by Calculated Risk on 8/04/2010 10:26:00 PM

Wednesday, August 04, 2010

China's Stress Tests: 60% Decline in House Prices

From Bloomberg: China Said to Test Banks for 60% Home-Price Drop

Banks were instructed to include worst-case scenarios of prices dropping 50 percent to 60 percent in cities where they have risen excessively ... Previous stress tests carried out in the past year assumed home-price declines of as much as 30 percent.At least they are realize prices can fall sharply. In some European countries the regulators assumed steady prices was a worst-case economic scenario!

$26 Billion in Aid to States to pass Senate tomorrow

by Calculated Risk on 8/04/2010 06:55:00 PM

From the NY Times: Senate Vote Clears Way for $26 Billion in Aid to States

The Senate on Wednesday cleared the way to provide $10 billion to states and local school districts to prevent teacher layoffs and an additional $16 billion in federal aid to cash-strapped states ... The cost of the current version of the bill is fully paid with other spending cuts and a provision to close a tax loophole ... The $16.1 billion in aid to states would increase the federal government’s contribution toward Medicaid costsThis bill will provide Medicaid funding through the first 6 months of 2011, and the sponsors say it will help save 140,000 teacher jobs.

I'll have another update on the 2nd half slowdown tomorrow, but this will reduce the cutbacks at the state and local level in the 2nd half of 2010.

Q2: Office, Mall and Lodging Investment

by Calculated Risk on 8/04/2010 04:07:00 PM

First - the advance Q2 GDP report released last week showed an annualized real increase of 5.2% for investment in non-residential structures. This broke a streak of seven straight quarterly declines. However the construction spending report released on Monday suggests that most of this gain will be revised away.

Second - with the release of underlying detail data today - we can see that most of the reported gains in Q2 were for power and petroleum mining structures. My guess is some of this investment was related to the BP oil gusher.

If we look at just office, mall and lodging investment, non-residential structure investment continued to decline in Q2. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows investment in offices as a percent of GDP. Office investment as a percent of GDP peaked at 0.46% in Q3 2008 and has declined sharply to a new series low as a percent of GDP (data series starts in 1959).

Reis reported that the office vacancy rate is at a 17 year high at 17.4% in Q2, up from a revised 17.3% in Q1 and 16.0% in Q2 2009. With the office vacancy rate still rising, office investment will probably decline further - although most of the decline in investment has already happened. The second graph is for investment in malls.

The second graph is for investment in malls.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and has fallen by over two-thirds (note that investment includes remodels, so this will not fall to zero). Mall investment is also at a series low (as a percent of GDP) and will probably continue to decline through 2010.

Reis reported that the mall vacancy rate increased in Q2 2010, and was the highest on record at 9.0% for regional malls, and the highest since 1991 for strip malls.  The third graph is for lodging (hotels).

The third graph is for lodging (hotels).

The bubble boom in lodging investment was stunning. Lodging investment peaked at 0.32% of GDP in Q2 2008 and has fallen by over 70% already. And I expect lodging investment to continue to decline through at least 2010.

As projects are completed there will be little new investment in these categories for some time.

Also notice that investment in all three categories typically falls for a year or two after the end of a recession, and then usually recovers very slowly (flat as a percent of GDP for 2 or 3 years). Something similar will probably happen again, and there will not be a recovery in these categories until the vacancy rates fall significantly.

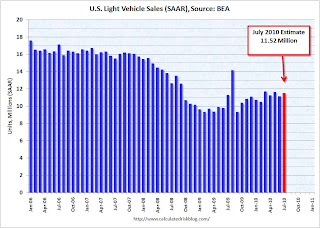

BEA: July light vehicle sales rate 11.5 million SAAR

by Calculated Risk on 8/04/2010 02:17:00 PM

I usually use the light vehicle estimate from AutoData for the seasonally adjusted annual rate. Their estimate is usually very close, however since the BEA didn't put out the adjustment factors in advance, AutoData estimated sales at 12 million SAAR in July with a notice that this might be revised.

The BEA released the sales numbers this morning, and the sales rate was 11.52 million (below most analyst estimates). This is a significant difference and worth mentioning. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA.

