by Calculated Risk on 10/04/2010 01:13:00 PM

Monday, October 04, 2010

Consumer Bankruptcy Filings increase in September

Via MarketWatch: Consumer bankruptcy filings climb 11%

The American Bankruptcy Institute reported that there were 130,329 consumer bankruptcies filings in September, up 3.3% from August. Filings were up 11% over the first 9 months of the year compared to the first 9 months of 2009.

"We expect that there will be nearly 1.6 million new bankruptcy filings by year end," ABI Executive Director Samuel Gerdano said.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter using monthly data from the ABI and previous quarterly data from USCourts.gov.

In 2005 the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005" was enacted. Since then the number of bankruptcy filings has increased steadily.

Fed's Sack: Managing the Federal Reserve’s Balance Sheet

by Calculated Risk on 10/04/2010 11:30:00 AM

This speech suggests to me that the Fed is prepared to embark on QE2 (subject to incoming data), and the program will be incremental - and persistent - and the amount of QE announced at each FOMC meeting. This is a long excerpt, but the speech has a number of key points.

From New York Fed EVP Brian Sack: Managing the Federal Reserve’s Balance Sheet

The sluggish outlook for the economy and the risks that surround that outlook have raised the possibility of further monetary policy accommodation.

...

The FOMC has several policy tools that it could use to achieve more accommodative financial conditions, as Chairman Bernanke discussed in his speech at the Jackson Hole symposium in August. My remarks today will focus on one of those options—changing the size of the Federal Reserve's holdings of securities. In particular, I will review the FOMC’s recent decision to keep the size of those security holdings at their current level, and I will discuss some of the issues to be considered in any decision on whether to expand them further.

...

In terms of the benefits, balance sheet expansion appears to push financial conditions in the right direction, in that it puts downward pressure on longer-term real interest rates and makes broader financial conditions more accommodative. One can reach that judgment based on the empirical evidence from the earlier round of asset purchases, as mentioned before. In addition, the market responses to more recent news about the balance sheet also lean in this direction. The market response to the reinvestment decision at the August FOMC meeting seemed largely in line with the estimated effects from the earlier round of asset purchases, once we account for the size of the surprise and the anticipatory pricing that occurred ahead of its announcement. And the increased expectations for balance sheet expansion in response to the September FOMC statement also generated a sizable market response.

To be sure, I think it is fair to say that this is an imperfect policy tool. Even under the estimates noted earlier, the Federal Reserve had to increase its securities holdings considerably to induce the estimated 50 basis point response of longer-term rates. In addition, there is a large degree of uncertainty surrounding the estimates of these effects, given our limited experience with this instrument. Lastly, it is reasonable to assume that the effects of balance sheet expansion would diminish at some point, especially if yields were to move to extremely low levels. Nevertheless, the tool appears to be working, and it is not clear that we have yet reached a point of diminishing effects.

Some observers have argued that balance sheet changes, even if they influence longer-term interest rates, will not affect the economy because the transmission mechanism is broken. This point is overstated in my view. It is true that certain aspects of the transmission mechanism are clogged because of the credit constraints facing some households and businesses, and it is true that monetary policy cannot directly target those parties that are the most constrained. Nevertheless, balance sheet policy can still lower longer-term borrowing costs for many households and businesses, and it adds to household wealth by keeping asset prices higher than they otherwise would be. It seems highly unlikely that the economy is completely insensitive to borrowing costs and wealth, or to other changes in broad financial conditions.

...

Designing a Purchase Program

...

First, should the balance sheet be adjusted in relatively continuous but smaller steps, or in infrequent but large increments? The earlier round of asset purchases involved the latter approach, which caused the market response to be concentrated in several days on which significant announcements were made. That might have been appropriate in circumstances when substantial and front-loaded policy surprises had benefits, but different approaches may be warranted in other circumstances. Indeed, it contrasts with the manner in which the FOMC has historically adjusted the federal funds rate, which has typically involved incremental changes to the policy instrument.

