by Calculated Risk on 10/17/2010 02:15:00 PM

Sunday, October 17, 2010

Schedule for Week of Oct 17th

Note: The previous post was the weekly summary for last week.

Two key housing reports will be released this week: September housing starts (Tuesday) and October homebuilder confidence (Monday). Also the Fed will release September industrial production and capacity utilization (Tuesday).

Update: Large bank earnings added for comments on Foreclosure-Gate.

CoreLogic House Price Index for August. This release will probably show further declines in house prices. The index is a weighted 3 month average for June, July and August.

Making Home Affordable Program (HAMP) for September and the “Housing Scorecard”

8:00 AM ET: Citigroup Third Quarter 2010 Earnings Review

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for September. The consensus is for a 0.2% increase in Industrial Production, and an increase to 74.8% (from 74.7%) for Capacity Utilization.

10 AM: The October NAHB homebuilder survey. This index collapsed following the expiration of the home buyer tax credit. The consensus is for a slight increase to 14 from 13 in September (still very depressed).

12:55 PM Atlanta Fed President Dennis Lockhart speaks at Savannah Rotary Club.

8:00 AM: Bank of America Q3 2010 Earnings

8:00 AM: Goldman Sachs earnings

8:30 AM: Housing Starts for September. Housing starts also collapsed following the expiration of the home buyer tax credit. The consensus is for a decrease to 580,000 (SAAR) in September from 598,000 in August. Note: the August increase was mostly from multi-family starts.

Morning: Moody's/REAL Commercial Property Price Index (CPPI) for August.

Various Fed Speeches scheduled: NY Fed's Dudley, Chicago Fed’s Evans at about 10 AM, Dallas Fed’s Fisher and Minneapolis Fed’s Kocherlakota at about 1:00 PM.

Early: The AIA's Architecture Billings Index for September will be released (a leading indicator for commercial real estate). This has been showing ongoing contraction, and usually this leads investment in non-residential structures (hotels, malls, office) by 9 to 12 months.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index declined sharply following the expiration of the tax credit, and the index has only recovered slightly over the last few months even with record low mortgage rates.

7:30 AM: Morgan Stanley third quarter 2010 financial results

8:00 AM: Wells Fargo earnings

2:00 PM: The Fed’s Beige Book for early October. This is anecdotal information on current economic conditions.

Fed Speeches: Philly Fed's Plosser at about 1:00 PM and Richmond Fed's Lacker at 4:00 PM.

8:30 AM: The initial weekly unemployment claims report will be released. Consensus is for about a decrease to 455,000 from 462,000 last week (still elevated).

10:00 AM: Philly Fed Survey for October. This survey showed contraction over the last two months. The consensus is for a slight increase to 1.8 from -0.7 in September.

10:00 AM: Conference Board's index of leading indicators for August. The consensus is for a 0.3% increase in this index.

Fed Speeches: St Louis Fed's Bullard at about 10:00 AM, and Kansas City Fed's Hoenig at 9:45 PM.

10:00 AM: the BLS will release the Regional and State Employment and Unemployment report for September.

After 4:00 PM: The FDIC will probably have another busy Friday afternoon ...

Summary for Week ending Oct 16th

by Calculated Risk on 10/17/2010 08:45:00 AM

A summary of last week - mostly in graphs.

Perhaps the biggest story of last week was the speech from Fed Chairman Ben Bernanke: Monetary Policy Objectives and Tools in a Low-Inflation Environment.

Although he didn't outline any specific details, he clearly stated that the unemployment rate was too high and inflation too low. Here are the key sentences:

"[I]nflation is running at rates that are too low relative to the levels that the Committee judges to be most consistent with the Federal Reserve's dual mandate in the longer run.That strongly suggests QE2 will arrive on November 3rd.

...

[U]nemployment is clearly too high relative to estimates of its sustainable rate. Moreover, with output growth over the next year expected to be only modestly above its longer-term trend, high unemployment is currently forecast to persist for some time."

On a monthly basis, retail sales increased 0.6% from August to September (seasonally adjusted, after revisions - August sales were revised up), and sales were up 7.3% from September 2009. Retail sales increased 0.4% ex-autos - about at expectations.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 9.6% from the bottom, but still off 3.2% from the pre-recession peak.

Retail sales had moved mostly moved sideways for six months, but this is now the high for the year.

Here is a graph from the NY Fed.

Here is a graph from the NY Fed."The general business conditions index rose 12 points, to 15.7. The new orders and shipments indexes were also positive and well above their September levels.