This was below most forecasts of around 11.6 to 11.8 million SAAR, and is below the levels of March and May earlier this year.

Fed Research Supports Mortgage Cram Downs

by Calculated Risk on 8/04/2010 12:30:00 PM

Thomas J. Fitzpatrick IV and James B. Thomson at the Cleveland Fed provide new research that supports residential mortgage cram downs: Stripdowns and Bankruptcy: Lessons from Agricultural Bankruptcy Reform . A few excerpts:

[One proposal is] to revise Chapter 13 of the bankruptcy code to allow judges to modify mortgages on primary residences. The type of loan modification under consideration is known as a loan cramdown or loan stripdown because the judge would reduce the balance of the secured claim to the current market value of the house, turning the remaining balance of the mortgage into an unsecured claim (which would receive the same proportionate payout as other unsecured debts included in the bankruptcy petition).And the authors discuss how this worked for farm loans:

The actual negative impact of the farm stripdown legislation was minor. Although the legislation created a special chapter in the Bankruptcy Code for farmers and allowed stripdowns on primary residences, it did not change the cost and availability of farm credit dramatically. In fact, a United States General Accounting Office (1989) survey of a small group of bankers found that none of them raised interest rates to farmers more than 50 basis points. While this rate change may have been a response to the Chapter 12, it is also consistent with increasing premiums due to the economic environment. This suggests that the changes in the cost and availability of farm credit after the bankruptcy reform differed little from what would be expected in that economic environment, absent reform.It appears the cram down legislation was very effective.

What was most interesting about Chapter 12 is that it worked without working. According to studies by Robert Collender (1993) and Jerome Stam and Bruce Dixon (2004), instead of flooding bankruptcy courts, Chapter 12 drove the parties to make private loan modifications. In fact, although the U.S. General Accounting Office reports that more than 30,000 bankruptcy filings were expected the year Chapter 12 went into effect, only 8,500 were filed in the first two years. Since then, Chapter 12 bankruptcy filings have continued to fall.

And residential mortgage cram downs are not new. The law was changed in 1978 and cram downs eliminated in 1993.

In 2007 my former co-blogger and mortgage banker Tanta explained the history of mortgage cram downs and argued they would be helpful now: Just Say Yes To Cram Downs

I am fully in favor of removing restrictions on modifications of mortgage loans in Chapter 13, but not necessarily because that helps current borrowers out of a jam. I'm in favor of it because I think it will be part of a range of regulatory and legal changes that will help prevent future borrowers from getting into a lot of jams, which is to say that it will, contra MBA, actually help "stabilize" the residential mortgage market in the long term. Any industry that wants special treatment under the law because of the socially vital nature of its services needs to offer socially viable services, and since the industry has displayed no ability or willingness to quit partying on its own, then treat it like any other partier under BK law.Looking at the Fed research, it appears Tanta's argument about mortgage cram downs bringing stability and discipline to the residential mortgage market long term would be correct. It is never too late: Say yes to cram downs!

ISM Non-Manufacturing Index shows expansion in July

by Calculated Risk on 8/04/2010 10:00:00 AM

The July ISM Non-manufacturing index was at 54.3%, up from 53.8% in June - and above expectations of 53.7%. The employment index showed expansion in July at 50.9%. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

The employment index is at the highest level since December 2007.

From the Institute for Supply Management: July 2010 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in July for the seventh consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee; and senior vice president — supply management for Hilton Worldwide. "The NMI (Non-Manufacturing Index) registered 54.3 percent in July, 0.5 percentage point higher than the 53.8 percent registered in June, indicating continued growth in the non-manufacturing sector at a slightly faster rate. The Non-Manufacturing Business Activity Index decreased 0.7 percentage point to 57.4 percent, reflecting growth for the eighth consecutive month. The New Orders Index increased 2.3 percentage points to 56.7 percent, and the Employment Index increased 1.2 percentage points to 50.9 percent, reflecting growth after one month of contraction. The Prices Index decreased 1.1 percentage points to 52.7 percent in July, indicating that prices are still increasing but at a slower rate than in June. According to the NMI, 13 non-manufacturing industries reported growth in July. Respondents' comments are mixed. They vary by industry and company, with a tilt toward cautious optimism about business conditions."

emphasis added