by Calculated Risk on 9/23/2010 10:00:00 AM

Thursday, September 23, 2010

Existing Home Sales at 4.1 million SAAR, 11.6 months of supply

The NAR reports: Existing-Home Sales Move Up in August

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, increased 7.6 percent to a seasonally adjusted annual rate of 4.13 million in August from an upwardly revised 3.84 million in July, but remain 19.0 percent below the 5.10 million-unit pace in August 2009.

...

Total housing inventory at the end of August slipped 0.6 percent to 3.98 million existing homes available for sale, which represents an 11.6-month supply at the current sales pace, down from a 12.5-month supply in July.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in August 2010 (4.13 million SAAR) were 7.6% higher than last month, and were 19.0% lower than August 2009 (5.1 million SAAR).

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased slightly to 3.98 million in August from 4.01 million in July. The all time record high was 4.58 million homes for sale in July 2008.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory increasing in the spring and into the summer. I'll have more on inventory later ...

The last graph shows the 'months of supply' metric.

The last graph shows the 'months of supply' metric.Months of supply decreased to 11.6 months in August from 12.5 months in July. This is extremely high and suggests prices, as measured by the repeat sales indexes like Case-Shiller and CoreLogic, will continue to decline.

These weak numbers are exactly what I expected. Ignore the median price! Double digit supply and the low sales rate are the key stories. I'll have more ...

Weekly Initial Unemployment Claims increase

by Calculated Risk on 9/23/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Sept. 18, the advance figure for seasonally adjusted initial claims was 465,000, an increase of 12,000 from the previous week's revised figure of 453,000. The 4-week moving average was 463,250, a decrease of 3,250 from the previous week's revised average of 466,500.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 3,250 to 463,250.

The 4-week moving average has been moving sideways at an elevated level for about 10 months - and that suggests a weak job market.

Wednesday, September 22, 2010

Oops! No mortgage and still foreclosed on

by Calculated Risk on 9/22/2010 10:42:00 PM

From Harriet Johnson Brackey at the Sun Sentinel: Man's home sold out from under him in foreclosure mistake (ht Clint)

When Jason Grodensky bought his modest Fort Lauderdale home last December, he paid cash. But seven months later, he was surprised to learn that Bank of America had foreclosed on the house, even though Grodensky did not have a mortgage.Talk about a foreclosure error. I'm surprised a notice wasn't posted on the front door. At least the property wasn't sold to another party on the court house steps - imagine if that 3rd party had shown up with an eviction notice.

Grodensky knew nothing about the foreclosure until July, when he learned that the title to his home had been transferred to a [Fannie Mae]. ... Bank of America has acknowledged the error and will correct it at its own expense, said spokeswoman Jumana Bauwens.

Existing Home Sales Preview

by Calculated Risk on 9/22/2010 07:39:00 PM

Last month it was obvious that the consensus forecast for existing home sales was way too high. For July, the consensus was 4.65 million on a seasonally adjusted annual rate (SAAR) basis, and the National Association of Realtors (NAR) reported sales of 3.83 million SAAR (the lowest sales rate in almost 15 years).

Tomorrow (Thursday), the NAR will report existing home sales for August at 10 AM ET (existing home sales are counted when transactions close). The consensus is for an increase to 4.1 million (SAAR) in August from 3.83 million in July, and down sharply from the 5.1 million SAAR in August 2009.

Housing economist Tom Lawler is also projecting 4.1 million SAAR.

Other key numbers will be the the level of inventory and months-of-supply.

Excluding July, the last time sales were this low was in 1997. And based on the MBA purchase index, I don't expect much of a sales increase in September or October either.

HAMP data for August

by Calculated Risk on 9/22/2010 05:18:00 PM

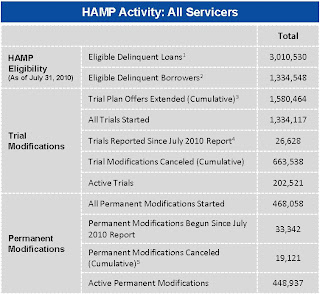

From Treasury: HAMP Servicer Performance Report Through August 2010

And here is the HUD Housing Scorecard.

About 468 thousand modifications are now "permanent" - up from 422 thousand last month - and 663 thousand trial modifications have been cancelled.

The pace of new trial modifications has slowed sharply from over 150,000 in September 2009 to under 18,000 in August. The program has slowed way down.

According to HAMP, there are 202,521 "active trials", down from 255,934 last month.

The shows that the HAMP servicers have made progress on getting borrowers out of "modification limbo" - although the trial program was originally designed to be for 3 months - so maybe the measurement should be 4 months (instead of 6 months).

Debt-to-income ratios

If we look at the HAMP program stats (see page 3), the median front end DTI (debt to income) before modification was 44.9% - the same as last month. And the back end DTI1 was an astounding 79.9%.

This means that for the median borrower, about 80% of the borrower's income went to servicing debt. And the median is 63.5% after the modification.

These borrowers still have too much debt, even after the modification - and that suggests an eventual high redefault rate. There have been 18,773 redefaults already. It would be nice to see percent defaults by months from when the "permanent modification" started.

1 Back end DTI from HAMP:

Ratio of total monthly debt payments (including mortgage principal and interest, taxes, insurance, homeowners association and/or condo fees, plus payments on installment debts, junior liens, alimony, car lease payments and investment property payments) to monthly gross income.

Temporary Decennial Census workers almost gone

by Calculated Risk on 9/22/2010 01:41:00 PM

Next week I'll have an estimate of the impact of the temporary decennial hiring and layoffs on the September employment report.

It is worth noting that the Census came in well under budget, and the temporary workers are almost all gone. One of the reasons the Census came in under budget was because of the quality of temporary workers hired (a small benefit from the high unemployment rate).

This month also marks the end of the weekly payroll report from the Census Bureau: "These data will continue through the end of September with the last release of data being the week of Sept. 26-Oct. 2." Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of Census workers paid each week. The red labels are the weeks of the BLS payroll survey.

The temporary Census payroll decreased to 9,820 last week, and September will be the last month with a significant impact on the employment report.