by Calculated Risk on 9/19/2010 10:30:00 AM

Sunday, September 19, 2010

Summary for week ending Sept 18th

A summary of last week - mostly in graphs:

From the Fed: Industrial production and Capacity Utilization

Industrial production rose 0.2 percent in August after a downwardly revised increase of 0.6 percent in July [revised down from 1.0 percent]. ... The capacity utilization rate for total industry rose to 74.7 percent, a rate 4.7 percentage points above the rate from a year earlier and 5.9 percentage points below its average from 1972 to 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is up 9.6% from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 74.7% is still far below normal - and well below the the pre-recession levels of 81.2% in November 2007. (Note: this is actual a decrease before the revision to July)

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.This is the highest level for industrial production since Oct 2008, but production is still 7.2% below the pre-recession levels at the end of 2007.

The increase in August was about consensus, however the sharp downward revision to July puts this below consensus.

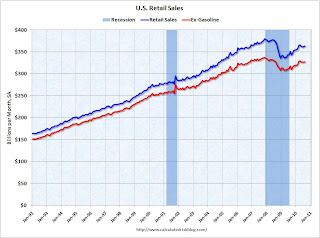

On a monthly basis, retail sales increased 0.4% from July to August (seasonally adjusted, after revisions), and sales were up 3.6% from August 2009. Retail sales increased 0.6% ex-autos.

On a monthly basis, retail sales increased 0.4% from July to August (seasonally adjusted, after revisions), and sales were up 3.6% from August 2009. Retail sales increased 0.6% ex-autos. This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 8.4% from the bottom, but still off 4.3% from the pre-recession peak.

Retail sales are still below the April level - and have mostly moved sideways for six months.

From CoreLogic: CoreLogic Home Price Index Remained Flat in July

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.The index is flat over the last year, and off 28% from the peak.

The index is 6.1% above the low set in March 2009, and I expect to see a new post-bubble low for this index later this year or early in 2011.

Press Release: August PCI Decline Signals Struggling Economy, but no Double-Dip

Press Release: August PCI Decline Signals Struggling Economy, but no Double-DipThis graph shows the index since January 1999.

This is a new index, and doesn't have much of a track record in real time, although the data appears to suggest that the recovery has slowed - even stalled - over the last 4 months.

The Cleveland Fed has released the median CPI:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (0.6% annualized rate) in August. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.2% annualized rate) during the month.

...

Over the last 12 months, the median CPI rose 0.5%, the trimmed-mean CPI rose 0.9%, the CPI rose 1.1%, and the CPI less food and energy rose 0.9%.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows three measure of inflation, Core CPI, Median CPI (from the Cleveland Fed), and 16% trimmed CPI (also from Cleveland Fed).

They all show that inflation has been falling, and that measured inflation is up less than 1% year-over-year. Core CPI was flat, and median CPI and the 16% trimmed mean CPI were up 0.1% in August.

Best wishes to all.

Hubbard and Mayer recycle Morgan Stanley's housing proposal

by Calculated Risk on 9/19/2010 07:25:00 AM

Let me start with an excerpt from Chirs Mayer and Todd Sinai's piece in Sept 2005: Bubble Trouble? Not Likely

Chicken Littles have squawked that the sky -- or the ceiling -- is about to fall on the housing market. ... Yet basic economic logic suggests that this apparent evidence of a bubble is anything but. Even in the highest-price cities, housing is, at most, slightly more expensive than average.And from Glenn Hubbard on Face the Nation in August, 2005

I don't think we're likely to see a large nominal price collapse, that is largely falling house prices, but I think we'll see much slower rates of growth in house prices after 2005.Since I was one of those "Chicken Littles", I'm curious how those views on housing worked out?

And now Glenn Hubbard and Chris Mayer recycle the poorly conceived Morgan Stanley proposal: How Underwater Mortgages Can Float the Economy

[W]e propose a new program through which the federal government would direct the public and quasi-public entities that guarantee mortgages — Fannie Mae, Freddie Mac, Ginnie Mae, the Department of Veterans Affairs loan-guarantee program and the Federal Housing Administration — to make it far easier and quicker for homeowners to refinance.At least they mention the existing refinance programs already in place (that was an improvement on MS)!