Second, how responsive should the balance sheet be to economic conditions? Historically, the FOMC has determined the federal funds target rate based on the Committee’s assessment of the outlook for economic growth and inflation. If changes in the balance sheet are now acting as a substitute for changes in the federal funds rate, then one might expect balance sheet decisions to also be governed to a large extent by the evolution of the FOMC’s economic forecasts. The earlier purchase program, in contrast, did not demonstrate much responsiveness to changes in economic or financial conditions. Indeed, the execution of the program largely involved confirming the expectations that were put in place by the two early announcements.

Third, how persistent should movements in the balance sheet be? An important feature of traditional monetary policy is that movements in the federal funds rate are not quickly reversed, which makes them more influential on broader financial conditions. A change that was expected to be transitory would instead move conditions very little. For similar reasons, one could argue that movements in the balance sheet should have some persistence in order to be more effective.

Fourth, to what extent should the FOMC communicate about the likely path of the balance sheet? The FOMC often communicates about the path of the federal funds rate or provides other forward-looking information that allows market participants to anticipate that path. This anticipation of policy actions is beneficial, as it brings forward their effects and thus helps to stabilize the economy. For the same reason, providing information about the likely course of the balance sheet could be desirable. In fact, such communication might be particularly important in the current circumstances, because financial market participants have no history from which to judge the FOMC’s approach and anticipate its actions.

Fifth, how much flexibility should the FOMC retain to change its policy approach? The original asset purchase programs specified the amount and distribution of purchases well in advance. However, the FOMC would be learning about the costs and benefits of its balance sheet changes as it implemented a new program. This might call for some flexibility to be incorporated into the program, providing some discretion to change course as market conditions evolve and as more is learned about the instrument.

Pending Home Sales increase 4.3% in August

by Calculated Risk on 10/04/2010 10:06:00 AM

From the NAR: Pending Home Sales Show Another Gain

The Pending Home Sales Index ... rose 4.3 percent to 82.3 based on contracts signed in August from a downwardly revised 78.9 in July, but is 20.1 percent below August 2009 when it was 103.0. The data reflects contracts and not closings, which normally occur with a lag time of one or two months.July was revised down from 79.4. Tom Lawler forecast an increase of about 4% - right on again.

This suggests some bounce back in existing home sales in September and October, but months-of-supply will probably still be in double digits - putting downward pressure on house prices.

Rates keep falling: 2-Year Treasury Yield Hits Record Low

by Calculated Risk on 10/04/2010 09:00:00 AM

Just a look at falling treasury yields and mortgage rates ...

From Reuters: US 2-Year Treasury Yield Hits Record Low

The two-year U.S. Treasury note yield fell to a record low of 0.403 percent on Monday ... the 30-year T-bond rose almost a full point in price to yield 3.676 percent, down 4 bps.The 10-year yield is down to 2.49% and, according to Freddie Mac (for the week ending Sept 30th): "The 30-year fixed-rate mortgage rate [4.32 percent] dropped to tie the survey’s all-time low and the 15-year fixed-rate [3.75 percent] set another record low." And mortgage rates have probably fallen further over the last week.

Lots of records ...

Sunday, October 03, 2010

Nightly Mortgage Mess

by Calculated Risk on 10/03/2010 11:32:00 PM

Note: Here is the weekly schedule for Oct 3rd, and the summary for last week.

A few articles ...

From Gretchen Morgenson at the NY Times: Flawed Paperwork Aggravates a Foreclosure Crisis

The implications are not yet clear for borrowers who have been evicted from their homes as a result of improper filings. But legal experts say that courts may impose sanctions on lenders or their representatives or may force banks to pay borrowers’ legal costs in these cases.Sanctions and awarding the defendants legal costs are likely - and it will be costly to fix these errors, but it is very unlikely in a foreclosure case that a judge will dismiss the bank's complaint with prejudice.

Judges may dismiss the foreclosures altogether, barring lenders from refiling and awarding the home to the borrower. That would create a loss for the lender or investor holding the note underlying the property. Almost certainly, lawyers say, lawsuits on behalf of borrowers will multiply.

