by Calculated Risk on 10/08/2010 11:36:00 PM

Friday, October 08, 2010

Late night Foreclosure-Gate

From Dina ElBoghdady at the WaPo: Buyers anxiously await foreclosure deals to go through

From David Streitfeld and Nelson Schwartz at the NY Times: Largest U.S. Bank Halts Foreclosures in All States

Note: the media is in a frenzy about this, but I've hardly mentioned it other than linking to a few articles and posting Tom Lawler's piece about Who will, and who should "pay"?.

Best to all.

Employment posts today (with many graphs):

Daily Show on Foreclosure-Gate

by Calculated Risk on 10/08/2010 07:26:00 PM

While we wait for the FDIC ...

From the Daily Show (link if embed doesn't work) Foreclosure Crisis

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Foreclosure Crisis | ||||

| www.thedailyshow.com | ||||

| ||||

Impact of estimated Benchmark Revision on Job Losses

by Calculated Risk on 10/08/2010 03:05:00 PM

This morning I mentioned the annual benchmark revision for the employment report - here are some more details, and a graph showing the impact on job losses.

As part of the employment report, the BLS released the preliminary annual benchmark revision of minus 366,000 payroll jobs. This will be finalized next February when the January 2011 employment report is released. Usually the preliminary estimate is pretty close to the final benchmark estimate.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the impact of the preliminary benchmark revision on job losses in percentage terms from the start of the employment recession.

The red line on the graph is the current estimate, and the dotted line shows the impact of estimated coming benchmark revision. This puts the current payroll employment about 8.1 million jobs below the pre-recession peak in December 2007.

Using the preliminary benchmark estimate, this means that payroll employment in March 2010 was 366,000 lower than originally estimated. This is slightly larger than a normal adjustment (see table below). So in February 2011, the payroll numbers will be revised down to reflect this estimate. The number is then "wedged back" to the previous revision (March 2009).

For details on the benchmark revision process, see from the BLS: Methodology

"The benchmark adjustment, a standard part of the payroll survey estimation process, is a once-a-year re-anchoring of the sample-based employment estimates to full population counts available principally through unemployment insurance (UI) tax records filed by employers with State Employment Security Agencies."The following table shows the benchmark revisions since 1979.

| Year | Percent difference | Difference in thousands |

|---|---|---|

| 1979 | 0.5 | 447 |

| 1980 | -0.1 | -63 |

| 1981 | -0.4 | -349 |

| 1982 | -0.1 | -113 |

| 1983 | * | 36 |

| 1984 | 0.4 | 353 |

| 1985 | * | -3 |

| 1986 | -0.5 | -467 |

| 1987 | * | -35 |

| 1988 | -0.3 | -326 |

| 1989 | * | 47 |

| 1990 | -0.2 | -229 |

| 1991 | -0.6 | -640 |

| 1992 | -0.1 | -59 |

| 1993 | 0.2 | 263 |

| 1994 | 0.7 | 747 |

| 1995 | 0.5 | 542 |

| 1996 | * | 57 |

| 1997 | 0.4 | 431 |

| 1998 | * | 44 |

| 1999 | 0.2 | 258 |

| 2000 | 0.4 | 468 |

| 2001 | -0.1 | -123 |

| 2002 | -0.2 | -313 |

| 2003 | -0.2 | -122 |

| 2004 | 0.2 | 203 |

| 2005 | -0.1 | -158 |

| 2006 | 0.6 | 752 |

| 2007 | -0.2 | -293 |

| 2008 | -0.1 | -89 |

| 2009 | -0.7 | -902 |

| 2010 | -0.3 | -366 estimate |

Earlier employment posts today (with many graphs):

Unemployment by Level of Education and Employment Diffusion Indexes

by Calculated Risk on 10/08/2010 12:34:00 PM

By request ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.

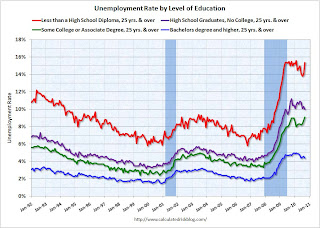

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

Note that the unemployment rate increased sharply for all four categories in 2008 and into 2009.

Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - but education didn't seem to matter as far as the recovery rate in unemployment following the 2001 recession. All four groups recovered slowly.

Earlier this year, the group with "less than a high school diploma" recovered a little better than the more educated groups - possibly because of the tax credit related increase in construction - but that changed in September as the unemployment rate increased sharply.

For the group with some college or an associate degree, the unemployment rate is at a new high for this employment recession.

Diffusion Indexes

This is a little more technical ...