This program would be simple: the agencies would direct loan servicers — the middlemen who monitor and report loan payments — to send a short application to all eligible borrowers promising to allow them to refinance with minimal paperwork. Servicers would receive a fixed fee for each mortgage they refinanced, which would be rolled into the mortgage to eliminate costs to taxpayers.

But the rest of Tom Lawler's criticism still holds: “Slam-Dunk” Stimulus? MS = Missing Something!!!!

Saturday, September 18, 2010

FOMC Statement Preview

by Calculated Risk on 9/18/2010 09:44:00 PM

I thought there were three things to look for in the August 10th FOMC statement:

1) How the statement would discuss the economic slowdown.

The FOMC statement was more pessimistic in August than in June.

Information received since the Federal Open Market Committee met in June indicates that the pace of recovery in output and employment has slowed in recent months. Household spending is increasing gradually, but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software is rising; however, investment in nonresidential structures continues to be weak and employers remain reluctant to add to payrolls. Housing starts remain at a depressed level. Bank lending has continued to contract. Nonetheless, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, although the pace of economic recovery is likely to be more modest in the near term than had been anticipated.In the period since the August FOMC meeting, the economic data has remained weak, but the data hasn't indicated a further slowdown (at least not yet). So I expect the tone of the first paragraph to be about the same.

2) How the FOMC would express more concern about deflation. The FOMC didn't make a significant change:

Measures of underlying inflation have trended lower in recent quarters and, with substantial resource slack continuing to restrain cost pressures and longer-term inflation expectations stable, inflation is likely to be subdued for some time.Actually inflation expectations have been trending down, and the FOMC might remove the "stable" expectations phrase this week (although this seems to be a key point of contention on the FOMC).

3) And the BIG one for the August meeting was how the FOMC would change their reinvestment strategy. They decided to keep the Federal Reserve's holdings of securities stable by investing the principal payments from maturing MBS in longer-term Treasury securities.

So what will change in the September FOMC statement? Probably very little. The first paragraph will be reworked a little, but the tone will probably remain the same. And the key sentence "exceptionally low levels of the federal funds rate for an extended period" will mostl likely stay the same.

And it seems too soon for further easing based on Fed Chairman Ben Bernanke comments in his speech at Jackson Hole. Bernanke suggested that additional easing would probably require “significant weakening of the outlook” or a meaningful decline in inflation expectations (or further disinflation). The first hasn't happened yet ... although they might express more concern about disinflation this week.

Q2 Flow of Funds: Household Net Worth off $12.3 Trillion from Peak

by Calculated Risk on 9/18/2010 05:10:00 PM

The Federal Reserve released the Q2 2010 Flow of Funds report yesterday: Flow of Funds.

According to the Fed, household net worth is now off $12.3 Trillion from the peak in 2007, but up $4.7 trillion from the trough in Q1 2009.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

Note that this ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles. This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices collapsed in 2007 and 2008.

In Q2 2010, household percent equity (of household real estate) was up to 40.7% from the all time low of 36.1% in Q1 2009. The increase was due to both an increase in the value of household real estate and a $49 billion decline in mortgage debt.

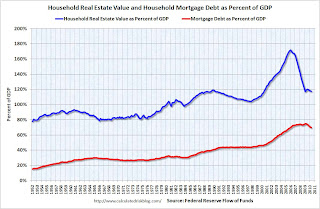

Note: something less than one-third of households have no mortgage debt. So the approximately 50+ million households with mortgages have far less than 40.7% equity. The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $49 billion in Q2. Mortgage debt has now declined by $463 billion from the peak. According to an analysis by the WSJ, most of the decline in debt has been because of defaults, see: Defaults Account for Most of Pared Down Debt

As house prices decline further, I expect the percent equity to decline and household net worth to fall.

Unofficial Problem Bank List increases to 854 institutions

by Calculated Risk on 9/18/2010 11:20:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for September 17, 2010.