...

The index for number of employees climbed for a third consecutive month, although the average workweek index dipped slightly."

These regional surveys had been showing a slowdown in manufacturing and are being closely watched right now. This was above expectations.

Three measures of inflation: core CPI, median CPI and trimmed-mean CPI, were all below 1% in September, and also under 1% for the last 12 months.

This graph shows these three measure of inflation on a year-over-year basis.

This graph shows these three measure of inflation on a year-over-year basis.From the Cleveland Fed: "Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.2% annualized rate) in September. The CPI less food and energy was unchanged at 0.0% (0.0% annualized rate) on a seasonally adjusted basis.

Over the last 12 months, the median CPI rose 0.5%, the trimmed-mean CPI rose 0.8%, the CPI rose 1.1%, and the CPI less food and energy rose 0.8%"

They all show that inflation has been falling, and that measured inflation is up less than 1% year-over-year. Core CPI and median CPI were flat in September, and the 16% trimmed mean CPI was up 0.1%.

Here are a few graphs based on the NFIB press release: Small Business Optimism Index Remains at Recessionary Level

This graph shows the small business optimism index since 1986. Although the index increased slightly in September, it is still at recessionary level according to NFIB Chief Economist Bill Dunkelberg who said: "The downturn may be officially over, but small business owners have for the most part seen no evidence of it."

This graph shows the small business optimism index since 1986. Although the index increased slightly in September, it is still at recessionary level according to NFIB Chief Economist Bill Dunkelberg who said: "The downturn may be officially over, but small business owners have for the most part seen no evidence of it." This graph shows the net hiring plans over the next three months.

This graph shows the net hiring plans over the next three months.Hiring plans have turned negative again. According to NFIB: "Over the next three months, eight percent plan to increase employment (unchanged), and 16 percent plan to reduce their workforce (up three points), yielding a seasonally adjusted net negative three percent of owners planning to create new jobs, down four points from August."

This graph shows the percent of small businesses saying "poor sales" is their biggest problem.

This graph shows the percent of small businesses saying "poor sales" is their biggest problem.Usually small business owners complain about taxes and regulations (that usually means business is good!), but now their self reported biggest problem is lack of demand.

"The Ceridian-UCLA Pulse of Commerce Index™ (PCI), a real-time measure of the flow of goods to U.S. factories, retailers, and consumers, fell .5 percent in September after falling 1.0 percent in August ... The decline indicates four consecutive months of limited to no increases in over the road movement of produce, raw materials, goods-in-process and finished goods since the PCI peaked in May 2010."

"The Ceridian-UCLA Pulse of Commerce Index™ (PCI), a real-time measure of the flow of goods to U.S. factories, retailers, and consumers, fell .5 percent in September after falling 1.0 percent in August ... The decline indicates four consecutive months of limited to no increases in over the road movement of produce, raw materials, goods-in-process and finished goods since the PCI peaked in May 2010."This graph shows the index since January 1999.

This is a new index, and doesn't have much of a track record in real time, although the data suggests the recovery has "stalled" since May.

From MarketWatch: Consumer sentiment edges lower in October

From MarketWatch: Consumer sentiment edges lower in October The preliminary Reuters-University of Michigan consumer sentiment index edged lower in October, falling to 67.9 ... from 68.2 last month.

Consumer sentiment is a coincident indicator - and this suggests a sluggish economy.

This was a big story in July when consumer sentiment collapsed to the lowest level since late 2009.

It has moved sideways since then ...

This year’s Nobel Memorial Prize in Economic Science ... was awarded today to Peter A. Diamond, Dale T. Mortensen and Christopher A. Pissarides for their research on “markets with search frictions,” which means any setting where buyers and sellers don’t automatically find each other.

Best wishes to all.

Saturday, October 16, 2010

Foreclosure-Gate: The Lowest Bidder

by Calculated Risk on 10/16/2010 10:42:00 PM

In the previous post I asked Why did the mortgage servicers use "robo-signers"?

Note: Apparently not all servicers used "robo-signers", but several of them did.

This might be an example of the "lowest bidder", from Ariana Eunjung Cha and Zachary Goldfarb at the WaPo: For foreclosure processors hired by mortgage lenders, speed equaled money

The law firm of David J. Stern in Plantation, Fla., for instance, assigned a team of 12 to handle 12,000 foreclosure files at once ... Each time a case was processed without a challenge from the homeowner, the firm was paid $1,300. ...What a mess.