The facts of these cases are 1) the borrower had a mortgage, and 2) the borrower is seriously delinquent (with the exception of a few cases with outright errors). Those facts are not in dispute. Just something to remember when reading these stories.

From Robbie Whelan at the WSJ: Foreclosure? Not So Fast

Israel Machado's foreclosure started out as a routine affair. In the summer of 2008, as the economy began to soften, Mr. Machado's pool-cleaning business suffered and like millions of other Americans, he fell behind on his $400,000 mortgage.That explains why Machado (and I suppose others) are hiring attorneys - they are trying to get the banks to do a principal reduction.

But Mr. Machado's response was unlike most other Americans'. Instead of handing his home over to the lender, IndyMac Bank FSB, he hired Ice Legal LP in nearby Royal Palm Beach to fight the foreclosure. ...

Mr. Machado and his lawyer, Tom Ice, say they now want to convince the owners of the mortgage to cut Mr. Machado's loan balance to between $150,000 and $200,000—the current selling price for comparable homes in his community near West Palm Beach. "The whole intent was to get them to come to the negotiating table, to get me in a fixed-rate mortgage that worked," Mr. Machado said.

And from the NY Times editorial: On the Foreclosure Front

It is hard to be shocked. During the bubble, banks and other lenders ignored loan standards and stuffed the mortgage pipeline with toxic loans and related securities. Since the bubble burst, efforts to rework bad loans have been slowed by the lenders’ resistance, and by their incompetence.

...

The robo-signing scandal is yet another reminder that it is folly to rely on banks that got us into this mess to get us out.

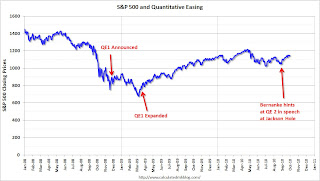

A QE1 Timeline

by Calculated Risk on 10/03/2010 05:21:00 PM

Note: Here is the weekly schedule for Oct 3rd, and the summary for last week.

QE2 will probably arrive on November 3rd. By request here is a look back at the QE1 announcements (phased in over a few months):

S&P 500: 851.81

The Federal Reserve announced

the purchase of the direct obligations of housing-related government-sponsored enterprises (GSEs)--Fannie Mae, Freddie Mac, and the Federal Home Loan Banks--and mortgage-backed securities (MBS) backed by Fannie Mae, Freddie Mac, and Ginnie Mae.

...

Purchases of up to $100 billion in GSE direct obligations under the program will be conducted with the Federal Reserve's primary dealers through a series of competitive auctions and will begin next week. Purchases of up to $500 billion in MBS will be conducted by asset managers selected via a competitive process with a goal of beginning these purchases before year-end. Purchases of both direct obligations and MBS are expected to take place over several quarters.

S&P 500: 913.18

As previously announced, over the next few quarters the Federal Reserve will purchase large quantities of agency debt and mortgage-backed securities to provide support to the mortgage and housing markets, and it stands ready to expand its purchases of agency debt and mortgage-backed securities as conditions warrant. The Committee is also evaluating the potential benefits of purchasing longer-term Treasury securities.

S&P 500: 874.09

The Federal Reserve continues to purchase large quantities of agency debt and mortgage-backed securities to provide support to the mortgage and housing markets, and it stands ready to expand the quantity of such purchases and the duration of the purchase program as conditions warrant. The Committee also is prepared to purchase longer-term Treasury securities if evolving circumstances indicate that such transactions would be particularly effective in improving conditions in private credit markets.

S&P 500: 794.35

To provide greater support to mortgage lending and housing markets, the Committee decided today to increase the size of the Federal Reserve’s balance sheet further by purchasing up to an additional $750 billion of agency mortgage-backed securities, bringing its total purchases of these securities to up to $1.25 trillion this year, and to increase its purchases of agency debt this year by up to $100 billion to a total of up to $200 billion. Moreover, to help improve conditions in private credit markets, the Committee decided to purchase up to $300 billion of longer-term Treasury securities over the next six months.

Click on graph for larger image in new window.

Click on graph for larger image in new window.S&P 500: 1064.79

This is not investment advice!