by Calculated Risk on 8/30/2010 02:33:00 PM

Monday, August 30, 2010

Report: No discussions underway to revive housing tax credit

Last night I posted some comments from HUD Secretary Shaun Donovan. From CNN's "State of the Union" transcript:

[CNN's Ed] HENRY: Is that housing credit now dead? Or does the administration think you should try to revive it to try to prop this industry up?Diana Olick at CNBC contacted HUD today: Another Home Buyer Tax Credit?

DONOVAN: Look, Ed, I think it's too early to say after one month of numbers whether the tax credit will be revived or not. All I can tell you is that we are watching very carefully.

[A] HUD spokesperson ... responded: "No news here...there are no discussions underway to revive the credit."Hopefully the tax credit is done.

Regional Fed Manufacturing Surveys and the ISM PMI

by Calculated Risk on 8/30/2010 11:39:00 AM

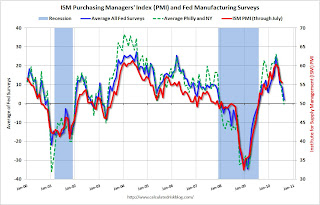

Now that all the regional Fed manufacturing surveys for August have been released, here is an update to the graph I posted last week: Click on graph for larger image in new window.

Click on graph for larger image in new window.

For this graph I averaged the New York and Philly Fed surveys (dashed green), and averaged five surveys including New York, Philly, Richmond, Dallas and Kansas City (blue).

The Institute for Supply Management (ISM) PMI (red) is through July (right axis).

ISM PMI for August will be released on Wednesday at 10 AM ET. The consensus is for a decline to 53.0 from 55.5 in July.

Based on the regional surveys, it appears that the PMI will decline in August - but will probably still be above 50 (indicating expansion in August).

Dallas Fed: Texas Manufacturing Activity Still Weak in August

by Calculated Risk on 8/30/2010 10:33:00 AM

From the Dallas Fed: Texas Manufacturing Activity Still Weak

Texas factory activity was unchanged in August, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, came in at zero, posting a third consecutive month of little to no growth.This is the last of the regional Fed surveys for August, and they all showed manufacturing slowing or even contracting.

Most other indexes for current activity remained negative in August. The new orders index stayed at –9, implying incoming orders continue to fall. The capacity utilization and shipments indexes pushed deeper into negative territory, suggesting further contraction of business.

...

The employment index turned negative for the first time in six months, largely due to the share of firms reporting layoffs rising from 15 percent in July to 23 percent in August, and hours worked contracted again.

The national ISM manufacturing survey will be released on Wednesday.

Personal Income, Spending increase in July

by Calculated Risk on 8/30/2010 08:30:00 AM

From the BEA: Personal Income and Outlays, July 2010

Personal income increased $30.0 billion, or 0.2 percent ... Personal consumption expenditures (PCE) increased $44.1 billion, or 0.4 percent

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in July, compared with an increase of 0.1 percent in June.

...

Personal saving as a percentage of disposable personal income was 5.9 percent in July, compared with 6.2 percent in June.

Click on graph for large image.

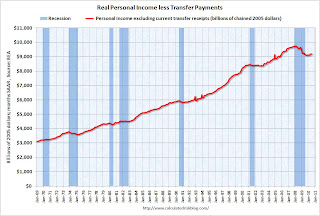

Click on graph for large image.This graph shows real personal income less transfer payments since 1969.

This measure of economic activity is moving sideways - similar to what happened following the 2001 recession.

This month the saving rate decreased slightly ...

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the July Personal Income report. The saving rate decreased to 5.9% in July from 6.2% in June (flat at 6.1% using a three month average).

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the July Personal Income report. The saving rate decreased to 5.9% in July from 6.2% in June (flat at 6.1% using a three month average). I expect the saving rate to rise further - perhaps to 8% or more.

The increase in income was good news, but personal income less transfer payments are still only 1.2% above the low of last year - and still 5.5% below the pre-recession peak.

Sunday, August 29, 2010

Another Housing Tax Credit?

by Calculated Risk on 8/29/2010 09:17:00 PM

From Reuters: No Decision on Reviving Homebuyer Credit: Donovan

"It's too early to say whether the tax credit will be revived," Donovan said in an interview on CNN's "State of the Union" program. He said the administration would "do everything we can" to stabilize the shaky U.S. housing market.The problem in housing is there is too much supply (at the current price). Incentivizing people to buy existing homes just shuffles households around - it does NOT reduce the overall supply unless the buyer is moving out of their parent's basement. I doubt that happened very often. Note: It is important to remember that rental units are part of the overall supply, so moving people from a rental unit to homeownership doesn't help.

And if the tax credit leads to more new home sales - that ADDS to the excess supply. And that makes the situation WORSE.

It would be far better for housing and the economy to announce "There will be no further housing tax credits."

Earlier today:

Foreclosures: Movin' on up!

by Calculated Risk on 8/29/2010 06:19:00 PM

This is a something we've been watching for some time ...

From Lauren Beale at the Los Angeles Times: Foreclosures of million-dollar-plus homes on the rise

Although the pace of foreclosures has slowed in the general housing market in Southern California and much of the nation, it's still rising for upper-tier homes.Earlier today:

The number of homes in the $1-million-and-up slice of the market that have become bank owned has tripled in the second quarter compared with the same period three years earlier in Los Angeles County, which has the majority of Southern California's high-priced REO houses. And the trend has shown little sign of slowing, according to data from ForeclosureRadar.

...

"We believe the high end is ready to fall apart," [Bryan Ochse of Media West Realty in Burbank, which works with 11 lending institutions and specializes in REO sales] said.