by Calculated Risk on 9/28/2010 09:00:00 AM

Tuesday, September 28, 2010

Case-Shiller: "Home Prices Stable in July"

S&P/Case-Shiller released the monthly Home Price Indices for July (actually a 3 month average of May, June and July).

This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Home Prices Remain Stable Around Recent Lows According to the S&P/Case-Shiller Home Price Indices

Data through July 2010, released today by Standard & Poor’s for its S&P/Case-Shiller Home Price Indices, the leading measure of U.S. home prices, show that the annual growth rates in 16 of the 20 MSAs and the 10- and 20-City Composites slowed in July compared to June 2010. The 10-City Composite is up 4.1% and the 20-City Composite is up 3.2% from where they were in July 2009. For June they were reported as +5.0% and +4.2%, respectively. Although home prices increased in most markets in July versus June, 15 MSAs and both Composites saw these monthly rates moderate in July.

Click on graph for larger image in new window.

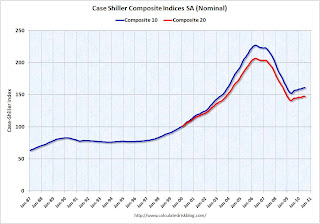

Click on graph for larger image in new window. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 29.0% from the peak, and flat in July (SA).

The Composite 20 index is off 28.6% from the peak, and down 0.1% in July (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 is up 4.0% compared to July 2009.

The Composite 20 is up 3.1% compared to July 2009.

The year-over-year changes appear to be rolling over - and will probably be negative later this year.

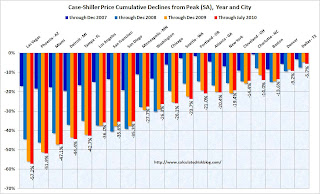

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in only 4 of the 20 Case-Shiller cities in July seasonally adjusted.

Prices increased (SA) in only 4 of the 20 Case-Shiller cities in July seasonally adjusted.Prices in Las Vegas are off 57.2% from the peak, and prices in Dallas only off 5.7% from the peak.

Prices probably declined just about everywhere in July, but this will not be evident in the Case-Shiller index until next month since the Case-Shiller index is an average of three months.

Monday, September 27, 2010

Bank of England official to savers: 'Start spending'

by Calculated Risk on 9/27/2010 10:28:00 PM

From the Telegraph: Savers told to stop moaning and start spending

[Bank of England deputy governor Charles Bean said] "Savers shouldn't necessarily expect to be able to live just off their income in times when interest rates are low. It may make sense for them to eat into their capital a bit."In the U.K., savers are receiving about £18 billion a year less in interest. In the U.S., using the monthly personal interest income data from the BEA, interest income is off about $143 billion from the peak - and falling ...

...

Mr Bean said that encouraging Britons to spend was one reason why the Bank had cut interest rates.

WSJ: Fed Weighs new QE Approach

by Calculated Risk on 9/27/2010 06:20:00 PM

From Jon Hilsenrath at the WSJ: Fed Weighs New Tactics to Bolster Recovery

Rather than announcing massive bond purchases with a finite end, as they did in 2009 to shock the U.S. financial system back to life, Fed officials are weighing a more open-ended, smaller-scale program that they could adjust as the recovery unfolds.Although QE2 isn't a done deal, I think it is very likely.

This article suggests two approaches: 1) a large scale purchase program ( longer-term Treasury securities), or 2) a smaller-scale program with the amounts set at each FOMC meeting.

In Fed Chairman Ben Bernanke's speech at Jackson Hole on Aug 27th, he seemed to favor the first approach:

The channels through which the Fed's purchases affect longer-term interest rates and financial conditions more generally have been subject to debate. I see the evidence as most favorable to the view that such purchases work primarily through the so-called portfolio balance channel, which holds that once short-term interest rates have reached zero, the Federal Reserve's purchases of longer-term securities affect financial conditions by changing the quantity and mix of financial assets held by the public. ...It is possible that they could do the smaller-scale program as a compromise (note: Hilsenrath clearly has great sources at the Fed). As I noted yesterday in Bernanke and QE2, there will be plenty of economic data between now and the two day meeting on November 2nd and 3rd, but the two key releases are the September employment report (to be released on October 8th) and the Q3 GDP advance estimate (to be released on October 29th). Barring a significant upside surprise in one or both of those reports, it appears likely that QE2 will arrive in November.

