by Calculated Risk on 8/11/2010 04:30:00 PM

Wednesday, August 11, 2010

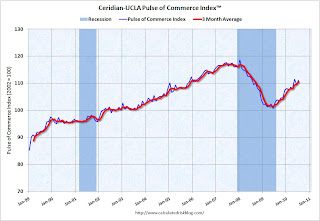

Ceridian-UCLA: Diesel Fuel index increases in July

This is the new UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce IndexTM

Press Release: PCI Climbs in July, Confirming Economy’s Slow but Steady Recovery

All signs continue to point to an economy in recovery with the latest release of the Ceridian-UCLA Pulse of Commerce Index™ (PCI) by UCLA Anderson School of Management. The July PCI climbed 1.7 percent after dropping 1.9 percent in June.

...

“The key takeaway from the July report is that the economy continues to recover – which is encouraging – but the pace needs to substantially pick up to put people back to work,” said Ed Leamer, chief PCI economist. “With the unemployment rate still at 9.5 percent and consumers understandably nervous about opening their wallets, it is hard to be very optimistic about economic growth. On the other hand, there is nothing about the PCI that is supportive of the pessimistic double-dip view.”

...

The PCI is based on an analysis of real-time diesel fuel consumption data from over the road trucking tracked by Ceridian ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the index since January 1999.

This is a new index and doesn't have much of a track record in real time - although it appears to suggest that the sluggish recovery was continuing in July.

NY Fed Plans to Buy $18 billion in Treasuries over the next month

by Calculated Risk on 8/11/2010 03:03:00 PM

This is a followup to the FOMC announcement yesterday ...

From the NY Fed: New York Fed releases tentative outright Treasury operation schedule

[T]he Desk plans to purchase approximately $18 billion. This is the amount of principal payments from agency debt and agency MBS expected to be received between mid-August and mid-September, adjusted for prior SOMA agency MBS purchases that have been allocated since August 4.The $18 billion will be spread over 9 purchases (one of TIPS), with duration of 2 to 30

Two Stories: More Homeowner Assistance for Unemployed, Q2 GDP likely to be Revised Down

by Calculated Risk on 8/11/2010 01:00:00 PM

A couple of stories ...

From HUD: Obama Administration Announces Additional Support for Targeted Foreclosure-Prevention Programs to Help Homeowners Struggling with Unemployment

Treasury’s Hardest Hit Fund Will Provide $2 Billion of Additional Assistance in 17 states and the District of Columbia; HUD to Launch a New $1 Billion Program to Help Unemployed Borrowers in Other AreasThis is an extension of a program announced in February to help the unemployed.

...

The program will work through a variety of state and non-profit entities and will offer a declining balance, deferred payment “bridge loan” (zero percent interest, non-recourse, subordinate loan) for up to $50,000 to assist eligible borrowers with payments on their mortgage principal, interest, mortgage insurance, taxes and hazard insurance for up to 24 months.

And from Catherine Rampell at the NY Times Economix: 2nd Quarter G.D.P. May Be Revised Even Lower

The government’s preliminary estimate for economic growth in the second quarter is likely to be revised substantially lower.

...

"Combining the bigger-than-expected trade deficit with other weak data suggests that Q2 growth was only 1.2 percent rather than the 2.4 percent originally estimated, placing the economy on even shakier ground than it seemed,” wrote Nigel Gault, chief United States economist at IHS Global Insight

BLS: Low Labor Turnover in June

by Calculated Risk on 8/11/2010 10:26:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings in June was 2.9 million, which was little changed from May. Although the month-to-month change is small, the number of job openings has risen by 599,000 (26 percent) since the most recent series trough of 2.3 million in July 2009. Even with the gains since July 2009, the number of job openings remained well below the 4.4 million open jobs when the recession began in December 2007...Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. The CES (Current Employment Statistics, payroll survey) is for positions, the CPS (Current Population Survey, commonly called the household survey) is for people.

The following graph shows job openings (purple), hires (blue), Total separations (include layoffs, discharges and quits) (red) and Layoff, Discharges and other (yellow) from the JOLTS.

Unfortunately this is a new series and only started in December 2000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notice that hires (blue) and separations (red) are pretty close each month. In June, about 4.35 million people lost (or left) their jobs, and 4.25 million were hired (this is the labor turnover in the economy) for a loss of 97,000 jobs in June (this includes Census jobs lost).

When the hires (blue line) is above total separations, the economy is adding net jobs, when the blue line is below total separations (as in June), the economy is losing net jobs.

Note: The temporary Census hiring has distorted this series over the last few months.

The separations in June included the 225 thousand temporary Census 2010 jobs lost. Layoffs and discharges increased in June, but that is probably because of the temporary Census jobs. The number of job openings also decreased slightly in June, after increasing earlier this year.

The overall turnover, especially after removing the impact of the Census hiring, is still low.

Trade Deficit increases sharply in June

by Calculated Risk on 8/11/2010 08:30:00 AM

The Census Bureau reports:

[T]otal June exports of $150.5 billion and imports of $200.3 billion resulted in a goods and services deficit of $49.9 billion, up from $42.0 billion in May, revised.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through June 2010.

Clearly imports are increasing much faster than exports. On a year-over-year basis, exports are up 17% and imports are up 29%. This is an easy comparison because of the collapse in trade at the end of 2008 and into early 2009.

The second graph shows the U.S. trade deficit, with and without petroleum, through June.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The increase in the deficit in June was unrelated to oil as the trade gap with China increased to $26.15 billion in June - the highest level since October 2008 and up sharply from last year. Once again the imbalances have returned ...

MBA: Mortgage Applications Essentially Unchanged Despite Lowest Rates

by Calculated Risk on 8/11/2010 07:35:00 AM

The MBA reports: Mortgage Applications Essentially Unchanged Despite Lowest Rates

The Refinance Index increased 0.6 percent from the previous week and the seasonally adjusted Purchase Index increased 0.3 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.57 percent from 4.60 percent, with points decreasing to 0.89 from 0.93 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This was the lowest 30-year contract rate ever recorded in the survey.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The purchase index has increased slightly for four straight weeks - but is still 40% below the level of the last week of April (and about 32% below the last week of April using the 4-week average).

This recent collapse in the purchase index has already shown up as a decline in new home sales (counted when the contract is signed), and will show up in the July and August existing home sales reports (counted at close of escrow).

Note: Mortgage rates will probably fall to another record low this week too.