| Jan 2015 | 201 | 257 | 213 | 115 | 308 | 20 |

| Feb 2015 | 264 | 295 | 212 | 235 | 282 | 10 |

| Mar 2015 | 126 | 189 | NA | 293 | 15 | |

| Apr 2015 | Friday | 169 | 220 | 296 | 15 | |

| 1Lower is better for Unemployment Claims | ||||||