by Calculated Risk on 5/12/2015 10:09:00 AM

Tuesday, May 12, 2015

BLS: Jobs Openings at 5.0 million in March, Up 19% Year-over-year

From the BLS: Job Openings and Labor Turnover Summary

There were 5.0 million job openings on the last business day of March, little changed from 5.1 million in February, the U.S. Bureau of Labor Statistics reported today. Hires were little changed at 5.1 million in March and separations were little changed at 5.0 million....The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... There were 2.8 million quits in March, little changed from February.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for March, the most recent employment report was for April.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in March to 4.994 million from 5.144 million in February.

The number of job openings (yellow) are up 19% year-over-year compared to March 2014.

Quits are up 14% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another solid report. It is a good sign that job openings are around 5 million, and that quits are increasing solidly year-over-year.

NFIB: Small Business Optimism Index increased in April

by Calculated Risk on 5/12/2015 09:06:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Rises, But Future Sales Cloud Outlook

The Small Business Optimism Index increased 1.7 points from March to 96.9, this in spite of a quarter of virtually no economic growth. Unfortunately, the Index remained below the January reading. Nine of the 10 Index components gained, only real sales expectations were weaker. But this still leaves the Index below its historical average, oscillating between 95 and 98 but never breaking out except for December, when the Index just tipped past 100, only to fall again.More good news: Only 11 percent of companies reported "poor sales" as the most important problem, down from 16% a year ago, and a recession high of 34%.

...

Small businesses posted another decent month of job creation. Those that hired were more aggressive than those reducing employment, producing an average increase of 0.14 workers per firm, continuing a string of solid readings for 2015. ... Twenty-seven percent of all owners reported job openings they could not fill in the current period, up 3 points from March. A net 11 percent plan to create new jobs, up 1 point and a solid reading.

emphasis added

Click on graph for larger image.

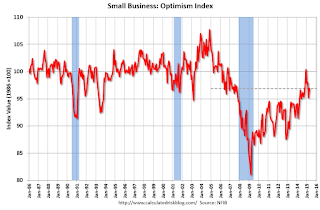

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 96.9 in April from 95.2 in March.

Monday, May 11, 2015

Tuesday: Job Openings, Q1 Household Debt and Credit Report

by Calculated Risk on 5/11/2015 09:27:00 PM

A couple of posts on consumers ...

From Professor Hamilton at Econbrowser: Energy prices and consumer spending

Whatever the explanation, the facts seem to be that, unlike what we usually observed historically, consumers have been using much of the gains from lower energy prices to bolster their saving rather than using it to increase spending on other goods and services.And from Dr. Altig at Macroblog: All Eyes on the Consumer

... the "fundamentals" suggest the four-month annualized growth of consumer spending should have been in excess of 4 percent, as opposed to the approximately 1.5 percent we actually saw. That is a story we don't expect to persist, and our current view of the year is that first-quarter consumer spending results are not indicative of future performance.My sense is the increase in consumer spending will be larger in Q2.

Consumers are, of course, a forward-looking bunch, and it is possible the recent weak spending reflects a looming reality not captured by the simple model described above. But our forecast for now is that consumers will move to the fundamentals, and not vice versa.

Tuesday:

• At 9:00 AM ET, NFIB Small Business Optimism Index for April.

• At 10:00 AM, the Job Openings and Labor Turnover Survey for March from the BLS. Jobs openings increased in February to 5.133 million from 4.965 million in January. This was the highest level for job openings since January 2001. The number of job openings (yellow) were up 23% year-over-year, and Quits were up 10% year-over-year.

• At 11:00 AM, the The New York Fed will release their Q1 2015 Household Debt and Credit Report

Research: Natural Rate of Unemployment under 5% and Falling

by Calculated Risk on 5/11/2015 05:32:00 PM

From the Chicago Fed: Changing labor force composition and the natural rate of unemployment Excerpts:

We estimate our baseline natural rate of unemployment as of 2014:Q4 to be 4.9% —0.5 percentage points lower than the CBO’s estimate of the short-run natural rate. We project this rate to fall by about 0.06 percentage points per year through the end of the decade, reaching 4.5% at the end of 2020—0.7 percentage points below the CBO’s estimate.

Two broad assumptions underlie these simple calculations. First, demographics and educational attainment are fundamental determinants of unemployment, and thus, changes in them over time should drive overall levels of aggregate unemployment. Second, the unemployment rate was at its natural rate in late 2005. Both of these assumptions seem plausible, but neither is completely unassailable. ...

...

While great progress has been made over the past few years, significant labor market slack remains. We estimate the natural rate at or below 5%, at least half of a percentage point below its actual level as of March 2015. This estimate of slack, in combination with labor market measures such as LFP and involuntary part-time workers, may help explain why wage inflation and price inflation remain so low. Moreover, we estimate that absent major new developments, demographic and educational changes will persist, potentially reducing the trend unemployment rate to around 4.4% to 4.8% by 2020.

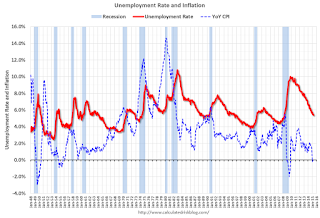

Demographics, Unemployment Rate and Inflation

by Calculated Risk on 5/11/2015 03:19:00 PM

It wasn't long ago that several FOMC members were arguing inflation would pick up when the unemployment rate declined to 6%. They were wrong with the unemployment rate now at 5.4%. I think they were looking at the '70s and ignoring the demographic differences.

The first graph shows the year-over-year change in the prime working age population (25 to 54 years old) with projections for the next 25 years.

If there is a demographic component to inflation, then we would have expected inflation to increase in the '70s, and be very low now.

Note: Ignore the steps up and down - the data was affected by changes in population controls.

The dashed red line is based on Census Bureau projections through 2040.

A key is the prime working age population was declining in the early part of this decade and has only started increasing again recently.

This is very similar to what happened in the '60s. In the early '60s, there was a slow increase in the prime working age population until the baby boomers started pouring into the labor force.

Now the prime working age population is growing again, and we can expect growth to pick up over the next decade. However there will not be as large in increase in the prime working age labor force like in the '70s and '80s.

In the 1960s, inflation didn't pickup until the unemployment rate had fallen close to 4% - and when the early baby boomers started entering the labor force.

The current period is similar to the '60s (although there won't be as large a group entering the labor force). And the current period - from a demographics perspective - is very different from the '70s and '80s.

Ignoring for the moment monetary and fiscal policy differences between the '60s and now, demographics suggests that the unemployment rate will have to fall below 5% before inflation picks up.