by Calculated Risk on 9/17/2010 09:41:00 PM

Friday, September 17, 2010

WSJ: Pension Gaps Loom Larger

From David Reilly at the WSJ: Pension Gaps Loom Larger

The median expected investment return for more than 100 U.S. public pension plans surveyed by the National Association of State Retirement Administrators remains 8%, the same level as in 2001, the association says.I keep expecting the plans to lower their expected returns, but that increases the funding requirements ...

...

Return assumptions can affect the size of so-called funding gaps—the amounts by which future liabilities to retirees exceed current pension assets. ... The concern is that the reluctance to plan for smaller gains will understate the scale of the potential time bomb facing America's government and corporate pension plans

Bank Failure #125: Maritime Savings Bank, West Allis, Wisconsin

by Calculated Risk on 9/17/2010 07:05:00 PM

Bankers wailing sea chanties

While the sea consumes

by Soylent Green is People

From the FDIC: North Shore Bank, FSB, Brookfield, Wisconsin, Assumes All of the Deposits of Maritime Savings Bank, West Allis, Wisconsin

As of June 30, 2010, Maritime Savings Bank had approximately $350.5 million in total assets and $248.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $83.6 million. ... Maritime Savings Bank is the 125th FDIC-insured institution to fail in the nation this year, and the first in Wisconsin.

Bank Failures #121 to 124: Georgia and Ohio

by Calculated Risk on 9/17/2010 06:19:00 PM

Autumn leaves fall to the ground

As do many banks.

by Soylent Green is People

From the FDIC: Community & Southern Bank, Carrollton, Georgia, Assumes All of the Deposits of Three Georgia Institutions

As of June 30, 2010, Bank of Ellijay had total assets of $168.8 million and total deposits of $160.7 million; First Commerce Community Bank had total assets of $248.2 million and total deposits of $242.8 million; and The Peoples Bank had total assets of $447.2 million and total deposits of $398.2 million.From the FDIC: Foundation Bank, Cincinnati, Ohio, Assumes All of the Deposits of Bramble Savings Bank, Milford, Ohio

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for Bank of Ellijay will be $55.2 million; for First Commerce Community Bank, $71.4 million; and for The Peoples Bank, $98.9 million. ... These failures bring the total number of failures to 123 for the nation and to 14 for Georgia. Prior to these failures, the last bank closed in the state was Northwest Bank & Trust, Acworth, on July 31, 2010.

As of June 30, 2010, Bramble Savings Bank had approximately $47.5 million in total assets and $41.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $14.6 million. ... Bramble Savings Bank is the 124th FDIC-insured institution to fail in the nation this year, and the second in Ohio.Five down today. The FDIC is back to work ...

Bank Failure #120: ISN Bank, Cherry Hill, New Jersey

by Calculated Risk on 9/17/2010 04:18:00 PM

Wild times had with Cherry Hill

Never meant to be.

by Soylent Green is People

From the FDIC: New Century Bank, Phoenixville, Pennsylvania, Assumes All of the Deposits of ISN Bank, Cherry Hill, New Jersey

As of June 30, 2010, ISN Bank had approximately $81.6 million in total assets and $79.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be approximately $23.9 million. Compared ... ISN Bank is the 120th FDIC-insured institution to fail in the nation this year, and the first in New Jersey. The last FDIC-insured institution closed in the state was First BankAmericano, Elizabeth, on July 31, 2009.Off to a quick start ...

Inflation: Core CPI, Median CPI, 16% trimmed-mean CPI

by Calculated Risk on 9/17/2010 02:25:00 PM

The Cleveland Fed has released the median CPI:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (0.6% annualized rate) in August. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.2% annualized rate) during the month.

...

Over the last 12 months, the median CPI rose 0.5%, the trimmed-mean CPI rose 0.9%, the CPI rose 1.1%, and the CPI less food and energy rose 0.9%.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows three measure of inflation, Core CPI, Median CPI (from the Cleveland Fed), and 16% trimmed CPI (also from Cleveland Fed).

They all show that inflation has been falling, and that measured inflation is up less than 1% year-over-year. Core CPI was flat, and median CPI and the 16% trimmed mean CPI were up 0.1% in August.

Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation

No increase to Social Security Benefits for 2011 (unofficial)

by Calculated Risk on 9/17/2010 11:28:00 AM

It won't be official until the BLS releases the September CPI-W report, but we can already say there will be no increase in Social Security benefits or the Maximum Contribution Base in 2011 (assuming no new legislation).

The BLS reported this morning that the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) was at 214.205 in August (CPI-W was at 213.898 in July).

Here is an explanation of why there will be no change (some repeated from a post last month):

The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U.

Click on graph for larger image in new window.

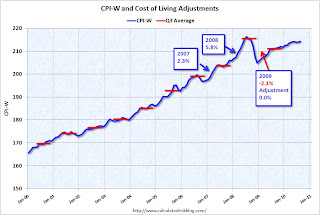

Click on graph for larger image in new window.This graph shows CPI-W over the last ten years. The red lines are the Q3 average of CPI-W for each year.

The COLA adjustment is based on the increase from Q3 of one year from the highest previous Q3 average. So a 2.3% increase was announced in 2007 for 2008, and a 5.8% increase was announced in 2008 for 2009.

In Q3 2009, CPI-W was lower than in Q3 2008, so there was no change in benefits for 2010.

For 2011, the calculation is not based on Q3 2010 over Q3 2009, but based on the average CPI-W for Q3 2010 over the highest preceding Q3 average - the 215.495 in Q3 2008. This means CPI-W in Q3 2010 has to average above 215.495 for there to be an increase in Social Security benefits in 2011.

In July 2010, CPI-W was at 213.898, and in August CPI-W was at 214.205 - so CPI-W would have to increase by almost 2% in September for the Q3 average to be at or above the Q3 2008 average. There is no evidence of a huge surge in inflation this month, so there will be no increase in Social Security benefits in 2011.

Even though there was no increase last year, and there will be no increase this year, those receiving benefits are still ahead because of the huge increase in Q3 2008.

Note: See post last month for a discussion of CPI-W and the Contribution Base.

Now the question is: Will Social Security benefits be flat in 2012 too? That is possible.