The logic of the portfolio balance channel implies that the degree of accommodation delivered by the Federal Reserve's securities purchase program is determined primarily by the quantity and mix of securities the central bank holds or is anticipated to hold at a point in time (the "stock view"), rather than by the current pace of new purchases (the "flow view").

Now the question is how will they do QE2.

Report: Morgan Stanley Freezes Investment-Bank Hiring

by Calculated Risk on 9/27/2010 04:03:00 PM

Another sign of weaker Wall Street earnings ...

From Bloomberg: Morgan Stanley Said to Freeze Investment-Bank Hiring for 2010 (ht Brian)

Morgan Stanley, the sixth-largest U.S. bank by assets, froze hiring at its investment-banking division for the rest of 2010 ... The freeze, which includes the New York-based firm’s sales and trading units, comes as weak trading and equity underwriting volume may lead the five largest Wall Street banks to post their lowest revenue from investment banking and trading since the fourth quarter of 2008.This follows the weak results at Jefferies last week, from the Financial Times: Trading slump hits Jefferies earnings

In a preview of what might loom for investment banks, a sharp slowdown in trading activity led Jefferies to report its worst quarter since the market hit bottom last year.

Brazil’s finance minister: World in “international currency war”

by Calculated Risk on 9/27/2010 01:27:00 PM

From the Financial Times: Brazil warns of ‘currency war’

Guido Mantega, Brazil’s finance minister, said on Monday the world was in an “international currency war” ... Mr Mantega, who has made increasingly aggressive comments recently about the need to control Brazil’s currency, said governments around the world were trying to weaken their currencies to promote competitiveness.It seems everyone wants to devalue to export more.

"We’re in the midst of an international currency war, a general weakening of currency. This threatens us because it takes away our competitiveness,” he said ...

excerpt with permission

As a reminder, Bernanke touched on devaluation in his well known 2002 speech: Deflation: Making Sure "It" Doesn't Happen Here

Although a policy of intervening to affect the exchange value of the dollar is nowhere on the horizon today, it's worth noting that there have been times when exchange rate policy has been an effective weapon against deflation. A striking example from U.S. history is Franklin Roosevelt's 40 percent devaluation of the dollar against gold in 1933-34, enforced by a program of gold purchases and domestic money creation. The devaluation and the rapid increase in money supply it permitted ended the U.S. deflation remarkably quickly. Indeed, consumer price inflation in the United States, year on year, went from -10.3 percent in 1932 to -5.1 percent in 1933 to 3.4 percent in 1934.Bernanke also said in 2002:

I want to be absolutely clear that I am today neither forecasting nor recommending any attempt by U.S. policymakers to target the international value of the dollar.Of course a lower dollar only helps U.S. competitiveness with countries not pegged to the dollar - and not intervening in their currency. It sounds like Brazil might be intervening soon.

Dallas Fed: Manufacturing activity rose slightly in September

by Calculated Risk on 9/27/2010 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Picks Up and Six-Month Outlook Improves

Texas factory activity rose slightly in September, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, edged back into positive territory following a reading near zero in August.This report is at best mixed, especially with new orders down again.

Other factory activity indicators also improved in September. The new orders and shipments indexes remained negative for the fourth month in a row but moved up from their August levels. The growth rate of orders index jumped from –13 to zero, suggesting the pace of incoming orders may be stabilizing. Meanwhile, the September capacity utilization index climbed back into positive territory ...

Measures of general business conditions continued to worsen. The general business activity index pushed further negative this month, falling to –18. The company outlook index dipped back into negative territory, with 25 percent of firms reporting a worsened outlook, the highest share in more than a year.

Labor market indicators improved slightly in September. The employment index turned positive, up from a negative reading in August. Nineteen percent of respondents said they hired additional employees, while 17 percent noted layoffs. Hours worked were largely unchanged, while wages and benefits rose modestly.

The Richmond Fed survey will be released tomorrow and the Kansas City Fed survey on Thursday. Earlier this month, the Philly Fed survey showed contraction, the NY Fed survey showed manufacturing growth slowing.

The national ISM manufacturing survey will be released on Friday.