by Calculated Risk on 9/25/2010 06:46:00 PM

Saturday, September 25, 2010

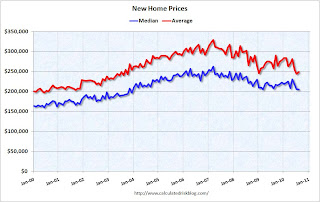

New Home Sales: Lowest Median Price since 2003

As part of the new home sales report, the Census Bureau reported that the median price for new homes fell to the lowest level since 2003.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the median and average new home price.

Some analysts pointed to the slight recovery in the median and average new home prices last year and into 2010 as evidence of the beginning of a recovery.

However in August, new home prices fell to the lowest level since 2003.

The second graph shows the percent of new home sales by price.

The second graph shows the percent of new home sales by price.

Over 52% of all home sales were under $200K in August - the highest percentage since 2003. (update: nemo notes the the median is over $200K in the first graph - this is an issue with rounding).

And 82.6% of new home sales were under $300K - the highest percentage under $300K since August 2002. Only 17.4% of new homes sales were over $300K in August.

To summarize: Not only are new home sales near record lows (slightly above the record in May 2010 on a seasonally adjusted annual rate basis), but the median prices are back to 2003 levels. And there are very few homes being sold above $300K.

Dubai: See-through office buildings are still being completed

by Calculated Risk on 9/25/2010 02:45:00 PM

Just a Saturday visit to Dubai ...

From Richard Spencer at the Telegraph: Dubai may have to knock down buildings constructed during boom (ht Eyal)

The report [from property firm Jones Lang LaSalle] said that between the end of 2007 and the first half of 2010, the amount of office space available in the city grew by 140 per cent – more than double – to 48 million square feet. But the increase in the space occupied was only 70 per cent.Talk about over building! Demolishing completed buildings probably doesn't make sense (it is the desert and the buildings will last a long time with little maintenance). Maybe they can convert the buildings to other uses, but they already have too many high rise condos too.

There were still new tenants moving in, but with 19 million square feet coming available this year, and more in 2011 and 2012, the vacancy rate would increase further, from 38 per cent now to over 50 per cent outside the central business district.

Just imagine the impact on unemployment as these buildings are completed over the next couple of years. (update: most construction related jobs are held by immigrants - and I was referring to the unemployment of those workers).

Unofficial Problem Bank List increases to 872 institutions

by Calculated Risk on 9/25/2010 11:31:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for September 24, 2010.

Changes and comments from surferdude808:

The Unofficial Problem Bank List underwent significant changes this week from failures and the FDIC releasing its enforcement actions for August 2010. The list finished the week at 872 institutions with assets of $422.4 billion, up from 854 institutions with assets of $416 billion last week.The list just keeps growing.

Changes this week include three removals and 21 additions. The removals are the two failures -- Haven Trust Bank Florida ($149 million) and North County Bank ($289 million) and one from an unassisted merger -- Sunrise Bank of Atlanta ($50 million).

Most notable among the additions are Lydian Private Bank, Palm Beach, FL ($1.96 billion); Universal Bank, West Covina, CA ($537 million); TruPoint Bank, Grundy, VA ($484 million); First Guaranty Bank and Trust Company of Jacksonville, Jacksonville, FL ($460 million); and First South Bank, Spartanburg, SC ($456 million Ticker: FSBS).

Other changes include Prompt Corrective Action Orders issued against Peoples State Bank ($445 million), LandMark Bank of Florida ($320 million), First Arizona Savings, a FSB ($272 million), American Patriot Bank ($108 million), and Idaho First Bank ($82 million).

WSJ: Committee to Save the Euro

by Calculated Risk on 9/25/2010 08:41:00 AM

An interesting back story in the WSJ: On the Secret Committee to Save the Euro, a Dangerous Divide

Two months after Lehman Brothers collapsed in the fall of 2008, a small group of European leaders set up a secret task force ... Its mission: Devise a plan to head off a default by a country in the 16-nation euro zone.And a year later - when Greece was near default - the committee hadn't agreed on a strategy. And that lead to the frantic last minute scramble to piece together a bailout for Greece - with Germany calling the shots.

Friday, September 24, 2010

Misc: Bernanke, "Toxie", GMAC, Credit Card debt and Housing

by Calculated Risk on 9/24/2010 10:46:00 PM

A few stories:

When we bought Toxie , in January of this year, she seemed like a great deal. We paid $1,000. That was 99 percent less than she cost dring the housing boom.And on the four housing reports this week: "Been down so long it looks like up to me", (book by Richard Fariña)

Every month, when homeowners paid their mortgages, we got a check. We thought we'd make back our investment before she died. But in the end, we collected only $449.

I'll have a weekly summary on Sunday.

Bank Failure #127: North County Bank, Arlington, Washington

by Calculated Risk on 9/24/2010 09:07:00 PM

From the FDIC: Whidbey Island Bank, Coupeville, Washington, Assumes All of the Deposits of North County Bank, Arlington, Washington

As of June 30, 2010, North County Bank had approximately $288.8 million in total assets and $276.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $72.8 million. ... North County Bank is the 127th FDIC-insured institution to fail in the nation this year, and the ninth in Washington.Just 2 this week? The unofficial problem bank list will be increasing ...