by Calculated Risk on 8/27/2010 08:20:00 PM

Friday, August 27, 2010

Jim the Realtor: "Good time to be a looker"

Prices are falling ... and Jim the Realtor says: "You won’t hear me say it’s a great time to buy, but ... it’s a great time to look.”

U.S. Births decline in 2009

by Calculated Risk on 8/27/2010 04:03:00 PM

From the National Center for Health Statistics: Births, Marriages, Divorces, and Deaths: Provisional Data for 2009

The NCHS reports that U.S. births declined to 4.136 million in 2009, from 4.247 million in 2008. The birth rate declined to 13.5 from 13.9 in 2008 (births per 1000 total population).

Here is a long term graph of annual U.S. births through 2009 ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Births have declined for two consecutive years, and are now 4.2% below the peak in 2007. I suspect certain segments of the population were under stress before the recession started - like construction workers - and even more families were in distress in 2008 and 2009. Of course it takes 9 months to have a baby, so families in distress in 2009 probably put off having babies in 2010 too.

Notice that the number of births started declining a number of years before the Great Depression started. Many families in the 1920s were under severe stress long before the economy collapsed. By 1933 births were down by almost 23% from the early '20s levels.

Of course economic distress isn't the only reason births decline - look at the huge decline following the baby boom that was driven by demographics. But it is common for births to slow or decline during tough economic times in the U.S. - and that appears to be happening now.

Last year I guessed that we'd see further declines in births in 2009 (now confirmed) and probably in 2010. But I don't think the declines in births will be anything like what happened during the 1920s.

Estimate of Decennial Census impact on August payroll employment: minus 116,000

by Calculated Risk on 8/27/2010 12:49:00 PM

The Census Bureau released the weekly payroll data for the week ending August 14th this week (ht Bob_in_MA). If we subtract the number of temporary 2010 Census workers in the week containing the 12th of the month, from the same week for the previous month - this provides a close estimate for the impact of the Census hiring on payroll employment.

The Census Bureau releases the actual number with the employment report.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

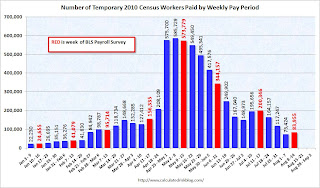

This graph shows the number of Census workers paid each week. The red labels are the weeks of the BLS payroll survey.

The Census payroll decreased from 200,346 for the week ending July 17th to 83,955 for the week ending August 14th.

So my estimate for the impact of the Census on August payroll employment is minus 116 thousand (this will probably be close). The employment report will be released on September 3rd, and the headline number for August - including Census numbers - will probably be negative again. But a key number will be the hiring ex-Census (so we will add back the Census workers again this month).

The following table compares the weekly payroll report estimate to the monthly BLS report on Census hiring (the weekly report is revised slightly, so the correlation looks better than in real time):

| Payroll, Weekly Pay Period | Payroll, Monthly BLS | Change based on weekly report | Actual Change (monthly) | |

|---|---|---|---|---|

| Jan | 25 | 24 | ||

| Feb | 41 | 39 | 16 | 15 |

| Mar | 96 | 87 | 55 | 48 |

| Apr | 156 | 154 | 61 | 67 |

| May | 574 | 564 | 418 | 410 |

| Jun | 344 | 339 | -230 | -225 |

| Jul | 200 | 196 | -144 | -143 |

| Aug | 84 | -116 | ||

| All thousands | ||||

Analysis: Bernanke paves the way for QE2

by Calculated Risk on 8/27/2010 11:22:00 AM

Just some quick thoughts on Fed Chairman Ben Bernanke's speech today.

For a sustained expansion to take hold, growth in private final demand--notably, consumer spending and business fixed investment--must ultimately take the lead. On the whole, in the United States, that critical handoff appears to be under way. ... the pace of that growth recently appears somewhat less vigorous than we expected. ... Incoming data on the labor market have remained disappointing. ... Overall, the incoming data suggest that the recovery of output and employment in the United States has slowed in recent months, to a pace somewhat weaker than most FOMC participants projected earlier this year. ... I expect the economy to continue to expand in the second half of this year, albeit at a relatively modest pace.

Despite the weaker data seen recently, the preconditions for a pickup in growth in 2011 appear to remain in place.

Under what conditions would the FOMC make further use of these or related policy tools? At this juncture, the Committee has not agreed on specific criteria or triggers for further action, but I can make two general observations.

First, the FOMC will strongly resist deviations from price stability in the downward direction. ... It is worthwhile to note that, if deflation risks were to increase, the benefit-cost tradeoffs of some of our policy tools could become significantly more favorable.

Second, regardless of the risks of deflation, the FOMC will do all that it can to ensure continuation of the economic recovery. Consistent with our mandate, the Federal Reserve is committed to promoting growth in employment and reducing resource slack more generally. Because a further significant weakening in the economic outlook would likely be associated with further disinflation, in the current environment there is little or no potential conflict between the goals of supporting growth and employment and of maintaining price stability.

A first option for providing additional monetary accommodation, if necessary, is to expand the Federal Reserve's holdings of longer-term securities. As I noted earlier, the evidence suggests that the Fed's earlier program of purchases was effective in bringing down term premiums and lowering the costs of borrowing in a number of private credit markets. I regard the program (which was significantly expanded in March 2009) as having made an important contribution to the economic stabilization and recovery that began in the spring of 2009. Likewise, the FOMC's recent decision to stabilize the Federal Reserve's securities holdings should promote financial conditions supportive of recovery.Bernanke was not as positive on changes to the "extended period" language or reducing the interest rate on excess reserves.

