by Calculated Risk on 8/03/2010 11:00:00 AM

Tuesday, August 03, 2010

General Motors: Sales up sharply compared to July 2009

From General Motors: Chevrolet-Buick-GMC-Cadillac Sales Up 25 Percent in July.

General July sales for Chevrolet, Buick, GMC and Cadillac increased by a combined 25 percent to 199,432 units.There was one more selling day in July 2010, so this increase is overstated a little. Note: this is just these brands too.

Note: in July 2009 U.S. light vehicle sales rose to 11.2 million (SAAR) from 9.7 million (SAAR) in June 2009. This increase was related to "Cash-for-clunkers". General Motors didn't emerge from bankruptcy until July 10, 2009, so GM will probably have the best year-over-year comparison of the major automakers.

I'll add reports from the other major auto companies as updates to this post.

Update 1: From MarketWatch: Ford U.S. July sales up 3.1% to 170,411 vehicles

Update 2: From MarketWatch: Chrysler U.S. July sales rise 5% to 93,313 units

Update 3: From MarketWatch: Toyota U.S. July sales fall 3.2% to 169,224 units

NOTE: Once all the reports are released, I'll post a graph of the estimated total July sales (SAAR: seasonally adjusted annual rate) - usually around 4 PM ET. Most estimates are for an increase to 11.6 to 11.8 million SAAR in July from the 11.1 million SAAR in June.

Pending Home fall to record series low in June

by Calculated Risk on 8/03/2010 10:02:00 AM

From the NAR: Pending Home Sales Ease in Post-Tax Credit Market

The Pending Home Sales Index, a forward-looking indicator, declined 2.6 percent to 75.7 based on contracts signed in June from an upwardly revised level of 77.7 in May [revised from 77.6], and is 18.6 percent below June 2009 when it was 93.0. The data reflects contracts and not closings, which normally occur with a lag time of one or two months.This decline was expected and suggests existing home sales - reported at closing - will fall sharply in July and probably a little further in August.

NAR chief economist Lawrence Yun says: “Over the short term, inventory will look high relative to home sales."

Yes, the months-of-supply will be in double digits, and that will put downward pressure on prices.

Note: This is a record low for this series that started in 2001.

Personal Income, Spending flat in June

by Calculated Risk on 8/03/2010 08:30:00 AM

From the BEA: Personal Income and Outlays, June 2010

Personal income increased $3.0 billion, or less than 0.1 percent ... Personal consumption expenditures (PCE) decreased $2.9 billion, or less than 0.1 percent.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.1 percent in June, compared with an increase of 0.2 percent in May.

...

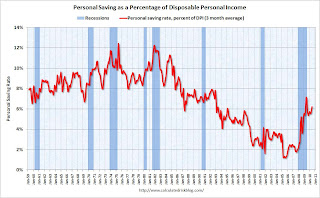

Personal saving as a percentage of disposable personal income was 6.4 percent in June

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the June Personal Income report. The saving rate increased to 6.4% in June (increased to 6.2% using a three month average).

I expect the saving rate to rise some more over the next year, perhaps to 8% or so - keeping the pace of PCE growth below income growth. But the good news is the saving rate is much higher than orginally estimated, so much of the expected drag from an increase in the saving rate has already happened.

Monday, August 02, 2010

WSJ: FOMC considering reinvesting when MBS Matures

by Calculated Risk on 8/02/2010 11:59:00 PM

From Jon Hilsenrath at the WSJ: Fed Mulls Symbolic Shift

Federal Reserve officials will consider a modest but symbolically important change in the management of their massive securities portfolio ...This seems unlikely to happen at the Aug 10th meeting based on Chairman Bernanke's speech this morning, and his testimony to Congress less than two weeks ago.

The issue: Whether to use cash the Fed receives when its mortgage-bond holdings mature to buy new mortgage or Treasury bonds, instead of allowing its portfolio to shrink gradually, as it is expected to do in the months ahead. ...

Buying new bonds with this stream of cash from maturing bonds—projected at about $200 billion by 2011—would show the public and markets that the Fed is seeking ways to support economic growth.

