by Calculated Risk on 9/09/2010 08:30:00 AM

Thursday, September 09, 2010

Weekly Initial Unemployment Claims decline

UPDATE: BofA noted this morning that 9 states reported delays in filing jobless claims because of labor day weekend ... so the actual was probably higher (ht Brian)

The DOL reports on weekly unemployment insurance claims:

In the week ending Sept. 4, the advance figure for seasonally adjusted initial claims was 451,000, a decrease of 27,000 from the previous week's revised figure of 478,000. The 4-week moving average was 477,750, a decrease of 9,250 from the previous week's revised average of 487,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 9,250 to 477,750.

Claims for last week were revised up from 472,000 to 478,000.

This is the lowest level for weekly claims since early July, but it is still very high - and the current level of the 4-week average suggests a weak job market.

Wednesday, September 08, 2010

The Frugal are Losers Too

by Calculated Risk on 9/08/2010 08:34:00 PM

From Graham Bowley at the NY Times: Debtors Feast at the Expense of the Frugal

For example, anyone keeping $500,000 in a 12-month certificate of deposit earning a rate of 1.5 percent annually — one of the best savings rates available nationally these days — would earn $7,500 a year, hardly enough to live on. Just three years ago, that same investment would have generated $26,250.Obviously retired people, living on bond yields, are taking a hit as bonds mature. And this is pushing some conservative investors into riskier assets too.

... Anyone investing $500,000 in 10-year Treasuries at current yields would earn $13,500 a year.

The BEA has been reporting that Personal interest income has been falling since Sept 2008, and I expect interest income will fall further as bonds and CDs mature.

Lawler: Again on Existing Home Months’ Supply: What’s “Normal?”

by Calculated Risk on 9/08/2010 04:49:00 PM

CR Note: This is from economist Tom Lawler.

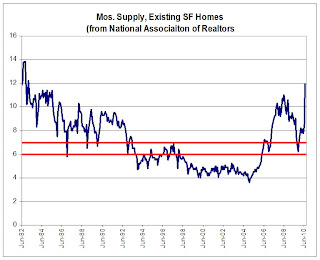

It has become “common practice” when talking about the “months’ supply” of existing homes for sale for folks to say that the “normal” months’ supply, or the months’ supply that means it is neither a “buyers” or a “sellers” market, is around 6 to 7 months. Yet here is the history of months’ supply for existing SF homes from the National Association of Realtors. Click on graph for larger image in new window.

Click on graph for larger image in new window.

As one can see, this “metric” actually has not been in the six-to-seven month range very often. From mid-1982 through 1992, the months’ supply measure was above seven months in all but a handful of months, while from 1998 to the spring of 2006 it was always below six months.

The measure, of course, is quite volatile, and sorta weird in that the inventory number (the numerator) is not seasonally adjusted while the sales data (the denominator) is seasonally adjusted. The measure also can be extremely volatile as sales tend to be impacted more by “special factors” (weather, tax credits, etc.) than listings.

But the measure is only one of many measures that may be “indicative” of “excess” supply, and it probably isn’t even close to the best measure. However, it is the most timely, so folks watch it closely – but sometimes place WAY to much meaning in month-to-month swings.

CR Note: The above was from economist Tom Lawler.

From CR: I'm one of the people who has called 6 to 7 months a "normal" months-of-supply. As the graph above shows, it is hard to define a normal based on the last 30 years.

I've heard the 6 to 7 months metric for years - and it fits the data I have. Perhaps the idea that 6 to 7 months is "normal" comes from new home inventory. This graph shows new home inventory back to 1963 (unfortunately Tom Lawler's graph only goes back to 1982).

This graph shows new home inventory back to 1963 (unfortunately Tom Lawler's graph only goes back to 1982).

For new homes, it does look like around 6 months supply is normal. I suspect if the existing home graph went back to the '60s, something like 6 months would be normal.

Lawler's caution is something to keep in mind. But double digit months-of-supply is clearly very high.

Consumer Credit Declines in July

by Calculated Risk on 9/08/2010 03:09:00 PM

The Federal Reserve reports:

In July, total consumer credit decreased at an annual rate of 1-3/4 percent. Revolving credit decreased at an annual rate of 6-1/4

percent, and nonrevolving credit increased at an annual rate of 1/2 percent.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the increase in consumer credit since 1978. The amounts are nominal (not inflation adjusted).

Revolving credit (credit card debt) is off 15.2% from the peak. Non-revolving debt (auto, furniture, and other loans) is off 1.1% from the peak. Note: Consumer credit does not include real estate debt.

Fed's Beige Book: Continued growth, but "widespread signs of a deceleration"

by Calculated Risk on 9/08/2010 02:00:00 PM

Note: This is based on information collected on or before August 30, 2010.

From the Federal Reserve: Beige book

Reports from the twelve Federal Reserve Districts suggested continued growth in national economic activity during the reporting period of mid-July through the end of August, but with widespread signs of a deceleration compared with preceding periods.And on real estate:

...

Manufacturing activity expanded further on balance, although the pace of growth appeared to be slower than earlier in the year. Most Districts reported further gains in production activity and sales across a broad spectrum of manufacturing industries. However, New York, Richmond, Atlanta, and Chicago noted that the overall pace of growth slowed, while Philadelphia, Cleveland, and Kansas City reported that demand softened compared with the previous reporting period.

Activity in residential real estate markets declined further. Most District reports highlighted evidence of very low or declining home sales, which many attributed to a sustained lull following the expiration of the homebuyer tax credit at the end of June. Some Districts, such as New York and Dallas, noted that the expiration of the tax credit created especially weak conditions for lower-priced homes, while others, including Philadelphia and Kansas City, identified the high end of the market as the primary weak spot. Residential construction activity declined in most areas in response to weak demand.Pretty weak, but still growing in August.

...

Demand for commercial, industrial, and retail space generally remained depressed. Vacancy rates stayed at elevated levels in general and rose further in a few Districts, placing substantial downward pressure on rents.

BLS: Job Openings increases in July, Low Labor Turnover

by Calculated Risk on 9/08/2010 10:00:00 AM

Note: The temporary decennial Census hiring and layoffs has distorted this series over the last few months. The total separations has increased, but that includes the temporary Census workers that were let go.

From the BLS: Job Openings and Labor Turnover Summary

There were 3.0 million job openings on the last business day of July 2010, the U.S. Bureau of Labor Statistics reported today. The job openings rate increased over the month to 2.3 percent. The hires rate (3.3 percent) and the separations rate (3.4 percent) were unchanged....Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. The CES (Current Employment Statistics, payroll survey) is for positions, the CPS (Current Population Survey, commonly called the household survey) is for people.

The following graph shows job openings (purple), hires (blue), Total separations (include layoffs, discharges and quits) (red) and Layoff, Discharges and other (yellow) from the JOLTS.

Unfortunately this is a new series and only started in December 2000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notice that hires (blue) and separations (red) are pretty close each month. In July, about 4.4 million people lost (or left) their jobs, and 4.23 million were hired (this is the labor turnover in the economy) for a loss of 168,000 jobs in July (this includes Census jobs lost).

The employment report (revised) showed a loss of only 54,000 jobs in July, and usually these numbers are pretty close, so this is a little puzzling. I expect some revisions to one or both reports.

When the hires (blue line) is above total separations, the economy is adding net jobs, when the blue line is below total separations (as in July), the economy is losing net jobs.

It appears job openings are still trending up, however labor turnover is still fairly low.