I believe that additional purchases of longer-term securities, should the FOMC choose to undertake them, would be effective in further easing financial conditions.

"Revenue is being affected by weaker than expected demand for consumer PCs in mature markets," the company said in a statement.Or perhaps the unemployment rate ticking up in the August employment report next Friday might be enough. There will be plenty of data released before the September 21 FOMC meeting (and if the data is weaker, the meeting might be expanded to two days). Or perhaps the FOMC will wait until November, but it does appears Bernanke is preparing everyone for QE2.

Bernanke: The Economic Outlook and Monetary Policy

by Calculated Risk on 8/27/2010 10:02:00 AM

From Fed Chairman Ben Bernanke: The Economic Outlook and Monetary Policy. Excerpt on monetary policy:

Policy Options for Further EasingPaving the way for QE2.

...

I will focus here on three that have been part of recent staff analyses and discussion at FOMC meetings: (1) conducting additional purchases of longer-term securities, (2) modifying the Committee's communication, and (3) reducing the interest paid on excess reserves. I will also comment on a fourth strategy, proposed by several economists--namely, that the FOMC increase its inflation goals.

A first option for providing additional monetary accommodation, if necessary, is to expand the Federal Reserve's holdings of longer-term securities. ...

A second policy option for the FOMC would be to ease financial conditions through its communication, for example, by modifying its post-meeting statement. ...

A third option for further monetary policy easing is to lower the rate of interest that the Fed pays banks on the reserves they hold with the Federal Reserve System. Inside the Fed this rate is known as the IOER rate, the "interest on excess reserves" rate. The IOER rate, currently set at 25 basis points, could be reduced to, say, 10 basis points or even to zero. ...

A rather different type of policy option, which has been proposed by a number of economists, would have the Committee increase its medium-term inflation goals above levels consistent with price stability. I see no support for this option on the FOMC.

Update: Bernanke also addressed WHEN the FOMC will act:

Each of the tools that the FOMC has available to provide further policy accommodation--including longer-term securities asset purchases, changes in communication, and reducing the IOER rate--has benefits and drawbacks, which must be appropriately balanced. Under what conditions would the FOMC make further use of these or related policy tools? At this juncture, the Committee has not agreed on specific criteria or triggers for further action, but I can make two general observations.

First, the FOMC will strongly resist deviations from price stability in the downward direction. Falling into deflation is not a significant risk for the United States at this time, but that is true in part because the public understands that the Federal Reserve will be vigilant and proactive in addressing significant further disinflation. It is worthwhile to note that, if deflation risks were to increase, the benefit-cost tradeoffs of some of our policy tools could become significantly more favorable.

Second, regardless of the risks of deflation, the FOMC will do all that it can to ensure continuation of the economic recovery. Consistent with our mandate, the Federal Reserve is committed to promoting growth in employment and reducing resource slack more generally. Because a further significant weakening in the economic outlook would likely be associated with further disinflation, in the current environment there is little or no potential conflict between the goals of supporting growth and employment and of maintaining price stability.

Q2 real GDP revised down to 1.6% annualized growth rate

by Calculated Risk on 8/27/2010 08:48:00 AM

From the BEA: Gross Domestic Product, 2nd quarter 2010 (second estimate)

The following table shows the changes from the advance release (this is the Contributions to Percent Change in Real Gross Domestic Product).

The largest downward revisions were to the change in private inventories, imports, and non-residential structure investment. Personal consumption expenditures and investment in Equipment and software were revised up.

| Advance | 2nd Estimate (Revision) | Change | |

|---|---|---|---|

| Percent change at annual rate: | |||

| Gross domestic product | 2.4 | 1.6 | -0.8 |

| Percentage points at annual rates: | |||

| Personal consumption expenditures | 1.15 | 1.38 | 0.23 |

| Goods | 0.79 | 0.82 | 0.03 |

| Durable goods | 0.53 | 0.49 | -0.04 |

| Nondurable goods | 0.25 | 0.33 | 0.08 |

| Services | 0.36 | 0.56 | 0.20 |

| Gross private domestic investment | 3.14 | 2.75 | -0.39 |

| Fixed investment | 2.09 | 2.12 | 0.03 |

| Nonresidential | 1.50 | 1.54 | 0.04 |

| Structures | 0.14 | 0.01 | -0.13 |

| Equipment and software | 1.36 | 1.53 | 0.17 |

| Residential | 0.59 | 0.58 | -0.01 |

| Change in private inventories | 1.05 | 0.63 | -0.42 |

| Net exports of goods and services | -2.78 | -3.37 | -0.59 |

| Exports | 1.22 | 1.08 | -0.14 |

| Imports | -4.00 | -4.45 | -0.45 |

| Government consumption expenditures and gross investment | 0.88 | 0.86 | -0.02 |

| Federal | 0.72 | 0.72 | 0.00 |

| National defense | 0.4 | 0.39 | -0.01 |

| Nondefense | 0.33 | 0.32 | -0.01 |

| State and local | 0.16 | 0.14 | -0.02 |