by Calculated Risk on 5/21/2015 01:33:00 PM

Thursday, May 21, 2015

Lawler: Existing Home Sales Dipped in April; Sales in South Seem Low

From housing economist Tom Lawler:

The National Association of Realtors reported that US existing home sales ran at an estimated seasonally adjusted annual rate of 5.04 million in April, down 3.3% from March’s upwardly-revised pace and up 6.1% from last March’s seasonally adjusted pace. The NAR’s estimate was below both my projection based on regional tracking and the “consensus” forecast. Relative to March, April sales (seasonally adjusted) were up 1.7% in the Midwest, but down 1.7% in the West, down 3.3% in the Northeast, and down a sizable 6.8% in the South.

In terms of my tracking, my “miss” was almost entirely in the South. According to the NAR’s estimates, existing home sales in the South last month (not seasonally adjusted) were up just 2.9% from last April, which seems way too low based on realtor/MLS reports from the South. For example, MLS-based reports show that home sales registered double-digit YOY gains in the broad Mid-Atlantic region (mainly most of Maryland, DC and Northern Virginia), Florida, Georgia, South Carolina, Alabama, and much of Kentucky and Arkansas (my coverage in those states is limited). MLS-based reports in most other states suggest YOY sales gains in the 5% (e.g., Texas) to 9% (e.g., North Carolina) range. To be sure, some areas in the region saw YOY declines in sales (e.g., Oklahoma at -2%, and Jackson, Mississippi at -13%). But for the region as a whole, local realtor/MLS reports would have suggested YOY sales growth for the region as a whole well above 2.9%.

Often when my projection for the NAR sales number is off, it turns out that realtor/MLS reports released subsequent to my projection (e.g., today) show significantly different sales numbers than I had had been assuming. That was not the case this month. Based on local realtor/MLS reports released through today (which included quite a few, including Florida and Texas), the NAR’s estimate for existing home sales in the South for April look way too low. The NAR’s estimates for the other regions, in contrast, look reasonable.

The NAR also reported that its preliminary estimate of the number of existing homes for sale at the end of April was 2.21 million, down 10.0% from March’s upwardly-revised (to 2.10 million from 2.00 million) level, and down 0.9% from last April’s level. This inventory number was just slightly below my projection.

Finally, the NAR estimated that the median existing SF home sales price in April, $221,200, up 10.0% from last April, and well above my projection based on regional tracking. The YOY % change in the median existing SF home sales price for March was revised downward to 7.9% from 8.7%.

A Few Comments on April Existing Home Sales

by Calculated Risk on 5/21/2015 11:37:00 AM

Inventory is still very low (and down 0.9% year-over-year in April). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases. This will be important to watch over the next few months during the Spring buying season.

Also, the NAR reported total sales were up 6.1% from April 2014, however normal equity sales were up even more, and distressed sales down sharply. From the NAR (from a survey that is far from perfect):

Distressed sales — foreclosures and short sales — were 10 percent of sales in April, unchanged from March and below the 15 percent share a year ago. Seven percent of April sales were foreclosures and 3 percent were short sales.Last year in April the NAR reported that 15% of sales were distressed sales.

A rough estimate: Sales in April 2014 were reported at 4.75 million SAAR with 15% distressed. That gives 712 thousand distressed (annual rate), and 4.04 million equity / non-distressed. In April 2015, sales were 5.04 million SAAR, with 10% distressed. That gives 504 thousand distressed - a decline of about 29% from April 2014 - and 4.54 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up around 12%.

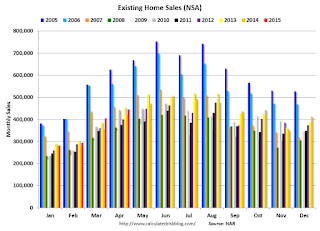

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in April (red column) were just below April 2013 (NSA).

Earlier:

• Existing Home Sales in April: 5.04 million SAAR, Inventory down 0.9% Year-over-year

Existing Home Sales in April: 5.04 million SAAR, Inventory down 0.9% Year-over-year

by Calculated Risk on 5/21/2015 10:10:00 AM

The NAR reports: Existing-Home Sales Lose Momentum in April

Total existing–home sales, which are completed transactions that include single–family homes, townhomes, condominiums and co–ops, declined 3.3 percent to a seasonally adjusted annual rate of 5.04 million in April from an upwardly revised 5.21 million in March. Despite the monthly decline, sales have increased year–over–year for seven consecutive months and are still 6.1 percent above a year ago. ...

Total housing inventory at the end of April increased 10.0 percent to 2.21 million existing homes available for sale, but is still 0.9 percent below a year ago (2.23 million). Unsold inventory is at a 5.3–month supply at the current sales pace, up from 4.6 months in March.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April (5.04 million SAAR) were 3.3% lower than last month, and were 6.1% above the April 2014 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.21 million in April from 2.01 million in March. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 2.21 million in April from 2.01 million in March. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 0.9% year-over-year in April compared to April 2014.

Inventory decreased 0.9% year-over-year in April compared to April 2014. Months of supply was at 5.3 months in April.

This was below expectations of sales of 5.20 million. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Weekly Initial Unemployment Claims increased to 274,000, Lowest 4-Week average in 15 years

by Calculated Risk on 5/21/2015 08:35:00 AM

The DOL reported:

In the week ending May 16, the advance figure for seasonally adjusted initial claims was 274,000, an increase of 10,000 from the previous week's unrevised level of 264,000. The 4-week moving average was 266,250, a decrease of 5,500 from the previous week's unrevised average of 271,750. This is the lowest level for this average since April 15, 2000 when it was 266,250.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 266,250.

This was above the consensus forecast of 270,000, and the low level of the 4-week average suggests few layoffs. This is the lowest 4-week average in 15 years (since April 2000).

Note: If the 4-week average falls to 266,000, it will be the lowest in 40 years!

Wednesday, May 20, 2015

Thursday: Existing Home Sales, Unemployment Claims and More

by Calculated Risk on 5/20/2015 07:27:00 PM

From Jon Hilsenrath at the WSJ: Fed Looks Past June for First Rate Hike

Federal Reserve officials at their April policy meeting said in the most explicit terms yet that they are unlikely to start raising short-term interest rates in June, as seemed possible when 2015 began.Thursday:

Officials have been saying they won’t begin lifting their benchmark federal funds rate from near zero until they see more improvement in the labor market and are confident inflation will rise toward their 2% target. Several of them started the year thinking they might reach that point by midyear.

But by last month, after watching the economy stumble through the winter, many at the April 28-29 meeting were doubtful those criteria for a rate increase would be met, according to minutes of the meeting released Wednesday.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 270 thousand from 264 thousand.

• Also at 8:30 AM, the Chicago Fed National Activity Index for April. This is a composite index of other data.

• At 10:00 AM, the Philly Fed manufacturing survey for May. The consensus is for a reading of 8.0, up from 7.5 last month (above zero indicates expansion).

• At 10:00 AM, Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for sales of 5.22 million on seasonally adjusted annual rate (SAAR) basis. Sales in March were at a 5.19 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.20 million SAAR.

• At 11:00 AM, the Kansas City Fed manufacturing survey for May.

• At 1:30 PM, Speech by Fed Vice Chairman Stanley Fischer, Past, Present, and Future Challenges for the Euro Area, At the ECB Forum on Central Banking, Linho Sintra, Portugal