Changes and comments from surferdude808:

The FDIC got back to work closing banks in earnest this Friday after taking about a month hiatus. Also, as anticipated the OCC released its actions for July/August. Activities by the FDIC and OCC contributed to many changes in the Unofficial Problem Bank List this week as the six failures were removed and there were 11 additions.Once again - a special thanks to surferdude808 for all his hard work maintaining this list.

After these changes, the Unofficial Problem Bank List stands at 854 institutions with assets of $416 billion, up from 849 institutions with assets of $415.3 billion last week.

The failures include The Peoples Bank ($447 million), Maritime Savings Bank ($350 million), First Commerce Community Bank ($248 million Ticker: FCGA), Bank of Ellijay ($169 million), ISN Bank ($82 million), and Bramble Savings Bank ($48 million).

Most notable among the 11 additions are Nextier Bank, National Association, Evans City, PA ($558 million); American National Bank of Minnesota, Baxter, MN ($322 million); State Bank Financial, La Crosse, WI ($308 million); and National Bank of New York City, New York City, NY ($253 million).

Lawler: US Households: Why Researchers / Analysts are “Confused”

by Calculated Risk on 9/18/2010 08:00:00 AM

CR Note: This from economist Tom Lawler.

[On Thursday, the Census Department released a report] entitled “Income, Poverty, and Health Insurance Coverage in the United State: 2009,” which was widely covered in the press, included a table showing an “estimate” of the number of US households in the US as of March 2010 --- 117,538,000, up just 357,000 from March 2009. The report also shows historical data on this estimated number of households, which is derived from a special Current Population Survey. The table with that data has tons of footnotes, which note that there have been multiple revisions in this so-called “time series.”

This ‘household estimate,” which is not subject to rigorous population or housing unit “controls,” is one of at least five household series one can “pick up” from various Census sources. And, of course, they are all unbelievably inconsistent, both in terms of levels and changes.

Below are various household (“occupied housing units") estimates from different reports/sources. Note that the Housing Vacancy Survey has quarterly average “estimates,” but I am just showing its annual data. I am also only showing data back to 2000.

| US Households: What's the "Right" Number? (thousands of units) | ||||||

|---|---|---|---|---|---|---|

| AHS (avg) | ACS (avg) | HVS, 2008 vintage (avg) | HVS, unadj (avg) | CPS (Mar) | Decennial Census (April 1) | |

| 2000 | 104,819 | 102,555 | 105,720 | 106,434 | 105,480 | |

| 2001 | 105,435 | 106,429 | 103,772 | 107,010 | 108,239 | |

| 2002 | 107,367 | 104,994 | 104,965 | 109,297 | ||

| 2003 | 105,842 | 108,420 | 105,636 | 105,560 | 111,278 | |

| 2004 | 109,902 | 106,971 | 106,588 | 112,000 | ||

| 2005 | 108,871 | 111,091 | 108,667 | 108,231 | 113,343 | |

| 2006 | 111,617 | 109,736 | 109,575 | 114,384 | ||

| 2007 | 110,692 | 112,378 | 110,173 | 110,306 | 116,011 | |

| 2008 | 113,101 | 110,475 | 111,409 | 116,783 | ||

| 2009 | 111,861 | 111,344 | 111,344 | 117,181 | ||

| 2010 | 117,538 | |||||

| AHS (avg)* | ACS (avg) | HVS, 2008 vintage (avg) | HVS, unadj (avg) | CPS (Mar) | Decennial Census (April 1) | |