The office was so overwhelmed with work that managers kept notary stamps lying around for anyone to use. Bosses would often scream at each other in daily meetings for "files not moving fast enough," Tammie Lou Kapusta, the senior paralegal in charge of the operation, said in a deposition Sept. 22 for state law enforcement officials who are conducting a fraud investigation into the firm. ... "The girls would come out on the floor not knowing what they were doing," Kapusta said. "Mortgages would get placed in different files. They would get thrown out. There was just no real organization when it came to the original documents."

Why did the mortgage servicers use "robo-signers"?

by Calculated Risk on 10/16/2010 07:53:00 PM

This is a difficult topic to write about because of all the hysteria, emotion and misinformation, but here goes ...

One of the interesting questions with "Foreclosure-Gate" is why several (but not all) mortgage servicers used "robo-signers". This includes GMAC, JPMorganChase, and several other servicers.

First, we have to remember that every foreclosure is a personal tragedy. I support alternatives to foreclosure including modifications, cram-downs, and even short sales. And before another person claims that I support the banks, I fully support fines, sanctions, disbarment, and the investigations by the 50 future governors (the state attorney generals) into "Foreclosure-Gate".

Second, "Foreclosure-Gate" is primarily about "robo-signers". Some people are trying to conflate other sloppy procedures, cost cutting and even MERS (Mortgage Electronic Registration Systems) into "Foreclosure-Gate". This is just confusing readers. All of the servicers who have put foreclosures on hold have done so either because they had "robo-signers" or because they wanted to verify that their processes did not use "robo-signers" (or anything similar). There are valid questions about MERS and other "cost cutting" measures - although most reports I've seen are grossly misinformed - but unfortunately it takes time to get that right (I'll write about that at a later date).

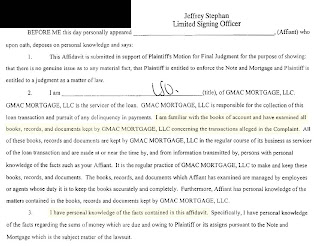

A review: "Robo-signers" are individuals who signed affidavits stating that they had "personal knowledge" of the facts in a foreclosure case, when in fact they did not.

JPM admitted as much this week: "We've identified issues relating to the mortgage foreclosure affidavits and those include signers not having personally reviewed the underlying loan files but instead having relied upon the work of others."

There were also situations of questionable notarization of the affidavits.

Here is an excerpt that I posted earlier from an affidavit signed by alleged "robo-signer" Jeffrey Stephen of GMAC:

I've highlighted a couple of sentences in yellow. Source: Stopa Law Blog

According to the affidavit the affiant claims to have "examined" the details of the transactions in the complaint, and that he has "personal knowledge of the facts contained in the affidavit". In a deposition - according to media reports - the affiant admitted to just signing the documents without verifying the details.

So back to the original question: why did some servicers use "robo-signers"?

I think there are several reasons: the flood of foreclosures, the lack of experienced staff, cost cutting - and also because several of the servicers seemed to use the same service providers to set up their processes (probably the lowest bidder).

Way back in February 2007, Tanta wrote: Mortgage Servicing for UberNerds. Tanta made it clear there are times when servicers are really hurting:

1) When rates are falling and borrowers are refinancing. The servicers get paid a slice of each monthly payment, however their fixed costs are front-loaded. So if people are refinancing too quickly, the servicer doesn't receive enough payments to recoup their fixed costs, and ...

2) When the 90+ day delinquency bucket is increasing rapidly. Although the servicer will eventually recoup the costs for foreclosure, the servicers are usually required to pay property taxes, insurance and all the expenses of foreclosure until the REO is sold.

And right now mortgage rates are falling, and many borrowers are refinancing. And at the same time the 90+ day bucket is at record levels and the servicers are swamped with foreclosure activity. So these are the worst of economic times for servicers.

So, to cut costs and control cash flow, some servicers outsourced foreclosures to the lowest bidders. Here is a possible example from Barry Meir at the NY Times: Foreclosure Mess Draws in the Lawyers Who Handled Them.

