by Calculated Risk on 9/24/2010 08:30:00 AM

Friday, September 24, 2010

Durable Goods Orders decreased 1.3% in August

From the Census Bureau:

New orders for manufactured durable goods in August decreased $2.5 billion or 1.3 percent to $191.2 billion, the U.S. Census Bureau announced today. Down three of the last four months, this decrease followed a 0.7 percent July increase. Excluding transportation, new orders increased 2.0 percent. Excluding defense, new orders decreased 1.2 percent.This was below the consensus for a decline of 1.0%.

...

Shipments of manufactured durable goods in August, down following two consecutive monthly increases, decreased $3.1 billion or 1.5 percent to $197.9 billion.

Next up: New home sales at 10 AM ET.

Thursday, September 23, 2010

Obama pushes China on exchange rate

by Calculated Risk on 9/23/2010 10:09:00 PM

From David Sanger at the NY Times: With Warning, Obama Presses Chinese Leader on Currency

President Obama increased pressure on China to immediately revalue its currency on Thursday, devoting most of a two-hour meeting with China’s prime minister to the issue and sending the message, according to one of his top aides, that if “the Chinese don’t take actions, we have other means of protecting U.S. interests.”The old imbalances have returned - as the trade data and west coast port traffic data show - but I don't have much confidence that the Chinese will take action.

But Prime Minister Wen Jiabao barely budged ...

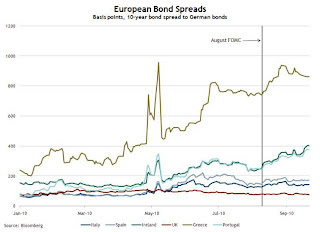

European Bond Spreads

by Calculated Risk on 9/23/2010 06:54:00 PM

Here is a look at European bond spreads from the Atlanta Fed weekly Financial Highlights released today (graph as of Sept 22nd):

Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the Atlanta Fed:

European bond spreads have for the most part risen and remain elevated since the August FOMC meeting.As of today, the Ireland-to-German spread has increased to 418 bps, and the Portugal-to-German spread has increased to 402 bps - both new records.

Note: The Atlanta Fed data is a couple days old. Nemo has links to the current data on the sidebar of his site.

And from Liz Alderman at the NY Times: In Europe, a Mood of Austerity and Anxiety. And some video interviews from different countries ...

Philly Fed State Coincident Indexes

by Calculated Risk on 9/23/2010 04:09:00 PM

Click on map for larger image.

Click on map for larger image.

Here is a map of the three month change in the Philly Fed state coincident indicators. Forty states are showing increasing three month activity. The index decreased in 6 states, and was unchanged in 4.

Based on the one month data, this three month activity map be turning red again.

Here is the Philadelphia Fed state coincident index release for August.

In the past month, the indexes increased in 27 states, decreased in 16, and remained unchanged in seven for a one-month diffusion index of 22. Over the past three months, the indexes increased in 40 states, decreased in six, and remained unchanged in four (California, Iowa, Indiana, and Missouri) for a three-month diffusion index of 68.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. The indexes increased in 27 states, decreased in 16, and remained unchanged in 7. Note: this graph includes states with minor increases (the Philly Fed lists as unchanged).

This is the fewest number of states showing increasing activity since January of this year.

Hotel Occupancy Rate: Just below 2008 levels

by Calculated Risk on 9/23/2010 02:03:00 PM

Hotel occupancy is one of several industry specific indicators I follow ...

From HotelNewsNow.com: STR: US hotels back on track in weekly results

Overall, the industry’s occupancy increased 6.7% to 63.5%, average daily rate was up 1.8% to US$100.25, and revenue per available room ended the week up 8.6% to US$63.66.The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change. The graph shows the 4-week average, not the weekly occupancy rate.

On a 4-week basis, occupancy is up 6.8% compared to last year (the worst year since the Great Depression) and 5.7% below the median for 2000 through 2007.

The occupancy rate has fallen below the levels of 2008 again - and 2008 was a tough year for the hotel industry!

Important: Even though the occupancy rate is close to 2008 levels, 2010 is a much more difficult year. The average daily rate (ADR) is off more than 10% from 2008 levels - so even with the similar occupancy rates, hotel room revenue is off sharply compared to two years ago.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Existing Home Inventory increases 1.5% Year-over-Year

by Calculated Risk on 9/23/2010 11:28:00 AM

Earlier the NAR released the existing home sales data for August; here are a couple more graphs ...

The first graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Although inventory decreased slightly from July 2010 to August 2010, inventory increased 1.5% YoY in August.

Note: Usually July is the peak month for inventory.

The year-over-year increase in inventory is especially bad news because the reported inventory is already historically very high (around 4 million), and the 11.6 months of supply in August is far above normal.

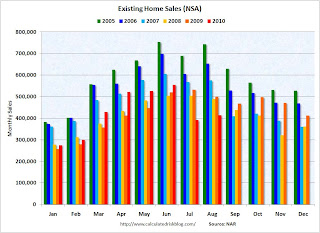

Based on the MBA mortgage purchase applications index, it appears there will be little increase in sales over the next couple of months (sales will probably remain in the low-to-mid 4 million SAAR range). That means we will see double digit months-of-supply for some time - and that suggests house prices will continue to fall. By request - the second graph shows existing home sales Not Seasonally Adjusted (NSA).

By request - the second graph shows existing home sales Not Seasonally Adjusted (NSA).

The red columns are for 2010. Sales for the last two months are significantly below the previous years, and sales will probably be well below the previous years for the remainder of 2010.

The bottom line: Sales were very weak in August - almost exactly at the levels I expected - and will continue to be weak for some time. Inventory is very high, and that will put downward pressure on house prices.