| 2001 | 1,610 | 1,217 | 1,290 | 1,805 | ||

| 2002 | 204 | 938 | 1,222 | -2,045 | 1,058 | |

| 2003 | 204 | 1,053 | 642 | 595 | 1,981 | |

| 2004 | 1,515 | 1,483 | 1,335 | 1,028 | 722 | |

| 2005 | 1,515 | 1,189 | 1,696 | 1,643 | 1,343 | |

| 2006 | 911 | 527 | 1,069 | 1,344 | 1,041 | |

| 2007 | 911 | 761 | 437 | 731 | 1,627 | |

| 2008 | 585 | 723 | 302 | 1,103 | 772 | |

| 2009 | 585 | 869 | -65 | 398 | ||

| 357 | ||||||

| *AHS: annual average for 2-year period | ||||||

The “HVS” is the Housing Vacancy Survey, which is the quarterly Census report that includes the homeownership rates and vacancy rates. This report is not actually designed to measure the size of the housing stock (or the number of households), but rather vacancy rates. The “2008 vintage” data are attempts to create a household estimate consistent with historical housing stock estimates from other Census reports. The “unadjusted” HVS data use periodic updates of the housing stock estimates (and updated forecasts), but do not correct for past over- or under-estimates of the housing stock – thus creating multiple discrete shifts in this time series.

I include this one because recently someone sent me a report asking me to comment on a piece by a firm which including showing a decline in the number of households in 2009, citing a Census report. This confused me, but I figured out that the hapless “analyst” had used this “unadjusted” series, which is absolutely useless as a time series. The 2009 and 2010 HVS household (and housing stock) data, are going to be revised downward materially in the upcoming Q3/10 report, reflecting the updated July 1, 2009 housing stock estimates released this June, and then revised in September, which show a MUCH lower housing stock than that assumed by the HVS.

All of these data are available on various Census sources or in vendor economic databases, but the caveats/concerns/issues associated with using them as a time series are often either barely mentioned in footnotes, or not mentioned at all.

Even a casual glance at the [above table] indicates that [these] various measures – some of which cover slightly different time spans, and some (such as the ACS) is a different “concept,” at times show vastly different trends, for reasons that are not at first glance clear. As many housing analysts have noted, how fast the current “excess” supply of housing (which in and of itself is extremely difficult to gauge, given the apparent unreliability of the data!) can be absorbed is heavily dependent both on the level of new construction and the growth in households. Sadly, there not only does not exist a reliable time series of household growth that enables one to look at the behavior during business downturns/recoveries, but there is no reliable time series to gauge how fast/slow RECENT growth has been – though the combined data suggest extremely slow growth over the last few years.

On the housing stock, Census – which released updated housing stock estimates through July 1, 2009 in June (based on a pretty simplistic methodology) -- updated those estimates this month to reflect the fact that the June estimates did not incorporate state/local inputs. [The next table] are the revised housing stock estimates back to July 1, 2000. Census does not have a reliable annual time series for earlier periods.

| Census Housing Stock Estimates, July 1 | |

|---|---|

| Revised 2009 Vintage | |

| 7/1/2000 | 116,300,799 |

| 7/1/2001 | 117,905,005 |

| 7/1/2002 | 119,456,206 |

| 7/1/2003 | 121,076,837 |

| 7/1/2004 | 122,824,501 |

| 7/1/2005 | 124,711,041 |

| 7/1/2006 | 126,500,212 |

| 7/1/2007 | 128,132,164 |

| 7/1/2008 | 129,313,137 |

| 7/1/2009 | 129,969,653 |

| 7/1/2001 | 1,604,206 |

| 7/1/2002 | 1,551,201 |

| 7/1/2003 | 1,620,631 |

| 7/1/2004 | 1,747,664 |

| 7/1/2005 | 1,886,540 |

| 7/1/2006 | 1,789,171 |

| 7/1/2007 | 1,631,952 |

| 7/1/2008 | 1,180,973 |

| 7/1/2009 | 656,516 |

In the “Vintage 2008” HVS data, it was assumed that the housing stock from mid 2008 to mid 2009 increased by about 1,140,000, and that from the spring of 2009 to the spring of 2010 the housing stock increased by a similar amount. In fact, of course, it did not, and as a result there will be sizable downward revisions in the HVS’ estimated household growth in 2009 and so far in 2010.

CR Note: The above was from Tom Lawler. I've tried to figure out when the excess supply will be absorbed, but as Tom points out, it is difficult since there is no reliable time series of household growth.