Krugman: "Why Is Deflation Bad?"

by Calculated Risk on 8/02/2010 08:15:00 PM

A few excerpts from Professor Krugman: Why Is Deflation Bad?

There are actually three different reasons to worry about deflation, two on the demand side and one on the supply side.There are more details at Krugman's post.

So first of all: when people expect falling prices, they become less willing to spend, and in particular less willing to borrow. ....

A second effect: even aside from expectations of future deflation, falling prices worsen the position of debtors, by increasing the real burden of their debts. Now, you might think this is a zero-sum affair, since creditors experience a corresponding gain. But as Irving Fisher pointed out long ago (pdf), debtors are likely to be forced to cut their spending when their debt burden rises, while creditors aren’t likely to increase their spending by the same amount. ...

Finally, in a deflationary economy, wages as well as prices often have to fall – and it’s a fact of life that it’s very hard to cut nominal wages — there’s downward nominal wage rigidity. ...

Now, alert readers will have noticed that none of these arguments abruptly kicks in when the inflation rate goes from +0.1% to -0.1%. Even with low but positive inflation the zero lower bound may be binding; inflation that comes in lower than borrowers expected leaves them with a worse debt burden than they were counting on, even if the inflation is positive; and since relative wages are shifting around all the time, some nominal wages will have to fall even if the overall rate of inflation is a bit above zero.

The third point on sticky wages (and prices) is very important. Relative wages are being adjusted all the time in the economy. With some inflation, real wages can be cut (if needed) by keeping wage increases below the inflation rate. However, if inflation is near zero - or there is deflation - many companies that need to cut wages a little will have difficulty competing since it is difficult to cut nominal wages. This is a key reason why a little inflation is better than no inflation. Of course too much inflation is really bad too, but that isn't the problem right now.

Preview: Auto Sales, Pending Home Sales, Aug 10th FOMC Meeting

by Calculated Risk on 8/02/2010 05:04:00 PM

1) July Auto Sales. Light vehicle sales will be reported tomorrow by the automakers. In the weekly schedule, I noted that "expectations are for about a 11.6 million SAAR for light vehicles in July – up from the 11.1 million sales rate in June." There is a pretty wide range in forecasts:

From Bloomberg: Auto Sales May Rise to Highest of Year on U.S. Closeout Deals

Industrywide deliveries ... may reach an annualized rate of 11.9 million vehicles in July, the average of eight analysts’ estimates compiled by Bloomberg. That would be 5.3 percent higher than last year’s 11.3 million pace and the best month since August 2009 ...And from Reuters: Auto Sales in US Expected to Rise Slightly in July

Analysts surveyed by Reuters expected an average annualized sales rate of 11.4 million vehicles in July, up slightly from 11.1 million in June and 11.2 million a year earlier. Forecasts for July range from 11.1 million to 12.1 million vehicles.2) Pending Home Sales: The consensus is for a slight decline in the pending homes sales index for June, after the 30% drop decline in May. Lawler expects about a 3% decline (based on limited data).

3) FOMC meeting on August 10th: There has been some speculation that the FOMC would ease monetary policy next week. As an example from CNBC: Fed Will Ease Monetary Policy on Aug. 10: Economist

Japan's Nomura has become the first investment bank to predict the Federal Reserve will begin to ease monetary policy following the recent slowdown in growth in the world's biggest economy.Given Chairman Bernanke's comments this morning, this seems very unlikely. Bernanke's speech was fairly positive, and I think the FOMC statement might note that growth has slowed, but the "extended period" wording will probably remain the same - and there will probably be no mention of further easing. The following was the key sentence in Bernanke's speech:

The deterioration in expectations for growth and inflation argues for an easing of monetary policy, Paul Sheard, the global chief economist at Nomura, wrote in his latest report.

"In particular, in the household sector, growth in real consumer spending seems likely to pick up in coming quarters from its recent modest pace, supported by gains in income and improving credit conditions."Unless there is a huge downside surprise this week, I think the FOMC statement will basically remain the same.