And this brings us to another key point that Tanta made in 2007:

[W]hen recovery values in a foreclosure are high (in an RE boom), servicers can noodle along and rack up expenses you didn’t know existed—i.e., shove as much of your “overhead” into FC expenses as you can get away with, since someone else will eventually pay the tab. That’s what we mean when we say that you used to be able to make money off a foreclosure. When the liquidation value starts to approach or drop under the loan amount, on the other hand, investors and insurers start going over those expense reports with a fine-toothed comb, and it can end up in [a] “war”.To no ones surprise, most liquidation values are far below the loan amounts, and investors and insurers are fighting over every servicer expense. This has pushed the servicers to do foreclosures as cheaply as possible (along with the cash flow reasons).

So my guess is a combination of getting swamped with foreclosures, lack of experienced staff, the poor economic environment for servicers, and outsourcing to the lowest bidder, all contributed to the servicers using "robo-signers". This doesn't excuse their behavior - I'm just trying to understand why this happened - and why it happened at more than one servicer.

Of course using the lowest bidders, and ending up with a flawed legal process, is going to lead to even larger battles over expenses between the investors and servicers. So instead of saving money, this is going to be far more expensive for certain servicers.

Fed's Evans suggests a Price Level Target

by Calculated Risk on 10/16/2010 03:19:00 PM

From Chicago Fed President Charles Evans: Monetary Policy in a Low-Inflation Environment: Developing a State-Contingent Price-Level Target

I think there are special circumstances when price-level targeting would be a helpful complement to our current and prospective strategies in the U.S. ... There are quite a number of academic studies of liquidity trap crises that find either price-level targeting or temporary above-average inflation to be nearly optimal policies; and yet, central bankers and the public generally loathe the idea that even a temporarily higher inflation rate could be beneficial or be consistent with price stability over the longer term.Evans suggests committing to low rates until the price level target is achieved. That way investor know that rates will stay low even with an increase in inflation. Once the price level is achieved, the Fed will move back to a 2% inflation target.

...

In my opinion, much more policy accommodation is appropriate today. In a speech two weeks ago, I stated that I believe the U.S. economy is best described as being in a bona fide liquidity trap.

...

In this setting, even a moderate expansion without a double dip will not lead to appropriate labor market improvement. Accordingly, highly plausible projections are 1 percent for core Personal Consumption Expenditure Price Index (PCE) inflation at the end of 2012 and 8 percent for the unemployment rate. For me, the Fed’s dual mandate misses are too large to shrug off, and there is currently no policy conflict between improving employment and inflation outcomes.

[CR Note: the currect FOMC forecast is for the unemployment rate to be in the 7.1% to 7.5% range in 2012, so clearly Evans is even more pessimistic]

...

If the Federal Reserve decided to increase the degree of policy accommodation today, two avenues could be: 1) additional large-scale asset purchases, and 2) a communication that policy rates will remain at zero for longer than “an extended period.”

A third and complementary policy tool would be to announce that, given the current liquidity trap conditions, monetary policy would seek to target a path for the price level. Simply stated, a price-level target is a path for the price level that the central bank should strive to hit within a reasonable period of time. For example, if the slope of the price path, which I will refer to as P*, is 2 percent and inflation has been underrunning the path for some time, monetary policy would strive to catch up to the path: Inflation would be higher than 2 percent for a time until the path was reattained. I refer to this as a state-contingent policy because the price-level targeting regime is only intended for the duration of the liquidity trap episode.

Fed's Rosengren: Important to "insure against the risk of deflation"

by Calculated Risk on 10/16/2010 12:12:00 PM

From Boston Fed President Eric Rosengren: Revisiting Monetary Policy in a Low Inflation Environment. Rosengren reviewed the Japanese experience and the 1999 Boston Fed conference on monetary policy in a low inflation environment. He noted:

From a policy perspective I take several lessons from the Japanese experience. First, should deflation occur, it can be quite difficult to overcome. Second, insuring against the risk of deflation may be much cheaper than waiting until it has occurred and then trying to address it. Finally, financially fragile economies may be particularly vulnerable to negative impacts from premature austerity measures.He also said

[A] policy of gradually adjusting monetary and fiscal policy, as conducted in Japan after deflation first occurred, may not be as effective as an active policy response taken before deflation has become embedded in the economy. Of course, it should depend on the given situation and incoming data.Also of interest, Rosengren discussed the policy channels of the Fed's Large Scale Asset Purchase or “LSAP” program. In his view there were several channels:

LSAP ChannelsRosengren is current on the FOMC.

LSAP can successfully reduce long-term rates

Cross-correlation of assets implies other rates will fall

Does signal intent to keep rates low –medium term Treasuries did move

Exchange rate channel may be important

Lending channel –firms with access to markets leave banks, providing more capacity for banks to focus