The BLS diffusion index for total private employment declined to 49.8 from 54.1 in August. For manufacturing, the diffusion index declined to 46.3 from 48.2 in August.

The BLS diffusion index for total private employment declined to 49.8 from 54.1 in August. For manufacturing, the diffusion index declined to 46.3 from 48.2 in August.

Both indexes are down sharply from earlier this year.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.The increases in the diffusion indexes in 2009 and earlier this year, was a clear positive in the monthly employment reports. However the decrease in the diffusion indexes over the last few months (falling below 50% for both in September), is disappointing.

Earlier employment posts today (with many graphs):

Employment-Population Ratio, Part Time Workers, Unemployed over 26 Weeks

by Calculated Risk on 10/08/2010 09:50:00 AM

Here are a few more graphs based on the employment report ...

Percent Job Losses During Recessions, aligned at Bottom

Click on graph for larger image.

Click on graph for larger image.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at the bottom of the recession (Both the 1991 and 2001 recessions were flat at the bottom, so the choice was a little arbitrary).

The dotted line shows the impact of Census hiring. As of the end of September, there were only 6,000 temporary 2010 Census workers still on the payroll. So the gap between the solid and dashed red lines is almost completely gone.

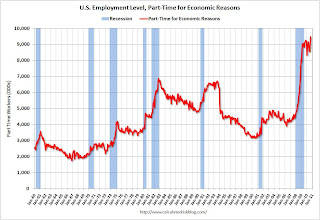

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) rose by 612,000 over the month to 9.5 million. Over the past 2 months, the number of such workers has increased by 943,000. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) was at 9.472 million in September, up sharply from August.

This is a new record high, and is obviously bad news.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 17.1% in September from 16.7% in August. The high for U-6 was 17.4% in October 2009. Grim.

Employment-Population Ratio

The Employment-Population ratio was steady at 58.5% in September (the same as in August).

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.Note: the graph doesn't start at zero to better show the change.

The Labor Force Participation Rate was also steady at 64.7% in September. This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years.

When the employment picture eventually improves, people will return to the labor force and the participation rate will increase from these very low levels. And that will put upward pressure on the unemployment rate.

Unemployed over 26 Weeks

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.According to the BLS, there are 6.123 million workers who have been unemployed for more than 26 weeks and still want a job. This is 4.0% of the civilian workforce. It appears the number of long term unemployed has peaked ... Although this may be because people are giving up.

The number of long term unemployed is staggering - still over 6 million people who are looking for a job.

Summary

The underlying details of the employment report were grim. The number of private sector jobs increased modestly by 64,000, otherwise ...

The negatives include the loss of 18,000 jobs ex-Census, the sharp increase in part time workers for economic reasons (and jump in U-6 unemployment rate), hours worked were flat (down for manufacturing workers), the employment-population ratio and labor force participation were flat at very low levels, and the unemployment rate was flat at a very high level.

Overall this was a weak report.

September Employment Report: 18K Jobs Lost ex-Census, 9.6% Unemployment Rate

by Calculated Risk on 10/08/2010 08:30:00 AM

Note: This will be the last "ex-Census" report this decade.

From the BLS:

Nonfarm payroll employment edged down (-95,000) in September, and the unemployment rate was unchanged at 9.6 percent, the U.S. Bureau of Labor Statistics reported today. Government employment declined (-159,000), reflecting both a drop in the number of temporary jobs for Census 2010 and job losses in local government. Private-sector payroll employment continued to trend up modestly (+64,000).Census 2010 hiring decreased 77,000 in September. Non-farm payroll employment decreased 18,000 in September ex-Census.

Both July and August payroll employment were revised down. The change in total nonfarm payroll employment for July was revised from -54,000 to -66,000, and the change for August was revised from -54,000 to -57,000.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate vs. recessions.

Nonfarm payrolls decreased by 95 thousand in August. The economy has gained 334 thousand jobs over the last year, and lost 7.75 million jobs since the recession started in December 2007.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).The dotted line is ex-Census hiring. The two lines have joined since the decennial Census is almost over.

For the current employment recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Note: The preliminary benchmark payroll revision is minus 366,000 jobs. This is a little larger than the normal adjustment (last year was especially large). The actual adjustment will be made in February 2011. This is the preliminary estimate of the annual revision, from the BLS: "The benchmark adjustment, a standard part of the payroll survey estimation process, is a once-a-year re-anchoring of the sample-based employment estimates to full population counts available principally through unemployment insurance (UI) tax records filed by employers with State Employment Security Agencies."

This is another weak employment report. I'll have much more soon ...

For more, see next post: Employment-Population Ratio, Part Time Workers, Unemployed over 26 Weeks